Abercrombie & Fitch 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

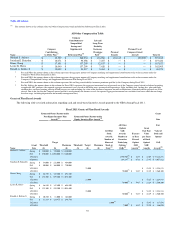

Semi-annual measurement period that ended on January 29, 2011: Pursuant to the CEO's employment agreement, the 1,590,908 SARs that were

awarded on March 22, 2011 represent the performance-based grant earned by Mr. Jeffries for the second half of Fiscal 2010 based on an overall increase in

total stockholder return (as defined in his employment agreement) of approximately $1.7 billion. These SARs have an exercise price of $54.87 per share and

had a grant date fair value of $35,144,271. However, these SARs are currently underwater and have no intrinsic value. For the CEO to realize any monetary

value, after the SARs have vested, the market price of the Company's Common Stock would need to appreciate by $5.94 from the April 25, 2012 price of

$48.93 per share. For the CEO to realize the reported grant date fair value, after the SARs have vested, the market price of the Company's Common Stock

would need to appreciate by $28.03 from the April 25, 2012 price of $48.93 per share.

Semi-annual measurement period that ended on July 30, 2011: Pursuant to the CEO's employment agreement, the 288,287 SARs that were awarded

on September 20, 2011 represent the performance-based grant earned by Mr. Jeffries for the first half of Fiscal 2011 based on an overall increase in total

stockholder return (as defined in his employment agreement) of approximately $300 million. These SARs have an exercise price of $67.83 per share and had

a grant date fair value of $8,057,622. However, these SARs are currently underwater and have no intrinsic value. For the CEO to realize any monetary value,

after the SARs have vested, the market price of the Company's Common Stock would need to appreciate by $18.90 from the April 25, 2012 price of $48.93

per share. For the CEO to realize the reported grant date fair value, after the SARs have vested, the market price of the Company's Common Stock would need

to appreciate by $46.85 from the April 25, 2012 price of $48.93 per share.

Semi-annual measurement period that ended on January 28, 2012: The CEO did not earn a semi-annual equity grant in March 2012 because the price

of our Common Stock during the measurement period with respect to the second half of Fiscal 2011 declined as compared to prior semi-annual periods.

The recent amendment to the CEO's employment agreement provides that 20% of the total fair value of any semi-annual equity grants earned during the

remaining term of his employment agreement will be awarded in the form of restricted stock units that will be subject to the same target and threshold

adjusted earnings per share performance levels that apply to the performance shares granted to our Executive Vice Presidents, as well as the time-based

vesting requirements specified in the CEO's employment agreement. Under this amendment to the CEO's employment agreement, 100% of the restricted stock

units will be eligible to vest if the target adjusted earnings per share performance level is achieved or exceeded. Only 50% of the restricted stock units will be

eligible to vest if the threshold adjusted earnings per share performance level is achieved and 50% of the restricted stock units will be forfeited. Interpolation

will be used to determine the percentage of the restricted stock units that will be eligible to vest if adjusted earnings per share are between the target and

threshold performance levels. If actual adjusted earnings per share are less than the threshold adjusted earnings per share performance level, the CEO will

forfeit 100% of the restricted stock units.

The Compensation Committee did not award a base salary increase to the CEO as his base salary was determined pursuant to his employment

agreement in Fiscal 2008. Mr. Jeffries participated in the annual incentive compensation performance plan for Fiscal 2011 on the same basis as other

participants, earning an annual cash incentive of 66% of the aggregate target on an annualized basis. Refer to page 50 for the performance metrics related to

the incentive compensation performance plan.

Additionally, the CEO is subject to mandatory holding periods beyond the completion of his employment agreement for a significant portion of the

equity awards he has received under his current employment agreement. The material terms of the employment agreement are provided in the section

captioned "Employment Agreement with Mr. Jeffries" beginning on page 58.

Base Salary

NEO base salaries reflect the Company's operating philosophy, culture and business direction, with each salary determined by an annual assessment of

a number of factors, including the individual's current base salary, job responsibilities, impact on development and achievement of business strategy, labor

market compensation data, individual performance relative to job requirements, the Company's ability to attract and retain critical executive officers and

salaries paid for comparable positions within an identified compensation peer group. No specific goals or weighting is applied to the factors considered in

setting the level of base salary, and thus the process relies on the subjective exercise of the Compensation Committee's judgment.

48