Abercrombie & Fitch 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

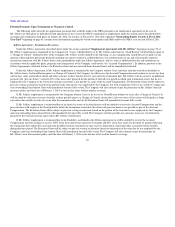

use exceeds $200,000. In addition, beginning with Fiscal 2010, Mr. Jeffries' right to a tax gross-up in connection with his personal use of Company aircraft

has been eliminated. In consideration for these modifications of the Jeffries Agreement, the Company paid Mr. Jeffries a lump-sum cash payment of

$4,000,000. This payment is subject to a clawback of a pro-rated portion thereof if Mr. Jeffries voluntarily terminates his employment without good reason (as

defined in the Jeffries Agreement) prior to February 1, 2014.

Beginning in Fiscal 2010, the Compensation Committee and Mr. Jeffries agreed to eliminate the tax gross-up in connection with personal security

provided by the Company. In addition, on January 28, 2011, Mr. Jeffries and the Company entered into Amendment No. 2 to the Jeffries Agreement whereby

Mr. Jeffries agreed that he will no longer be entitled to any gross-up payments in the event that any payments or benefits provided to him by the Company are

subject to the golden parachute excise tax under Sections 280G and 4999 of the Internal Revenue Code. Mr. Jeffries did not receive any remuneration from

the Company in exchange for agreeing to Amendment No. 2 to the Jeffries Agreement.

The terms of the Jeffries Agreement relating to the termination of Mr. Jeffries' employment are further discussed below under the section captioned

"Potential Payments Upon Termination or Change in Control" beginning on page 66.

Under the Jeffries Agreement, Mr. Jeffries agrees not to compete, directly or indirectly, with the Company or any affiliate of the Company or solicit any

associates, customers or suppliers of the Company, its subsidiaries and/or affiliates during the employment term and for one year thereafter.

Under the Jeffries Agreement, Mr. Jeffries also remains eligible to receive benefits under the Chief Executive Officer Supplemental Retirement Plan as

described under the section captioned "Pension Benefits" beginning on page 62.

60