ADT 2000 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIFTY SEVEN

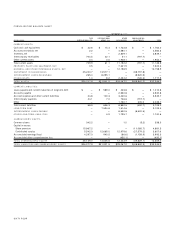

first quarter of Fiscal 1998, USSC recorded restructuring charges of

$12.0 million related to employee severance costs, facility disposals

and asset write-downs as part of USSC’s cost cutting program. USSC

substantially completed its 1998 restructuring activities during

Fiscal 1999.

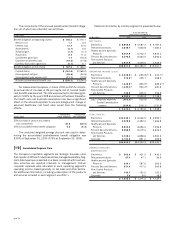

[1 7 ] Commitments and Contingencies

The Company occupies certain facilities under leases that expire at

various dates through the year 2030. Rental expense under these

leases and leases for equipment was $442.7 million, $381.0 million

and $331.7 million for Fiscal 2000, Fiscal 1999 and Fiscal 1998,

respectively. At September 30, 2000, the minimum lease payment

obligations under noncancelable operating leases were as follows:

$435.7 million in Fiscal 2001, $335.4 million in Fiscal 2002,

$239.5 million in Fiscal 2003, $170.4 million in Fiscal 2004, $142.7

million in Fiscal 2005 and an aggregate of $431.4 million in Fiscal

years 2006 through 2030.

In the normal course of business, the Company is liable for

contract completion and product performance. In the opinion of

management, such obligations will not significantly affect the

Company’s financial position or results of operations.

The Company is involved in various stages of investigation and

cleanup related to environmental remediation matters at a number

of sites. The ultimate cost of site cleanup is difficult to predict given

the uncertainties regarding the extent of the required cleanup, the

interpretation of applicable laws and regulations and alternative

cleanup methods. Based upon the Company’s experience with envi-

ronmental remediation matters, the Company has concluded that

there is at least a reasonable possibility that remedial costs will be

incurred with respect to these sites in an aggregate amount in the

range of $32.9 million to $95.2 million. At September 30, 2000, the

Company concluded that the most probable amount that will be

incurred within this range is $68.3 million. $35.4 million of such

amount is included in accrued expenses and other current liabilities

and $32.9 million is included in other long-term liabilities in the

Consolidated Balance Sheet. Based upon information available to

the Company, at those sites where there has been an allocation of

the liability for cleanup costs among a number of parties, including

the Company, and such liability could be joint and several, man-

agement believes it is probable that other responsible parties will

fully pay the cost allocated to them, except with respect to one site

for which the Company has assumed that one of the identified

responsible parties will be unable to pay the cost allocated to it and

that such party’s cost will be reapportioned among the remaining

responsible parties. In view of the Company’s financial position and

reserves for environmental matters of $68.3 million, the Company

has concluded that its payment of such estimated amounts will not

have a material effect on its financial position, results of operations

or liquidity.

The Company is a defendant in a number of other pending legal

proceedings incidental to present and former operations, acquisi-

tions and dispositions. The Company does not expect the outcome

of these proceedings, either individually or in the aggregate, to have

a material adverse effect on its financial position, results of opera-

tions or liquidity.

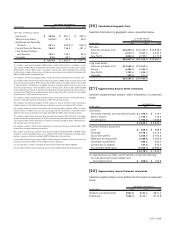

[1 8 ] Retirement Plans

DEFINED BENEFIT PENSION PLANS

The Company has a number of noncontributory and contributory

defined benefit retirement plans covering certain of its U.S. and

non-U.S. employees, designed in accordance with conditions and

practices in the countries concerned. Contributions are based on

periodic actuarial valuations which use the projected unit credit

method of calculation and are charged to the Consolidated State-

ments of Operations on a systematic basis over the expected aver-

age remaining service lives of current employees. The net pension

expense is assessed in accordance with the advice of professionally

qualified actuaries in the countries concerned or is based on sub-

sequent formal reviews for the purpose. The Company’s funding

policy is to make annual contributions to the extent such contribu-

tions are tax deductible as actuarially determined. The benefits

under the defined benefit plans are based on years of service and

compensation.

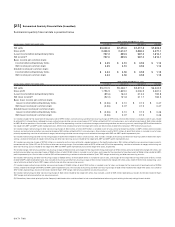

VOLUNTARY EARLY RETIREMENT PROGRAMS

In the fourth quarter of Fiscal 1998, AMP offered enhanced

retirement benefits to targeted groups of employees. The cost of

these benefits totaled $138.3 million and was recorded as part of

AMP’s fourth quarter restructuring charge. This amount has not

been included in the determination of net periodic pension cost

presented below. The net periodic pension (income) cost for all

U.S. and non-U.S. defined benefit pension plans includes the

following components:

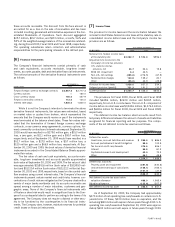

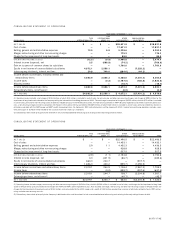

U.S. PLANS

(I N MILLI ONS) 2 00 0 1 9 9 9 19 9 8

Service cost $ 1 2 .1 $ 37.8 $ 44.7

Interest cost 8 4 .6 86.2 93.3

Expected return on plan assets (1 1 2 .8 ) (96.1) (109.9)

Recognition of initial net asset (1 .0 ) (0.9) (1.9)

Amortization of prior service cost 0 .7 3.0 3.2

Recognized net actuarial gain (6 .4 ) (0.6) (7.1)

Curtailment/settlement gain (4 .6 ) (102.6) (48.6)

Net periodic benefit income $ (2 7 .4 ) $ (73.2) $ (26.3)

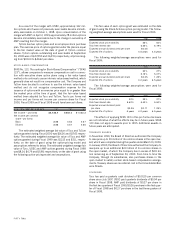

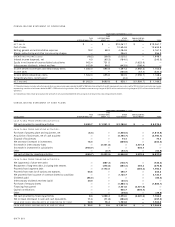

NON-U.S. PLANS

(I N MILLI ONS) 2 00 0 1 9 9 9 19 9 8

Service cost $ 6 0 .9 $ 47.4 $ 35.6

Interest cost 7 5 .1 48.0 43.1

Expected return on plan assets (8 5 .3 ) (56.8) (53.6)

Recognition of initial net obligation 0 .2 0.1

—

Amortization of prior service cost 0 .8 0.6 0.6

Recognized net actuarial loss (gain) 2 .3 1.1 (0.8)

Curtailment/settlement (gain) loss (2 .7 ) 1.2 6.7

Net periodic benefit cost $ 5 1 .3 $ 41.6 $ 31.6

The curtailment/settlement gains in Fiscal 1999 relate primar-

ily to the termination of employees at AMP and the freezing of AMP’s

pension plan. The curtailment/settlement gains in Fiscal 1998

relate primarily to the freezing of the ADT pension plan. These cur-

tailment/settlement gains have been recorded in selling, general

and administrative expenses.