Abercrombie & Fitch 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

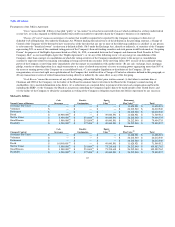

(2) Each of these SAR awards vests in four equal installments beginning on the first anniversary of the grant date, and in any event on February 1, 2014, provided that Mr. Jeffries remains

continuously employed by the Company through such date.

(3) Each of these SAR awards vests in four equal installments beginning on the first anniversary of the grant date.

(4) This restricted stock unit award vested 10% on March 9, 2009, 20% on March 9, 2010, 30% on March 9, 2011 and 40% on March 9, 2012.

(5) This restricted stock unit award vested 10% on the one-year anniversary of the March 22, 2011 grant date, and will vest an additional 20% on the two-year anniversary of the grant date,

an additional 30% on the three-year anniversary of the grant date and an additional 40% on the four-year anniversary of the grant date.

(6) This restricted stock unit award vests in four equal installments beginning March 9, 2010, contingent upon net income growth at 2% or more over the previous year's net income.

Mr. Ramsden has the opportunity to earn back one or more installments of this award if the cumulative performance hurdles are met in a subsequent year, subject to continued

employment with the Company.

(7) Each of these restricted stock unit awards vests in four equal installments beginning on the first anniversary of the grant date, contingent upon the Company's achievement of positive net

income at the end of the fiscal year immediately preceding the date that the tranche vests. The NEO has the opportunity to earn back one or more installments of this award if the

cumulative performance hurdles are met in a subsequent year, subject to continued employment with the Company.

(8) Each of these restricted stock unit awards was to vest in four equal installments beginning on the first anniversary of the grant date, contingent upon net income growth at 2% or more

over the previous year's net income. The NEO had the opportunity to earn back one or more installments of this award if the cumulative performance hurdles were met in a subsequent

year. No installments vested as a result of Fiscal 2011 performance (none of the 2008, 2009 and 2011 targets having been satisfied), as determined subsequent to the end of Fiscal 2011;

therefore, 75% of the original award was forfeited.

(9) Market value represents the product of the closing price of Common Stock as of January 27, 2012, which was $47.23, multiplied by the number of restricted stock units.

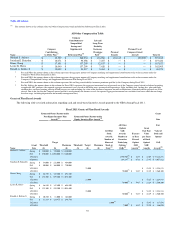

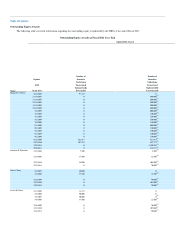

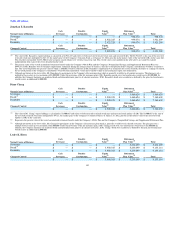

Stock Options and Stock Appreciation Rights Exercised and Restricted Stock Units Vested

The following table provides information regarding the aggregate dollar value realized by the NEOs in connection with the exercise of stock options

and SARs and the vesting of restricted stock units during Fiscal 2011.

Fiscal 2011 Stock Option and Stock Appreciation Right Exercises and Restricted Stock Units Vested

Option/SAR Awards Stock Awards

Name

Number of Shares

Acquired on Exercise

Value Realized

on Exercise(1)

Number of Shares

Acquired on Vesting

Value Realized

on Vesting(2)

Michael S. Jeffries 1,379,248 $ 44,639,803 25,600 $ 1,519,616

Jonathan E. Ramsden 0 $ — 10,500 $ 584,745

Diane Chang 138,500 $ 3,286,730 19,500 $ 1,112,085

Leslee K. Herro 105,000 $ 4,555,250 19,500 $ 1,112,085

Ronald A. Robins Jr. 0 $ — 0 $ —

(1) Value realized upon SAR/stock option exercises is calculated by multiplying (a) the difference between the closing price of a share of Common Stock on the date of exercise and the

exercise price of the SAR/stock option by (b) the number of shares of Common Stock covered by the portion of each SAR/stock option exercised.

(2) Value realized upon the vesting of restricted stock unit awards is calculated by multiplying the number of shares of Common Stock underlying the vested portion of each restricted stock

unit award by the closing price of a share of Common Stock on the vesting date.

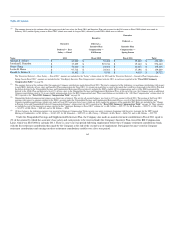

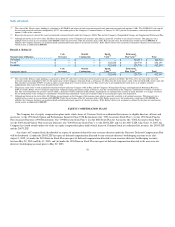

Pension Benefits

In conjunction with the employment agreement entered into by the Company and Mr. Jeffries as of January 30, 2003, the Company established the

Chief Executive Officer Supplemental Executive Retirement Plan effective February 2, 2003 (as amended, the "SERP"). Under the terms of the 2008 Jeffries

Agreement discussed above, Mr. Jeffries remains eligible to receive benefits under the SERP. Subject to the conditions described in the SERP, upon his

retirement, Mr. Jeffries will receive a monthly benefit for life equal to 50% of his final average compensation (base salary and actual annual incentive as

averaged over the last 36 consecutive full months ending prior to his retirement, as described in the SERP and not including any "stay bonus" paid pursuant to

Mr. Jeffries' prior employment agreement). If Mr. Jeffries had retired on January 28, 2012, the estimated annual benefit payable to him would have been

$1,336,200, based on his average compensation for the 36 consecutive

62