Abercrombie & Fitch 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

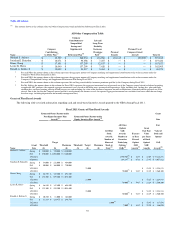

All associates who participate in the Company's stock-based compensation plans, including the NEOs (other than the CEO with respect to awards

granted to him pursuant to his employment agreement), are entitled to certain benefits in the event of termination due to death or disability or a change in

control as set forth in the plan documents for the Company's stock-based compensation plans. The Compensation Committee and the CEO agreed to an

amendment to the CEO's employment agreement (entered into on January 28, 2011), pursuant to which the CEO has voluntarily agreed, for no compensation,

that he will no longer be entitled to any gross-up payments in the event that any payments or benefits provided to him by the Company are subject to the

golden parachute excise tax under Sections 280G and 4999 of the Internal Revenue Code. The foregoing arrangements are discussed in further detail in the

section captioned "Potential Payments Upon Termination or Change in Control" beginning on page 66.

Clawback Policy

Each of the plans pursuant to which annual and long-term incentive compensation is paid to the Company's executive officers (i.e., the Incentive Plan,

the 2005 LTIP and the 2007 LTIP) includes a stringent "clawback" provision, which allows the Company to seek repayment of any incentive amounts that

were erroneously paid. Each of the plans provides that if (i) a participant (including one or more NEOs) has received payments under the plan pursuant to the

achievement of a performance goal and (ii) the Compensation Committee determines that the earlier determination as to the achievement of the performance

goal was based on incorrect data and in fact the performance goal had not been achieved or had been achieved to a lesser extent than originally determined

and a portion of such payment would not have been paid given the correct data, then such portion of any such payment made to the participant must be repaid

by such participant to the Company, without any requirement of misconduct on the part of the participant.

Stock Ownership Guidelines

As discussed above under the caption "Best Practices" on page 46, the Board believes it is important that the executive officers and directors have, and

are recognized both internally and externally as having, long-term financial interests that are aligned with those of the Company's stockholders. Accordingly,

the Board adopted stock ownership guidelines for all directors and executive officers effective as of November 12, 2009.

The guidelines for the executive officers are five times annual base salary for the CEO and one times annual base salary for the other executive officers.

The guidelines are initially calculated using the executive officer's base salary as of the later of the date the guidelines were adopted and the date the

individual was first designated as an executive officer by the Board. The guidelines may be modified, at the discretion of the Nominating and Board

Governance Committee, when an executive officer changes pay grade and otherwise from time to time. Until the amount contemplated by the guidelines is

achieved, the executive officer is required to retain an amount equal to 50% of the shares received as a result of the exercise of stock options or stock-settled

SARs or the vesting of restricted stock or restricted stock units, in each case netted to pay any exercise prior or withholding taxes; provided, that for a three-

year transition period ending November 12, 2012, executive officers are required to retain 33 1/3% of the net shares received if they are not above the

applicable guidelines. All of the executive officers have complied with their obligations under the guidelines.

The guideline for the directors is three times the amount of the annual retainer paid to directors, calculated using the annual retainer as of the later of the

date the guidelines were adopted and the date the director is elected to the Board. It is anticipated that directors should be able to achieve the guideline within

three years of joining the Board, or, in the case of directors serving at the time the guidelines were adopted, within three years of the date of adoption of the

guidelines. All of the directors are in compliance with the guidelines.

Compensation Considerations Related to Tax Deductibility under Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code generally prohibits any publicly-held corporation from taking a federal income tax deduction for

compensation paid in excess of $1,000,000 in any taxable year to the CEO and to each of the other three most highly compensated executive officers

(excluding the CFO) whose compensation is required to be disclosed pursuant to Item 402 of SEC Regulation S-K. Section 162(m) exempts qualified

performance-based compensation, among other things, from this deductibility limitation. It is the Compensation

54