Abercrombie & Fitch 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

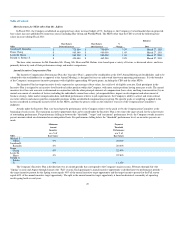

Portions of the restricted stock unit grants that were made in Fiscal 2008 to Mr. Ramsden, Ms. Chang and Ms. Herro did not vest as a result of Fiscal

2011 performance. The 2008, 2009 and 2011 targets for Ms. Chang's and Ms. Herro's awards were not satisfied; therefore, 75% of the Fiscal 2008 grant was

forfeited. Mr. Ramsden's Fiscal 2008 grant did not vest in 2009 and 2011, and to date, the cumulative targets have not been satisfied and thus portions of this

award remain unvested.

Restricted stock units granted in Fiscal 2011 to our Senior Vice President, General Counsel and Secretary vest according to a back-loaded schedule,

with 10% vesting on the one-year anniversary of the grant date, an additional 20% on the two-year anniversary of the grant date, an additional 30% on the

three-year anniversary of the grant date and the final vesting 40% on the four-year anniversary of the grant date.

While the Company believes that both retention and long-term performance are important objectives for a long-term incentive program, the Company

also believes that the "at risk" component of the long-term incentive program should be higher for the more senior executive officers. Structuring more of the

long-term incentive compensation of senior executive officers to be "at risk" more closely aligns the economic benefit of such compensation to the interests of

stockholders as a significant portion of their potential compensation will only be realized if the market price of the Company's Common Stock increases.

Therefore, the ratio of restricted stock units to SARs (or stock options) varies by level of participant. When compared to the percentage of the total long-term

award value received by a majority of the associates in the form of restricted stock units versus SARs (or, prior to 2009, stock options), the more senior

executive officers receive a relatively lower percentage of their long-term award value in the form of restricted stock units and a relatively higher percentage

in the form of SARs or stock options. For the Executive Vice Presidents, a majority of their total long-term incentive awards granted during Fiscal 2011 was

in the form of SARs. For Senior Vice Presidents, including Mr. Robins, a majority of the total long-term incentive awards were granted in the form of time-

vested restricted stock units.

The Compensation Committee follows an Equity Grant Policy pursuant to which it reviews and approves individual grants for the NEOs, as well as the

total number of shares covered by stock options, SARs and restricted stock unit grants made to all associates. The annual equity grants are typically reviewed

and approved at the Compensation Committee's scheduled March meeting. The grant date for these annual grants is the date of the Compensation Committee

meeting at which they are approved. Administration of restricted stock unit, stock option and SAR awards is managed by the Company's human resources

department with specific instructions related to timing of grants given by the Compensation Committee. The Company has no intention, plan or practice to

select annual grant dates for NEOs in coordination with the release of material, non-public information, or to time the release of such information because of

award dates.

Benefits

As associates of the Company, the NEOs are eligible to participate in all of the broad-based Company-sponsored benefits programs on the same basis

as other full-time associates.

In addition to the qualified Abercrombie & Fitch Co. Savings and Retirement Plan (the "401(k) Plan"), the Company has a nonqualified deferred

compensation plan, the Abercrombie & Fitch Nonqualified Savings and Supplemental Retirement Plan (the "Nonqualified Savings and Supplemental

Retirement Plan"), that allows members of senior management to defer a portion of their compensation over-and-above the Internal Revenue Service ("IRS")

limits imposed on the Company's 401(k) Plan. The Company also makes matching and retirement contributions to the Nonqualified Savings and

Supplemental Retirement Plan on behalf of the participants. Company contributions have a five-year vesting schedule. The Nonqualified Savings and

Supplemental Retirement Plan allows participants the opportunity to save and invest their own money on a similar basis (as a percentage of their

compensation) as other associates under the 401(k) Plan. Furthermore, the Nonqualified Savings and Supplemental Retirement Plan is competitive, and the

Company's contribution element provides retention value. The Company's Nonqualified Savings and Supplemental Retirement Plan is further described and

Company contributions and the individual account balances for the NEOs are disclosed under the section captioned "Nonqualified Deferred

Compensation" beginning on page 63. The Company provides a separate Supplemental Executive Retirement Plan to the Company's Chairman and CEO, the

material provisions of which are described under the section captioned "Pension Benefits" beginning on page 62.

51