Abercrombie & Fitch 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

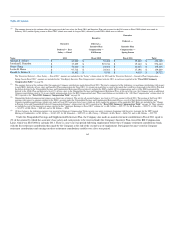

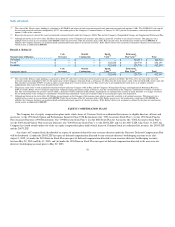

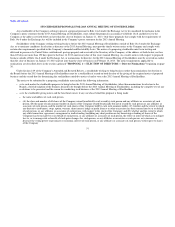

The following table summarizes equity compensation plan information for the 1998 Associates Stock Plan, the 1998 Director Stock Plan, the 2005

LTIP and the 2007 LTIP, all stockholder approved, as a group and for the 2002 Associates Stock Plan and the 2003 Director Stock Plan, both non-stockholder

approved, as a group, in each case as of January 28, 2012:

Equity Compensation Plan Information

Plan Category

Number of Shares

Underlying Outstanding

Options, Restricted Stock

Units and Rights(a)

Weighted-Average Exercise

Price of Shares

Underlying Outstanding

Options, Restricted Stock

Units and Rights(b)

Notional Deficit

Under Equity

Compensation Plans

(Excluding Shares

Reflected in Column(a))(c)

Equity compensation plans approved by stockholders(1) 10,726,794(3) $ 36.29(4) (2,071,690)(5)

Equity compensation plans not approved by stockholders(2) 257,035(6) $ 49.43(7) —(8)

Total 10,983,829 $ 36.59 (2,071,690)

(1) The 1998 Director Stock Plan was terminated as of May 22, 2003 in respect of future grants of stock options and issuances and distributions of shares of Common Stock other than

issuances of Common Stock upon the exercise of stock options granted under the 1998 Director Stock Plan which remained outstanding as of May 21, 2003 and issuances and

distributions of shares of Common Stock in respect of deferred compensation allocated to non-associate directors' bookkeeping accounts under the Directors' Deferred Compensation Plan

as of May 21, 2003.

(2) The 2002 Associates Stock Plan and the 2003 Director Stock Plan were terminated as of June 13, 2007 in respect of future grants of awards and issuances and distributions of shares of

Common Stock other than: (a) issuances of shares of Common Stock upon the exercise of stock options or the vesting of restricted shares granted under the 2002 Associates Stock Plan;

(b) issuances of shares of Common Stock upon the exercise of stock options or the vesting of stock units granted under the 2003 Director Stock Plan; and (c) issuances and distributions

of shares of Common Stock in respect of deferred compensation allocated to non-associate directors' bookkeeping accounts under the Directors' Deferred Compensation Plan as of

July 31, 2005.

(3) Represents the number of underlying shares of Common Stock associated with outstanding stock options, SARs, restricted stock units and share equivalents under stockholder approved

plans and includes 4,000 stock options granted under the 1998 Associates Stock Plan, 7,426 share equivalents attributable to compensation deferred by non-associate directors

participating in the Directors' Deferred Compensation Plan and distributable in the form of shares of Common Stock under the 1998 Director Stock Plan, 320,000 stock options granted

under the 2005 LTIP, 180,780 restricted stock units granted under the 2005 LTIP, 737,000 SARs granted under the 2005 LTIP, 30,842 share equivalents attributable to compensation

deferred by non-associate directors participating in the Directors' Deferred Compensation Plan and distributable in the form of shares of Common Stock under the 2005 LTIP, 136,200

stock options granted under the 2007 LTIP, 1,008,212 restricted stock units granted under the 2007 LTIP and 8,302,334 SARs granted under the 2007 LTIP.

(4) Represents weighted-average exercise price of stock options and SARs outstanding under the 1998 Associates Stock Plan, the 1998 Director Stock Plan, the 2005 LTIP and the 2007

LTIP and weighted-average price of share equivalents attributable to compensation deferred by non-associate directors participating in the Directors' Deferred Compensation Plan

distributable in the form of shares of Common Stock under the 1998 Director Plan or the 2005 LTIP.

(5) Represents the number of shares available for future issuance or notional deficit under stockholder approved equity compensation plans and is comprised of 61,790 shares available for

future issuance under the 2005 LTIP and a notional deficit of (2,133,480) shares under the 2007 LTIP.

Based on the net share counting methodology adopted by the Company in accordance with the terms of the 2005 LTIP and the 2007 LTIP, SARs are measured on an intrinsic value basis,

which means that a SAR does not have any value and does not reduce the number of shares available on a net basis unless the stock price increases above the initial grant price and then

only reduces the number of shares available on a net basis to the extent of the intrinsic value above the initial grant price. In addition, under the 2005 LTIP and the 2007 LTIP, shares

available for future issuance are measured net of shares expected to be retained by the Company to cover tax withholdings upon vesting or exercise.

On a net basis, as of January 28, 2012, there were 1,045,688 shares available for future issuance under the 2005 LTIP and 5,521,073 shares available for future issuance under the 2007

LTIP.

(6) Represents the gross number of underlying shares of Common Stock associated with outstanding stock options, restricted shares and share equivalents under plans not approved by

stockholders and includes 234,797 stock options granted under the 2002 Associates Stock Plan, 300 restricted shares granted under the 2002 Associates Stock Plan, 20,000 stock options

granted under the 2003 Director Stock Plan and 1,938 share equivalents attributable to compensation deferred by non-associate directors participating in the Directors' Deferred

Compensation Plan distributable in the form of shares of Common Stock under the 2003 Director Stock Plan.

(7) Represents weighted-average exercise price of stock options outstanding under the 2002 Associates Stock Plan and the 2003 Director Stock Plan and weighted-average price of share

equivalents attributable to compensation deferred by non-associate directors participating in the Directors' Deferred Compensation Plan distributable in the form of shares of Common

Stock under the 2003 Director Stock Plan.

(8) Except as described in footnote (6) to this table, no further shares of Common Stock may be issued or distributed under the 2002 Associates Stock Plan or the 2003 Director Stock Plan.

71