Abercrombie & Fitch 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

stock units that will be eligible to vest if adjusted earnings per share are between the target and threshold performance levels. If actual adjusted earnings per

share are less than the threshold adjusted earnings per share performance level, the CEO will forfeit 100% of the restricted stock units.

As discussed in more detail below, the CEO earned performance-based semi-annual equity grants of SARs in March 2011 and September 2011 because

the market price of our Common Stock increased during the semi-annual periods to which those grants related. The March 2011 SAR grant has an exercise

price of $54.87 per share and a grant date fair value, as reported in the "Fiscal 2011 Grants of Plan-Based Awards" table on page 57, of $35.1 million. The

September 2011 SAR grant has an exercise price of $67.83 per share and a reported grant date fair value of $8.1 million. As of April 25, 2012, both of the

semi-annual equity grants of SARs earned during Fiscal 2011 were underwater, since the exercise prices of the SARs are higher than the closing market price

of the Company's Common Stock on that date of $48.93. Mr. Jeffries will only realize monetary value from these grants if the market price of the Company's

Common Stock appreciates substantially beyond the respective exercise prices after the grants have vested. Consistent with the performance-based nature of

his agreement, Mr. Jeffries did not earn semi-annual equity grants in September 2010 or in March 2012 when the price of our Common Stock declined during

the semi-annual periods to which those potential grants relate, as compared to prior semi-annual periods.

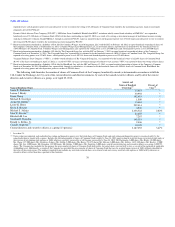

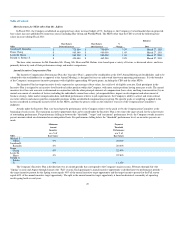

The following table shows the intrinsic value of the SARs awarded in Fiscal 2011 based on various prices of our Common Stock. As reflected in the

table, in order for the SAR awards to have an intrinsic value equal to the grant date fair value reported in the "Fiscal 2011 Summary Compensation Table,"

the price of the Company's Common Stock would need to be $79.85. In addition, equity awards granted to Mr. Jeffries are subject to vesting periods which

must have lapsed before any value may be realized.

Intrinsic Value of Fiscal 2011 CEO Awards Versus Common Stock Price

Fiscal 2011 — The Year in Review

During Fiscal 2011, the Company continued to invest for the future and build the organization to capitalize on the major opportunities the Company

sees ahead. The Company believes its Fiscal 2011 results were strong when considered against the backdrop of the challenging economic and consumer

environments in which they were achieved.

• Total net sales grew 20% to $4.2 billion, including 74% growth in sales from international stores and 36% growth in the direct-to-consumer

business.

43