Abercrombie & Fitch 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

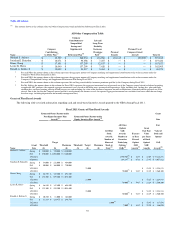

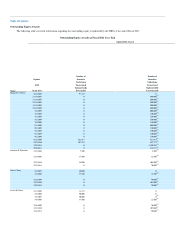

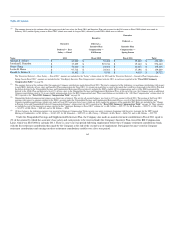

(1) These columns show the potential cash payouts under the Company's Incentive Plan for each of the Spring season and Fall season in Fiscal 2011. The first row for each NEO represents

the potential payout at various levels for Spring, and the second row represents the potential payout at various levels for Fall. Refer to page 50 for the performance metrics related to the

Incentive Plan. If threshold performance criteria are not satisfied, then the payouts for all associates, including the NEOs, would be zero. Actual amounts paid to the NEOs under the

Incentive Plan for Fiscal 2011 are shown in the column titled "Non-Equity Incentive Plan Compensation" in the "Fiscal 2011 Summary Compensation Table" on page 56.

(2) Represents restricted stock units granted in Fiscal 2011 under the Company's 2005 LTIP that will vest in four equal installments beginning on the first anniversary of the grant date,

contingent upon the Company reporting a positive adjusted non-GAAP net income at the end of the fiscal year immediately preceding the date the tranche vests. Each NEO has the

opportunity to earn back one or more installments of the award if the cumulative performance hurdles are met in a subsequent year.

(3) This column shows the number of restricted stock units granted under the Company's 2005 LTIP.

(4) This column shows the number of SARs granted to the NEOs in Fiscal 2011 under the Company's 2005 LTIP and the Company's 2007 LTIP. Grants were made to Michael S. Jeffries

under the Company's 2007 LTIP. Grants were made to Jonathan E. Ramsden, Diane Chang, Leslee K. Herro and Ronald A. Robins Jr. under the Company's 2005 LTIP.

(5) This column shows the exercise price of the SARs granted to NEOs, which was the closing price of the Company's Common Stock on the date of grant.

(6) Represents the grant date fair value of the restricted stock unit award or SAR award, as appropriate, determined in accordance with U.S. generally accepted accounting principles. The

grant date fair values for restricted stock unit awards are calculated using the closing price of the Common Stock on the grant date adjusted for anticipated dividend payments during the

vesting period. The grant date fair values for SARs are calculated using the Black-Scholes value on the grant date.

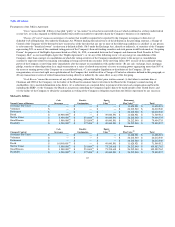

(7) The SARs granted to Mr. Jeffries vest 25% per year beginning on the one-year anniversary of the grant date, subject to 100% vesting on February 1, 2014, provided that Mr. Jeffries

remains continuously employed by the Company through February 1, 2014. The SARs granted to the other NEOs vest 25% per year beginning on the one-year anniversary of the grant

date.

(8) The restricted stock units vest as to 10% on the one-year anniversary of the grant date, an additional 20% on the two-year anniversary of the grant date, an additional 30% on the three-

year anniversary of the grant date and an additional 40% on the four-year anniversary of the grant date.

Employment Agreement with Mr. Jeffries

On December 19, 2008, the Company entered into a new employment agreement with Mr. Jeffries under which Mr. Jeffries serves as Chairman and

CEO of the Company. The Jeffries Agreement replaced the prior employment agreement between Mr. Jeffries and the Company dated as of August 15, 2005,

the term of which was to expire on December 31, 2008. The term of the Jeffries Agreement expires on February 1, 2014, unless earlier terminated in

accordance with its terms, and as such represents a long-term commitment from Mr. Jeffries to the Company. Under the Jeffries Agreement, the Company is

obligated to cause Mr. Jeffries to be nominated as a director.

The Jeffries Agreement provides for a base salary of $1,500,000 per year or such larger amount as the Compensation Committee may from time to time

determine. The Jeffries Agreement provides for participation in the Company's Incentive Plan as determined by the Compensation Committee. Mr. Jeffries'

annual target bonus opportunity is to be at least 120% of his base salary upon attainment of target, subject to a maximum bonus opportunity of 240% of base

salary.

In consideration for entering into the Jeffries Agreement, Mr. Jeffries received the Retention Grant of SARs covering 4,000,000 shares of the

Company's Common Stock awarded as follows: 40% of the total Retention Grant on December 19, 2008, 30% on March 2, 2009 and the remaining 30% on

September 1, 2009. With respect to 50% of the SARs awarded on each grant date, the exercise price (base price) is equal to the fair market value of the

Company's Common Stock on the grant date, and with respect to the remaining SARs, the number of SARs was divided into four equal tranches of 12.5%

each, and the exercise price (base price) for these tranches is equal to 120%, 140%, 160% and 180%, respectively, of the fair market value of the Company's

Common Stock on the grant date. The Retention Grant will vest in full on January 31, 2014; provided Mr. Jeffries remains continuously employed by the

Company through that date, subject only to limited vesting acceleration under the severance provisions of the Jeffries Agreement. The Retention Grant expires

on December 19, 2015, unless Mr. Jeffries is earlier terminated by the Company for Cause (as defined on page 67 of this Proxy Statement). The Retention

Grant is also subject to a clawback should Mr. Jeffries breach certain sections of the Jeffries Agreement. Shares of Common Stock acquired pursuant to the

Retention Grant (not including any shares of Common Stock sold or retained by the Company to fund the payment of the exercise price and/or any tax

58