Abercrombie & Fitch 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

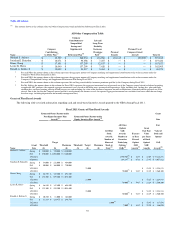

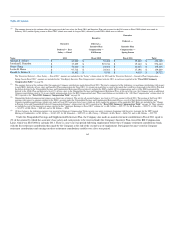

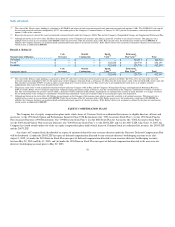

(1) The amounts shown in this column reflect the aggregate of the base salary for Fiscal 2011 and Incentive Plan cash payouts for the Fall season in Fiscal 2010 (which were made in

February 2011) and the Spring season in Fiscal 2011 (which were made in August 2011) deferred by each NEO, which were as follows:

Name

Executive

Deferral — Base

Salary — Fiscal

2011

Executive

Deferral —

Incentive Plan

Compensation —

Fall Season

Fiscal 2010

Executive

Deferral —

Incentive Plan

Compensation —

Spring Season

Fiscal 2011 Total

Michael S. Jeffries $ 45,000 $ 53,460 $ 35,640 $ 134,100

Jonathan E. Ramsden $ 37,259 $ 519,741 $ 19,140 $ 576,140

Diane Chang $ 70,660 $ 24,361 $ 40,125 $ 135,146

Leslee K. Herro $ 97,712 $ 24,361 $ 17,196 $ 139,269

Ronald A. Robins Jr. $ 13,802 $ 8,910 $ 4,010 $ 26,722

The "Executive Deferral — Base Salary — Fiscal 2011" amounts are included in the "Salary" column totals for 2011 and the "Executive Deferral — Incentive Plan Compensation —

Spring Season Fiscal 2011" amounts are included in the "Non-Equity Incentive Plan Compensation" column totals for 2011, in each case reported in the "Fiscal 2011 Summary

Compensation Table" on page 56.

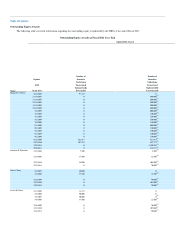

(2) The amounts shown in this column reflect the aggregate Company contributions made during Fiscal 2011. The total is comprised of the following: (a) matching contributions with respect

to each NEO's deferrals of base salary and Incentive Plan compensation for Fiscal 2011; (b) a make-up match that is equal to the match that would have been made to the 401(k) Plan had

the dollars deferred to the Nonqualified Savings and Supplemental Retirement Plan not directly reduced the NEO's eligible 401(k) compensation; and (c) if the NEO maximized the

deferral to the 401(k) Plan and deferred at least 3% of base salary to the Nonqualified Savings and Supplemental Retirement Plan, at the end of the year, the Company made an additional

Company contribution equal to 3% on any eligible compensation above the IRS Compensation Limit. These contributions are included in the "All Other Compensation" column totals for

2011 reported in the "Fiscal 2011 Summary Compensation Table" on page 56.

(3) Nonqualified deferred compensation balances earn fixed rates of interest. The rate for all account balances was fixed at 4.5% per annum for Fiscal 2011. The portion of the Fiscal 2011

earnings with respect to amounts credited to the NEOs' accounts under the Nonqualified Savings and Supplemental Retirement Plan as a result of their deferral contributions and

Company matching contributions (which were made in Fiscal 2011 and prior fiscal years) which are above-market for purposes of the applicable SEC Rules are included in the "Change

in Pension Value and Nonqualified Deferred Compensation Earnings" column totals for 2011 reported in the "Fiscal 2011 Summary Compensation Table" on page 56. These amounts

are included as part of the aggregate earnings reported in this "Aggregate Earnings in Fiscal 2011" column for: (a) Mr. Jeffries — $85,757; (b) Mr. Ramsden — $10,372; (c) Ms. Chang

— $23,972; (d) Ms. Herro — $40,362; and (e) Mr. Robins — $986.

(4) Of these balances, the following amounts were reported in Summary Compensation Tables in prior-year proxy statements beginning with the proxy statement for the 2007 Annual

Meeting of Stockholders: (a) Mr. Jeffries — $1,367,429; (b) Mr. Ramsden — $107,185; (c) Ms. Chang — $556,643; (d) Ms. Herro — $626,784; and (e) Mr. Robins — $39,795.

Under the Nonqualified Savings and Supplemental Retirement Plan, the Company also made an annual retirement contribution in Fiscal 2011 equal to

4% of the amount by which the associate's base salary and cash payouts to be received under the Company's Incentive Plan exceed the IRS Compensation

Limit, which was $245,000 for calendar 2011. There is a one-year wait period following employment before these Company retirement contributions begin,

with the first retirement contribution then made by the Company at the end of the second year of employment. Participants become vested in Company

retirement contributions and earnings on those retirement contributions ratably over a five-year period.

64