ADT 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TWENTY EIGHT

FIRE AND SECURITY SERVICES

Tyco’s Fire and Security Services segment’s products and services

include:

• designing, installing and servicing of a broad line of fire detec-

tion, prevention and suppression systems;

• providing electronic security installation and monitoring

services; and

• manufacturing and servicing of fire extinguishers and related

products.

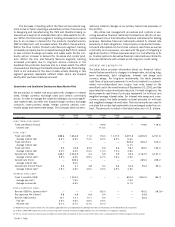

The following table sets forth sales and operating income and

margins for the Fire and Security Services segment:

($ IN M I LLIONS) FISCAL 20 00 FISCAL 19 99 FISCAL 19 98

Sales $ 6 ,0 7 6 .6 $5,534.0 $4,393.5

Operating income, before

certain credits $ 1 ,0 2 9 .3 $ 907.0 $ 630.6

Operating margins, before

certain credits 1 6 .9 % 16.4% 14.4%

Operating income, after

certain credits $ 1 ,0 4 0 .5 $ 934.2 $ 630.6

Operating margins, after

certain credits 1 7 .1 % 16.9% 14.4%

The 9.8% increase in sales in Fiscal 2000 over Fiscal 1999

resulted primarily from increased sales in the worldwide electronic

security services business and higher sales volume in fire protection

operations in North America, Asia and Australia. The increases were

due primarily to a higher volume of recurring service revenues

and, to a lesser extent, the effects of acquisitions in the security

services business. These acquisitions included: Entergy Security

Corporation (“Entergy”), acquired in January 1999, and Alarmguard

Holdings (“Alarmguard”), acquired in February 1999, both of which

were included in results for all of Fiscal 2000 but only part of Fis-

cal 1999. Excluding the impact of these acquisitions, the sales

increase for the segment in Fiscal 2000 was an estimated 8.9%.

The 26.0% sales increase in Fiscal 1999 over Fiscal 1998

reflected increased sales worldwide in both our electronic security

services and our fire protection businesses. The increases were

due both to a higher volume of recurring service revenues and

the effects of Fiscal 1999 acquisitions in the security services busi-

ness. These acquisitions included CIPE S.A., Wells Fargo Alarm,

Entergy and Alarmguard. Excluding the effects of these acquisi-

tions, the increase in sales for the segment in Fiscal 1999 was an

estimated 15.4%.

The 13.5% increase in operating income, before certain cred-

its, in Fiscal 2000 over Fiscal 1999 reflects increased service vol-

ume in security operations in the United States and fire protection

businesses in North America and Asia. The increase in operating

margins, before certain credits, was due to increased sales volume

in both security services and fire protection offset slightly, in the

case of security services, by the costs of the reorganization of the

security services’ dealer program and internal sales force during the

first two quarters of Fiscal 2000.

The 43.8% increase in operating income, before certain cred-

its, in Fiscal 1999 over Fiscal 1998 reflects the worldwide increase

in service volume, both in security services and fire protection,

including the higher margins associated with recurring monitoring

revenue. The increase in operating margins, before certain credits,

in Fiscal 1999 was principally due to increased volume of higher

margin service and inspection work in the North American fire pro-

tection operations; increased volume due to economic improve-

ments in the Asia-Pacific region; higher incremental margins in the

European security operations from additions to the customer base;

and cost reductions related to acquisitions.

In addition to the items discussed above, operating income and

margins, after certain credits reflect a restructuring and other non-

recurring credit of $11.2 million in Fiscal 2000 and $27.2 million in

Fiscal 1999.

FLOW CONTROL PRODUCTS AND SERVICES

Tyco’s Flow Control Products and Services segment’s products and

services include:

• a full line of valves and related products for industrial and

process control including butterfly, gate, globe, check, ball,

plug, safety relief, knife-gate, instrumentation, sampling, and

other valves as well as actuators, positioners, couplings and

related products, which are used to transport, control and sam-

ple liquids, gases, powders and other substances;

• pipe and tubular products, made primarily from steel, ductile

iron and plastic, utilized in the mechanical tubing, construc-

tion, automotive, water distribution, fencing products and

other markets;

• electrical raceway products, including steel conduit, pre-wired

armored cable, flexible conduit, steel support systems and

fasteners, cable tray and cable ladder;

• a broad range of consulting, engineering, construction man-

agement and operating services for the water, wastewater, envi-

ronmental, transportation and infrastructure markets; and

• fire sprinkler devices, specialty valves, steel pipe, plastic pipe

and fittings and pipe couplings used in commercial, residential

and industrial fire protection systems.

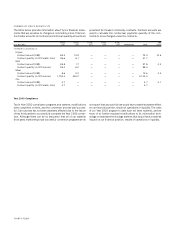

The following table sets forth sales and operating income and

margins for the Flow Control Products and Services segment:

($ IN M I LLIONS) FISCAL 20 00 FISCAL 19 99 FISCAL 19 98

Sales $ 3 ,9 3 7 .9 $3,508.6 $2,928.5

Operating income $ 7 4 6 . 9 $ 605.5 $ 456.9

Operating margins 1 9 .0 % 17.3% 15.6%

The 12.2% sales increase in Fiscal 2000 over Fiscal 1999 was

primarily due to increased volume at Allied Tube and Conduit,

increased demand for valve products in the Asia-Pacific region and

Europe, increased sales at Earth Tech and, to a lesser extent, the

impact of acquisitions. These acquisitions included: Glynwed Inter-

national, plc (“Glynwed”), acquired in March 1999; Central Sprin-

kler Corporation, acquired in August 1999; AFC Cable Systems,

Inc., acquired in November 1999; and Flow Control Technologies,

acquired in February 2000. In August 1999, we sold certain busi-

nesses within this segment, including The Mueller Company

(“Mueller”) and portions of Grinnell Supply Sales and Manufactur-

ing (“Grinnell”). Excluding the impacts of these acquisitions and

divestitures, sales increased an estimated 11.9%.

The 19.8% sales increase in Fiscal 1999 over Fiscal 1998

reflects increased demand for valve products in Europe, increased

sales at Earth Tech and the impact of acquisitions. These acquisi-

tions included Crosby Valve, Rust Environmental and Infrastructure,

Inc. and Glynwed. Excluding the effect of these acquisitions and the

divestitures of Mueller and Grinnell, the sales increase for the seg-

ment in Fiscal 1999 was an estimated 11.3%.

The 23.4% increase in operating income in Fiscal 2000 over

Fiscal 1999 was primarily due to increased volume at Allied Tube &

Conduit and increased volume and improved margins in the North