Abercrombie & Fitch 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

he is an officer of the Company and thus receives no compensation for his services as a director. The compensation received by Mr. Jeffries as an officer of

the Company is shown in the "Fiscal 2011 Summary Compensation Table" beginning on page 56 and discussed in the text and tables included under the

section captioned "EXECUTIVE OFFICER COMPENSATION" beginning on page 56.

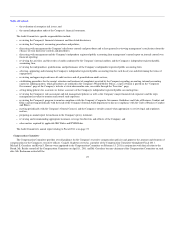

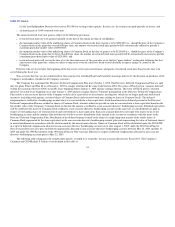

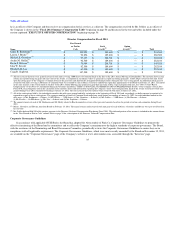

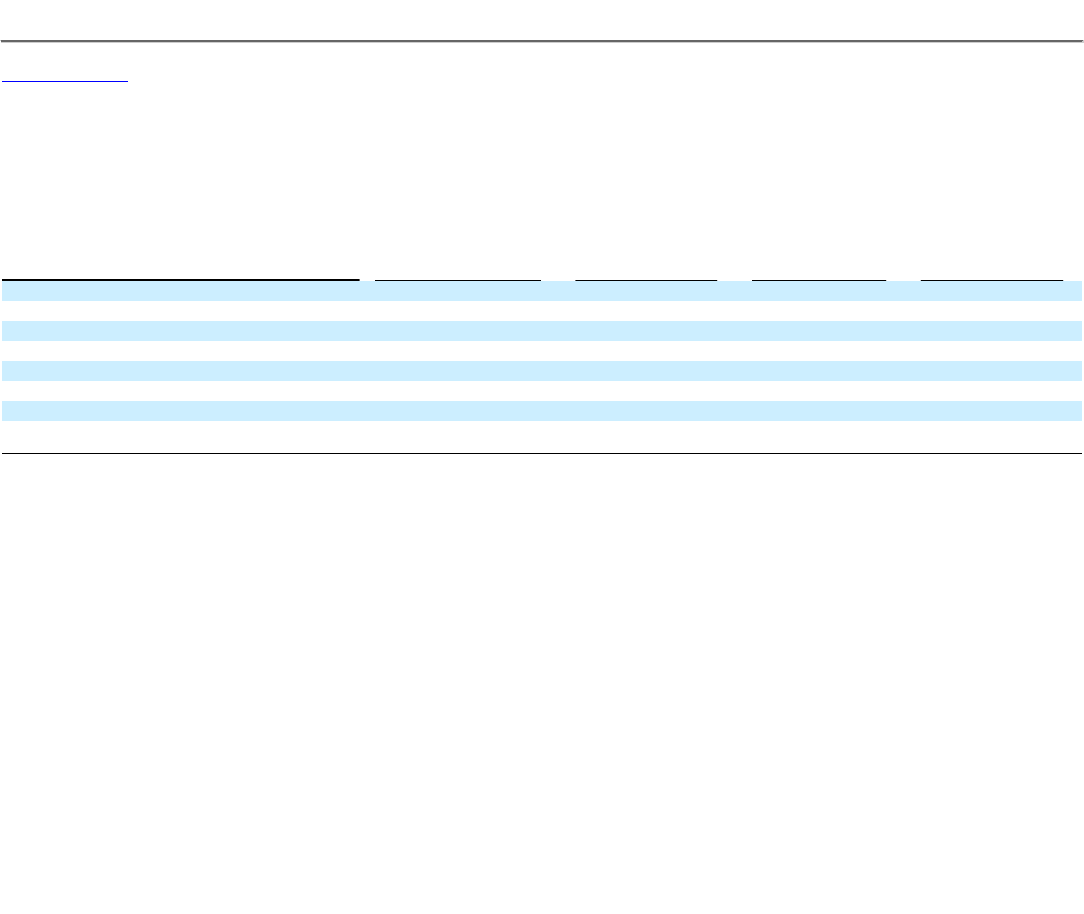

Director Compensation for Fiscal 2011

Name

Fees Earned

or Paid in

Cash

Stock

Awards(1)

Option

Awards(2) Total

James B. Bachmann(3) $ 104,959 $ 189,604 $ — $ 294,563

Lauren J. Brisky(3) $ 96,896 $ 189,604 $ — $ 286,500

Michael E. Greenlees(4) $ 97,157 $ 268,701 $ — $ 365,858

Archie M. Griffin(5) $ 92,500 $ 189,604 $ — $ 282,104

Kevin S. Huvane(4) $ 76,484 $ 268,701 $ — $ 345,185

John W. Kessler $ 92,500 $ 189,604 $ — $ 282,104

Elizabeth M. Lee $ 67,500 $ 189,604 $ — $ 257,104

Craig R. Stapleton $ 147,500 $ 189,604 $ — $ 337,104

(1) All non-associate directors were granted restricted stock units covering 3,000 shares of Common Stock on the date of the 2011 Annual Meeting of Stockholders. The amounts shown in this

column are reported using the grant date fair value of the awards, as computed in accordance with U.S. generally accepted accounting principles, of $63.20 per restricted stock unit, based

upon the closing price of the Company's Common Stock on the grant date and adjusted for anticipated dividend payments during the one-year vesting period. An additional initial grant of

restricted stock units covering 1,500 shares of Common Stock was awarded to each of Messrs. Greenlees and Huvane upon their appointment to the Board on February 15, 2011. Calculated

in the same manner as the awards made on the date of the 2011 Annual Meeting, this grant had a grant date fair value of $52.73 per restricted stock unit. See "Note 4. Share-Based

Compensation" of the Notes to Consolidated Financial Statements included in "ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA" of the Company's Fiscal 2011

Form 10-K, for assumptions used in the calculation of the amounts shown and information regarding the Company's share-based compensation. Each of the awards of restricted stock units

granted during Fiscal 2011 remained outstanding at January 28, 2012. The non-associate directors held no other restricted stock units at January 28, 2012.

(2) All of the stock options held by the individuals named in this table were granted and fully vested prior to the beginning of Fiscal 2011 and, accordingly, no dollar amount is required to be

reported in respect of these stock options. The aggregate number of shares of Common Stock underlying stock options outstanding at January 28, 2012, for each individual named in this

table were: (a) Mr. Bachmann — 0 shares; (b) Ms. Brisky — 7,500 shares; (c) Mr. Greenlees — 0 shares; (d) Mr. Griffin — 2,500 shares; (e) Mr. Huvane — 0 shares;

(f) Mr. Kessler — 14,000 shares; (g) Ms. Lee — 0 shares; and (h) Mr. Stapleton — 0 shares.

(3) The annual retainers of each of Mr. Bachmann and Ms. Brisky related to Board committee service reflect pro-rated amounts based on the period served on each committee during Fiscal

2011.

(4) Messrs. Greenlees and Huvane joined the Board on February 15, 2011. The annual retainer and restricted stock unit grant of each of Messrs. Greenlees and Huvane were pro-rated based on

his start date.

(5) Mr. Griffin deferred $46,250 of his retainer pursuant to the Directors' Deferred Compensation Plan during Fiscal 2011. This deferred portion of his retainer is included in the amount shown

in the "Fees Earned or Paid in Cash" column. Refer to page 34 for a description of the Directors' Deferred Compensation Plan.

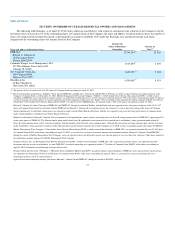

Corporate Governance Guidelines

In accordance with applicable NYSE Rules, the Board has adopted the Abercrombie & Fitch Co. Corporate Governance Guidelines to promote the

effective functioning of the Board and its committees and to reflect the Company's commitment to the highest standards of corporate governance. The Board,

with the assistance of the Nominating and Board Governance Committee, periodically reviews the Corporate Governance Guidelines to ensure they are in

compliance with all applicable requirements. The Corporate Governance Guidelines, which were most recently amended by the Board on November 15, 2011,

are available on the "Corporate Governance" page of the Company's website at www.abercrombie.com, accessible through the "Investors" page.

35