Abercrombie & Fitch 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Committee's policy to maximize the deductibility of executive compensation, to the extent compatible with the needs of the business, as the Compensation

Committee believes that compensation and benefits decisions should be primarily driven by the needs of the business, rather than by tax policy. Therefore, the

Compensation Committee may make pay decisions (such as the determination of the CEO's base salary) that result in compensation expense that is not fully

deductible under Section 162(m).

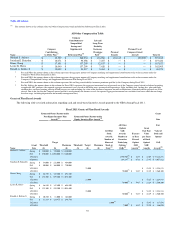

Compensation Considerations Related to Accounting

When determining amounts of long-term incentive grants to executive officers and associates, the Compensation Committee examines the accounting

cost associated with the grants. Under U.S. generally accepted accounting principles, grants of stock options, SARs, restricted stock units and other share-

based payments result in an accounting charge for the Company. The Committee considers the accounting implications of the executive compensation

program, including the estimated cost for financial reporting purposes of equity compensation as well as the aggregate grant date fair value of equity

compensation computed in accordance with FASB ASC Topic 718.

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board reviewed the "COMPENSATION DISCUSSION AND ANALYSIS" and discussed it with management.

Based on such review and discussion, the Compensation Committee recommended to the Board that the "COMPENSATION DISCUSSION AND

ANALYSIS" be included in this Proxy Statement.

Submitted by the Compensation Committee of the Board*:

Michael E. Greenlees (Chair) Kevin S. Huvane Craig R. Stapleton

* James B. Bachmann was a member of the Compensation Committee from January 30, 2011 to November 15, 2011.

55