Abercrombie & Fitch 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

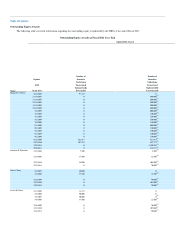

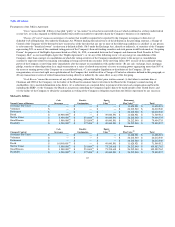

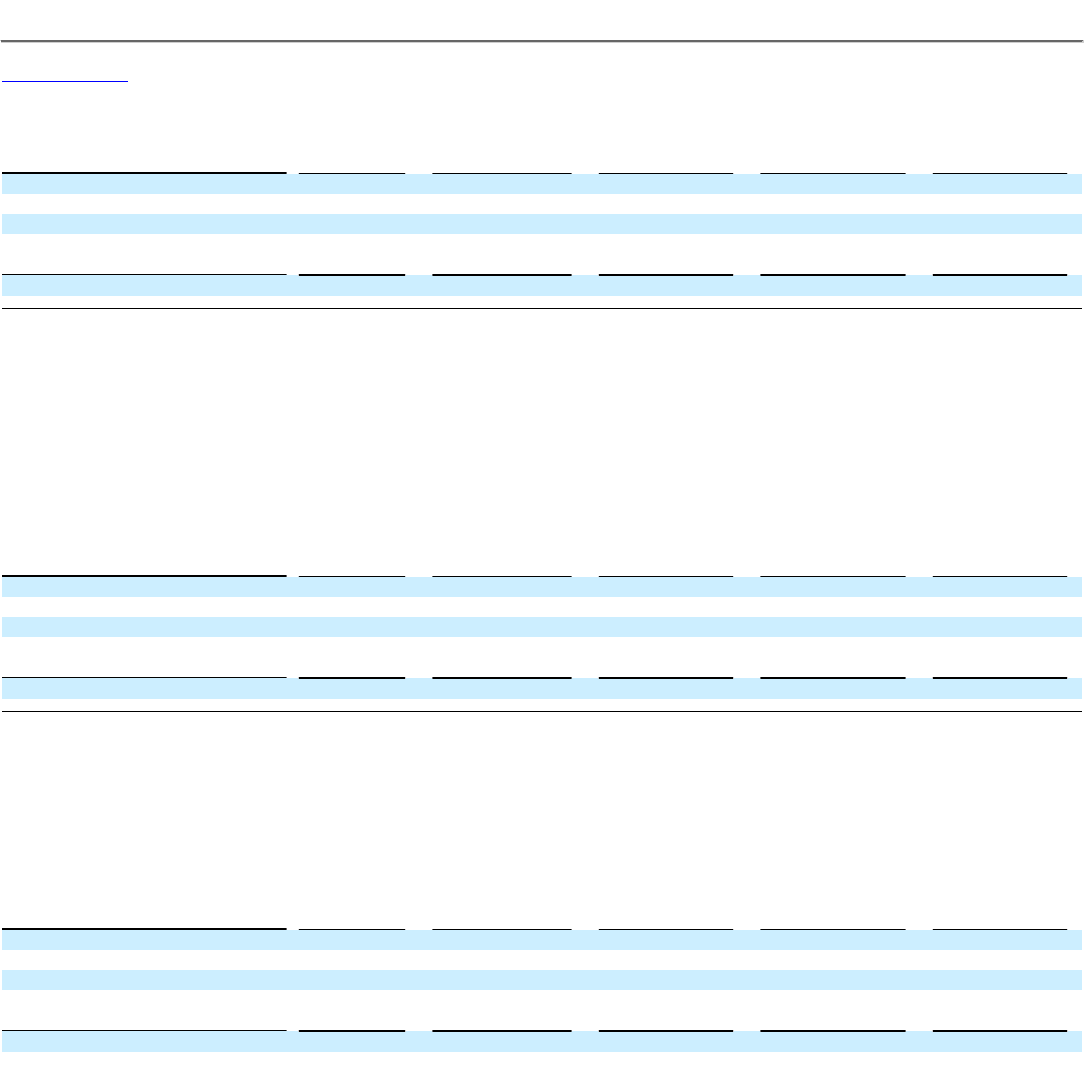

Jonathan E. Ramsden

Normal Course of Business

Cash

Severance

Benefits

Continuation

Equity

Value(1)

Retirement

Plan Value(2) Total

Severance $ — $ — $ — $ 948,472 $ 948,472

Death(3) $ — $ — $ 2,922,225 $ 999,074 $ 3,921,299

Disability $ — $ — $ 2,922,225 $ 999,074 $ 3,921,299

Change of Control

Cash

Severance

Benefits

Continuation

Equity

Value(1)

Retirement

Plan Value(2) Total

$ — $ — $ 2,922,225 $ 999,074 $ 3,921,299

(1) The value of Mr. Ramsden's equity holdings is calculated as $2,922,225 and relates to both unvested restricted stock units and unvested SARs. The $2,922,225 is the sum of the unvested

restricted stock units multiplied by $47.23, the market price of the Company's Common Stock as of January 28, 2012, plus the in-the-money value of the unvested SARs on the same date.

This total does not include $1,288,500 of value in equity awards which were vested at fiscal year end. This vested value is not included in the table above as it could be realized

independently from each of the events described in the table.

(2) The present value of the vested accumulated retirement benefit under the Company's 401(k) Plan and the Company's Nonqualified Savings and Supplemental Retirement Plan was

$948,472. If Mr. Ramsden were to terminate employment voluntarily during the normal course of business, only the vested portion of the Company's contributions would be available to

him. The unvested portion (the present value of which is $50,602) would be forfeited. If Mr. Ramsden's employment was terminated for reasons of death, disability or a change of control,

the unvested portion of the Company's contributions would become immediately vested and available to him or his beneficiaries upon such termination.

(3) Although not shown in the above table, Mr. Ramsden also participates in the Company's life insurance plan which is generally available to all salaried associates. The plan pays out a

multiple of base salary up to a maximum of $2,000,000. Under the provisions of the life insurance plan, if Mr. Ramsden passed away, his beneficiaries would receive $2,000,000. In

addition, the Company maintains an accidental death and dismemberment plan for all salaried associates. If Mr. Ramsden's death were accidental as defined by the plan, his beneficiaries

would receive an additional $2,000,000.

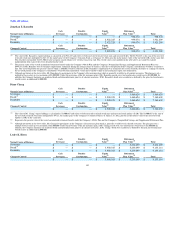

Diane Chang

Normal Course of Business

Cash

Severance

Benefits

Continuation

Equity

Value(1)

Retirement

Plan Value(2) Total

Severance $ — $ — $ — $ 3,460,624 $ 3,460,624

Death(3) $ — $ — $ 3,900,015 $ 3,460,624 $ 7,360,639

Disability $ — $ — $ 3,900,015 $ 3,460,624 $ 7,360,639

Change of Control

Cash

Severance

Benefits

Continuation

Equity

Value(1)

Retirement

Plan Value(2) Total

$ — $ — $ 3,900,015 $ 3,460,624 $ 7,360,639

(1) The value of Ms. Chang's equity holdings is calculated as $3,900,015 and relates to both unvested restricted stock units and unvested stock options / SARs. The $3,900,015 is the sum of

the unvested restricted stock units multiplied by $47.23, the market price of the Company's Common Stock as of January 28, 2012, plus the in-the-money value of the unvested stock

options / SARs on the same date.

(2) Represents the present value of the vested accumulated retirement benefit under the Company's 401(k) Plan and the Company's Nonqualified Savings and Supplemental Retirement Plan.

(3) Although not shown in the above table, Ms. Chang also participates in the Company's life insurance plan which is generally available to all salaried associates. The plan pays out a

multiple of base salary up to a maximum of $2,000,000. Under the provisions of the life insurance plan, if Ms. Chang passed away, her beneficiaries would receive $2,000,000. In

addition, the Company maintains an accidental death and dismemberment plan for all salaried associates. If Ms. Chang's death were accidental as defined by the plan, her beneficiaries

would receive an additional $2,000,000.

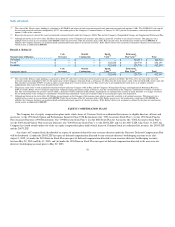

Leslee K. Herro

Normal Course of Business

Cash

Severance

Benefits

Continuation

Equity

Value(1)

Retirement

Plan Value(2) Total

Severance $ — $ — $ — $ 5,233,099 $ 5,233,099

Death(3) $ — $ — $ 3,900,015 $ 5,233,099 $ 9,133,114

Disability $ — $ — $ 3,900,015 $ 5,233,099 $ 9,133,114

Change of Control

Cash

Severance

Benefits

Continuation

Equity

Value(1)

Retirement

Plan Value(2) Total

$ — $ — $ 3,900,015 $ 5,233,099 $ 9,133,114

69