Abercrombie & Fitch 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

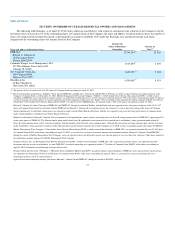

The Company's executive compensation programs promote these objectives by providing a large portion of executive pay via "at-risk" vehicles.

Mr. Jeffries receives the substantial majority of his annual compensation in the form of performance-based semi-annual equity grants. Under his 2008

employment contract, Mr. Jeffries is eligible for such grants only if the Company's total stockholder return during each semi-annual measurement period

increases above all previous high-water marks since the beginning of the contract, adjusted for cash dividends, and then only to the extent that the value

created exceeds any cash compensation paid to or earned by the CEO and any increase in the CEO's pension benefits accrued with respect to the semi-annual

period to which the grant relates.

For the remaining named executive officers, the majority of their compensation is provided in annual cash incentives contingent upon Company

financial performance and long-term equity incentives, including SARs and performance-based restricted stock units that provide an incentive to create long-

term stockholder value. The Company fosters a team-based approach and an environment of cooperation by tying both annual cash incentive compensation

and long-term equity compensation to the financial results of the Company as a whole. Because objectives for operating income for the Fall season during

Fiscal 2011 were not met, the annual cash incentive program paid out at only 66% of the aggregate target for the year.

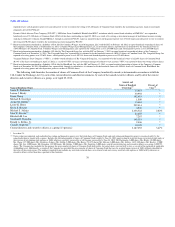

We believe that we have listened to our stockholders' message at the 2011 Annual Meeting of Stockholders and in subsequent engagement and

responded in a meaningful and appropriate manner. Beginning in Fiscal 2012, a portion of the long-term equity incentives granted to our Executive Vice

Presidents is in the form of performance shares that will be earned only if earnings per share growth objectives are achieved. The Compensation Committee

negotiated an amendment to the CEO's employment agreement (at no cost to the Company) to provide that 80% of the total fair value of any semi-annual

equity grants earned during the remaining term of the CEO's employment agreement will be awarded in the form of SARs and 20% will be awarded in the

form of restricted stock units. The restricted stock units will be subject to the same target and threshold adjusted earnings per share performance levels that

apply to performance shares granted to our Executive Vice Presidents, as well as the time-based vesting requirements specified in our CEO's employment

agreement.

In recent years, the Company has made changes to its executive compensation programs to respond to stockholder input and to conform with "best

practices". During Fiscal 2010, the CEO's employment agreement was amended (at no cost to the Company) to eliminate Internal Revenue Code

Section 280G excise tax gross-up payments. The Company's incentive plans are subject to a strict "clawback," allowing the Company to seek repayment of

any incentive amounts that were erroneously paid with no requirement of misconduct on the part of the plan participant before the clawback is triggered.

Further, the Company has implemented stock ownership guidelines for all directors and executive officers and has imposed holding requirements and five-

year cliff vesting on many of the equity awards granted to the CEO.

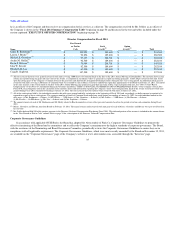

Stockholders are urged to read the "COMPENSATION DISCUSSION AND ANALYSIS" beginning on page 41, which describes in more detail how

the Company's executive compensation policies and procedures achieve its compensation objectives, as well as the "Fiscal 2011 Summary Compensation

Table" beginning on page 56 and related compensation tables, notes and narrative, which provide detailed information on the compensation of the named

executive officers.

In accordance with Section 14A of the Exchange Act, and as a matter of good corporate governance, the Company is asking stockholders to approve the

following advisory resolution at the Annual Meeting:

RESOLVED, that the stockholders of Abercrombie & Fitch Co. (the "Company") approve, on an advisory basis, the compensation of the

Company's named executive officers disclosed in the Compensation Discussion and Analysis, the Fiscal 2011 Summary Compensation Table and the

related compensation tables, notes and narrative in the Proxy Statement for the Company's 2012 Annual Meeting of Stockholders.

This advisory resolution, commonly referred to as a "Say on Pay" vote, is non-binding on the Board. Although non-binding, the Board and the

Compensation Committee will carefully review and consider the voting results when evaluating our executive compensation programs for Fiscal 2012. Taking

into account the advisory vote of stockholders regarding the frequency of future advisory votes to approve executive compensation at our 2011 Annual

Meeting of Stockholders, the Board's current policy is to include an advisory resolution regarding approval of the compensation of our named executive

officers annually. Accordingly, unless the Board modifies

40