ADT 2000 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIXTY NINE

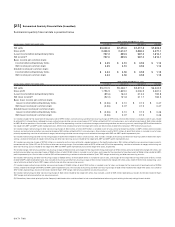

[2 5 ] Subsequent Events

On October 4, 2000, the Company entered into an agreement to

acquire InnerDyne, Inc. (“InnerDyne”), a manufacturer and distrib-

utor of patented radial dilating access devices used in minimally

invasive medical surgical procedures. The purchase price is approx-

imately $180 million payable in Tyco common shares. InnerDyne will

be integrated within Tyco’s Healthcare business. Tyco intends to

account for the acquisition as a purchase.

On October 6, 2000, the Company sold its ADT Automotive

business to Manheim Auctions, Inc., a wholly-owned subsidiary of

Cox Enterprises, Inc., for approximately $1 billion in cash. The sale

is expected to generate a one-time pre-tax gain to the Company in

excess of $300 million in the first quarter of Fiscal 2001.

On October 17, 2000, the Company acquired Mallinckrodt Inc.

(“Mallinckrodt”), a global healthcare company with products used

primarily for respiratory care, diagnostic imaging and pain relief.

The Company issued approximately 64.8 million common shares,

valued at approximately $3.2 billion, and assumed approximately

$1.0 billion in debt. Mallinckrodt is being integrated within the Com-

pany’s Healthcare business. The Company is accounting for the

acquisition as a purchase.

On November 13, 2000, the Company agreed to acquire the

Lucent Power Systems (“LPS”) business unit of Lucent Technolo-

gies, Inc. for $2.5 billion in cash. LPS provides a full line of energy

solutions and power products for telecommunications service

providers and for the computer industry and will be integrated

within the Electronics segment. LPS products include AC/DC and

DC/DC switching power supplies, batteries, power supplies and

back-up power systems. The acquisition is subject to customary

regulatory approvals.

On November 17, 2000, the Company completed a private

placement offering of $4,657,500,000 principal at maturity of zero-

coupon debt securities due 2020 for aggregate net proceeds of

approximately $3,374,000,000. Each $1,000 principal amount at

maturity security was issued at 74.165% of principal amount at

maturity, accretes at a rate of 1.5% per annum and is convertible

into 10.3014 Tyco common shares if certain conditions are met. The

Company may be required to repurchase the securities at the

accreted value at the option of the holders on November 17, 2001,

2003, 2005, 2007 or 2014. The proceeds of this offering will be

used to finance the LPS acquisition and to repay commercial paper.

On December 4, 2000, the Company agreed to acquire Simplex

Time Recorder Co. (“Simplex”) for approximately $1.15 billion in

cash. Simplex manufactures fire and security products and com-

munications systems including control panels, detection devices

and system software. Simplex also installs, monitors and services

fire alarms, security systems and access control systems and will be

integrated within the Fire and Security Services segment. The

acquisition is subject to customary regulatory approvals.