ADT 2000 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIFTY EIGHT

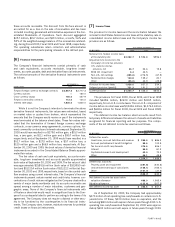

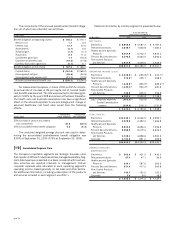

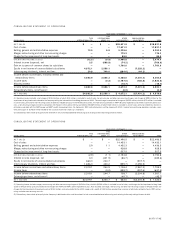

The net pension cost recognized at September 30, 2000 and 1999 for all U.S. and non-U.S. defined benefit plans is as follows:

U.S. PLANS N ON-U.S. PLANS

($ IN M I LLIONS) 2 0 0 0 1 9 99 2 00 0 1 9 9 9

CHANGE IN BENEFIT OBLIGATION

Benefit obligation at beginning of year $1,142.5 $1,191.8 $ 1 ,3 3 9 .9 $ 835.4

Service cost 9 .6 35.8 5 9 .6 45.7

Interest cost 8 4 .6 86.2 7 5 .1 48.0

Employee contributions

——

8 .7 8.7

Plan amendments 0 .1 8.3 0 .6 0.8

Actuarial (gain) loss (1 5 .1 ) (74.4) (5 5 .1 ) 28.1

Benefits paid (7 7 .0 ) (68.8) (4 4 .1 ) (49.2)

Acquisitions 1 9 .2 190.9 1 3 2 .3 404.9

Divestitures

—

(69.8)

—

(5.9)

Plan curtailments (9 .0 ) (136.3) (2 .9 ) (10.7)

Plan settlements (7 1 .0 ) (25.7) (1 0 .1 ) (2.4)

Special termination benefits 1 .9 4.5 3 .0 9 .2

Currency translation adjustment

——

(1 3 9 .4 ) 27.3

Benefit obligation at end of year $1,085.8 $1,142.5 $ 1 ,3 6 7 .6 $1,339.9

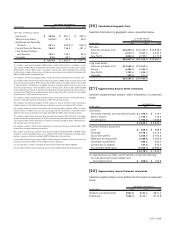

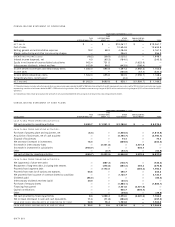

CHANGE IN PLAN ASSETS

Fair value of plan assets at beginning of year $1,165.8 $ 997.4 $ 1 ,1 7 5 .2 $ 700.5

Actual return on plan assets 258.7 169.3 1 2 1 .7 86.0

Employer contributions 2 3 .9 24.7 5 5 .6 38.8

Employee contributions

——

8 .7 8.8

Acquisitions 7 .7 155.8 7 4 .7 376.9

Divestitures

—

(84.2)

—

(7.5)

Plan settlements (7 1 .0 ) (25.7) (9 .9 ) (2.4)

Benefits paid (7 7 .0 ) (68.9) (4 4 .1 ) (49.2)

Administrative expenses paid (3 .9 ) (2.6) (1 .7 ) (1.8)

Currency translation adjustment

——

(1 2 7 .1 ) 25.1

Fair value of plan assets at end of year $1,304.2 $1,165.8 $ 1 ,2 5 3 .1 $1,175.2

Funded status $ 2 1 8 . 4 $ 23.3 $ (1 1 4 .5 ) $ (164.7)

Unrecognized net actuarial (gain) loss (2 8 4 .7 ) (128.8) (2 .3 ) 89.4

Unrecognized prior service cost 4 .4 6.7 5 .3 6 .0

Unrecognized transition asset (4 .0 ) (5.1) (3 .8 ) (4.5)

Net amount recognized $ (6 5 .9 ) $ (103.9) $ (1 1 5 .3 ) $ (73.8)

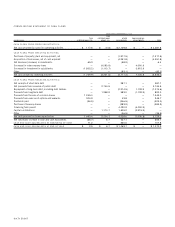

AMOUNTS RECOGNIZED IN THE CONSOLIDATED BALANCE SHEETS

Prepaid benefit cost $ 4 7 .6 $ 29.2 $ 1 0 7 . 6 $ 106.8

Accrued benefit liability (1 1 7 .6 ) (141.7) (2 5 5 .8 ) (222.1)

Intangible asset 0 .8 1.0 4 .9 6.3

Accumulated other comprehensive income 3 .3 7.6 2 8 . 0 35.2

Net amount recognized $ (6 5 .9 ) $ (103.9) $ (1 1 5 .3 ) $ (73.8)

WEIGHTED-AVERAGE ASSUMPTIONS

Discount rate 8.00% 7.75% 5 .7 5 % 5.65%

Expected return on plan assets 9 .7 5 8.60 7 .4 0 7.39

Rate of compensation increase 4 .4 0 4.30 4 .0 7 4.03