ADT 2000 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORTY EIGHT

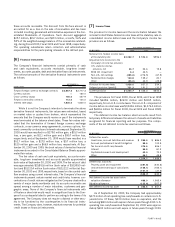

(2) In June 2000, TIG initiated a European commercial paper program under which it could ini-

tially issue notes with an aggregate face value of up to €300 million. In September 2000, TIG

increased its borrowing capacity under the European commercial paper program to €500 million.

The notes are fully and unconditionally guaranteed by the Company. Proceeds from the sale of these

notes are used for working capital and other corporate purposes.

(3) International overdrafts and demand loans represent borrowings by AMP from various banks

and other holders. All overdrafts and loans mature within one year from the balance sheet date. The

weighted-average interest rate on all international overdrafts and demand loans during Fiscal 2000

and Fiscal 1999 was 5.1% and 5.3%, respectively.

(4) In August 1999, TIG issued $500 million floating rate notes due 2000, $500 million floating

rate notes due 2001, $1 billion 6.875% notes due 2002 and ¥ 10 billion (approximately $89.7 mil-

lion) 0.57% notes due 2000. The $500 million floating rate notes bear interest at LIBOR plus 0.6%

for the 2000 notes and LIBOR plus 0.7% for the 2001 notes. These notes are fully and uncondi-

tionally guaranteed by Tyco (See Note 24). The net proceeds of approximately $2,080.3 million

were used to repay borrowings under TIG’s $4.5 billion commercial paper program discussed above.

In connection with the $1 billion 6.875% notes, TIG entered into an interest rate swap agreement

expiring in September 2002, under which TIG will receive a fixed rate of 6.875% and will pay a

floating rate based on the average of two different LIBOR rates, as defined, plus 3.755%. In June

2000, TIG offered to exchange all of its $1 billion 6.875% private placement notes due 2002 for

public notes. The form and terms of the public notes are identical in all material respects to the

form and terms of the outstanding private placement notes of the corresponding series, except that

the public notes are not subject to restrictions on transfer under United States securities laws. In

connection with the Yen denominated 0.57% notes, TIG entered into a cross-currency swap expir-

ing in September 2000, under which TIG received a payment of ¥ 10 billion plus accrued interest

at a rate of 0.57% and made quarterly U.S. dollar payments based on LIBOR plus 0.60%, as well

as a final payment at maturity of approximately $89.7 million.

(5) In June 1998, TIG issued $750 million 6.125% notes due 2001, $750 million 6.375% notes

due 2005, $750 million 6.25% Dealer Remarketable Securities (“Drs.”) due 2013 and $500 mil-

lion 7.0% notes due 2028 in a public offering. Interest is payable semi-annually in June and Decem-

ber. Under the terms of the Drs., the Remarketing Dealer has an option to remarket the Drs. in June

2003, which if exercised would subject the Drs. to mandatory tender to the Remarketing Dealer

and reset the interest rate to an adjusted fixed rate until June 2013. If the Remarketing Dealer does

not exercise its option, then all Drs. are required to be tendered to the Company in June 2003.

Repayment of amounts outstanding under these debt securities is fully and unconditionally guar-

anteed by Tyco (See Note 24). The net proceeds of approximately $2,744.5 million were ultimately

used to repay borrowings under TIG’s bank credit agreement and uncommitted lines of credit. In

December 1998, TIG terminated two interest rate swap agreements with notional amounts of $650

million each, which were entered into in June 1998 with a financial institution to hedge a portion

of the fixed rate terms of the public notes.

(6) In July 2000, TIG issued a €75 million floating rate note due 2002, which bears interest at

EURIBOR plus 0.42%.

(7) In October 1998, TIG issued $800 million of debt in a private placement offering consisting of

two series of restricted notes: $400 million of 5.875% notes due November 2004 and $400 mil-

lion of 6.125% notes due November 2008. The notes are fully and unconditionally guaranteed by

Tyco. The net proceeds of approximately $791.7 million were used to repay borrowings under TIG’s

bank credit agreement. At the same time, TIG also entered into an interest rate swap agreement

with a notional amount of $400 million to hedge the fixed rate terms of the 6.125% notes due 2008.

Under this agreement, which expires in November 2008, TIG will receive payments at a fixed rate

of 6.125% and will make floating rate payments based on LIBOR. Subsequently, during the third

and fourth quarters of Fiscal 1999, TIG exchanged all of the $400 million 5.875% private place-

ment notes due 2004 and $400 million 6.125% private placement notes due 2008 for public notes

(See Note 24). The form and terms of the public notes of each series are identical in all material

respects to the form and terms of the outstanding private placement notes of the corresponding

series, except that the public notes are not subject to restrictions on transfer under the United

States securities laws.

(8) In April 2000, TIG issued €600 million (approximately $565.7 million) 6.125% notes due 2007

in a private placement offering. The notes are fully and unconditionally guaranteed by Tyco. The

net proceeds were used to repay borrowings under TIG’s commercial paper program. In September

2000, TIG offered to exchange all of its €600 million (approximately $565.7 million) 6.125% notes

due 2007 for public notes. The form and terms of the public notes are identical in all material

respects to the form and terms of the outstanding private placement notes of the corresponding

series, except that the public notes are not subject to restrictions on transfer under United States

securities laws.

(9) In October 1998, Raychem issued notes in the amount of $400 million. The notes mature on

October 15, 2008, and bear interest at a rate of 7.2% per annum.

(10) In March 1998, USSC issued $300 million 7.25% senior notes due March 2008, which are

not redeemable prior to maturity and require semi-annual interest payments. In February 1999, the

Company completed a tender offer in which $292 million of the $300 million principal amount of

the notes outstanding were purchased.

(11) In January 1999, TIG issued $400 million of its 6.125% notes due 2009 and $800 million of

its 6.875% notes due 2029 in a public offering. The notes are fully and unconditionally guaran-

teed by Tyco (See Note 24). The net proceeds of approximately $1,173.7 million were used to repay

borrowings under TIG’s bank credit agreement. At the same time, TIG also entered into an interest

rate swap agreement to hedge the fixed rate terms of the $400 million notes due 2009. Under the

agreement, which expires in January 2009, TIG will receive payments at a fixed rate of 6.125% and

will make floating rate payments based on an average of three different LIBO rates, as defined,

plus a spread.

(12) In July 1995, ADT Operations, Inc. issued $776.3 million aggregate principal amount at matu-

rity of its zero coupon subordinated Liquid Yield Option Notes (“LYONs”) maturing July 2010. The

issue price per LYON was $383.09, being 38.309% of the principal amount of $1,000 per LYON at

maturity, reflecting a yield to maturity of 6.5% per annum (computed on a semi-annual bond equiv-

alent basis). The discount amortization on the LYONs is being charged as interest expense through

the Consolidated Statements of Operations on a basis linked to the yield to maturity. The LYONs

discount amortization amounted to $2.4 million in Fiscal 2000, $6.0 million in Fiscal 1999 and

$11.0 million in Fiscal 1998. Each LYON is exchangeable for common shares of the Company at the

option of the holder at any time prior to maturity, unless previously redeemed or otherwise pur-

chased by ADT Operations, Inc., at an exchange rate of 54.352 common shares per LYON. During

Fiscal 2000 and Fiscal 1999, respectively, 32,169 and 147,418 LYONs with carrying values of $16.4

million and $72.3 million were exchanged for 1,748,442 and 8,012,468 common shares of the Com-

pany. Any LYON will be purchased by ADT Operations, Inc., at the option of the holder, as of July

2002 for a purchase price per LYON of $599.46. At that time, if the holder exercises the option,

the Company has the right to deliver all or a portion of the purchase price in the form of common

shares of the Company. Beginning July 2002, the LYONs are redeemable for cash at any time at the

option of ADT Operations, Inc., in whole or in part, at redemption prices equal to the issue price

plus accrued original issue discount to the date of redemption. The LYONs are guaranteed on a sub-

ordinated basis by the Company.

(13) International bank loans represent term borrowings by Tyco Electronics from various commer-

cial banks. Borrowings are repayable in varying amounts through 2013. The weighted-average inter-

est rate on all international bank loans as of September 30, 2000 and 1999 was 3.3% and 3.9%,

respectively.

(14) The financing lease obligation relates to USSC’s European Headquarters office building and

distribution center complex in Elancourt, France. The French Franc denominated financing lease

requires principal amortization in varying amounts over the eleven year term of the lease with a bal-

loon payment of approximately 42 million French Francs ($6 million) at the end of the lease. Inter-

est is payable at a rate approximately 1.4% above Paris Interbank Offered Rate (PIBOR). The

effective interest rate on the financing lease debt was approximately 5.0% and 4.0% per annum at

September 30, 2000 and 1999, respectively.

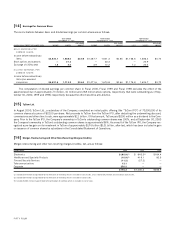

The weighted-average rate of interest on all long-term debt was

6.5% and 6.2% during Fiscal 2000 and Fiscal 1999, respectively.

The weighted-average rate of interest on all variable long-term debt

was 6.5% and 5.6% as of September 30, 2000 and 1999, respec-

tively. The impact of the Company’s interest rate swap activities on

its weighted-average borrowing rate was not material in any year. The

impact on reported interest expense was a reduction of $6.6 million,

$0.9 million and $1.9 million for Fiscal 2000, Fiscal 1999 and Fis-

cal 1998, respectively.

The aggregate amounts of total debt maturing during the next

five years are as follows (in millions): $1,537.2 in Fiscal 2001,

$4,075.5 in Fiscal 2002, $53.9 in Fiscal 2003, $129.4 in Fiscal

2004 and $1,161.6 in Fiscal 2005.

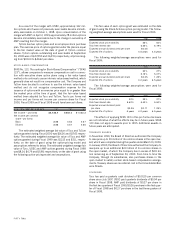

[5 ] Sale of Accounts Receivable

The Company has an agreement under which several of its operat-

ing subsidiaries sell a defined pool of trade accounts receivable to

a limited purpose subsidiary of the Company. The subsidiary, a sep-

arate corporate entity, holds these receivables and sells participat-

ing interests in such accounts receivable to financiers who, in turn,

purchase and receive ownership and security interests in those

receivables. As collections reduce accounts receivable included in

the pool, the operating subsidiaries sell new receivables to the lim-

ited purpose subsidiary. The limited purpose subsidiary has the risk

of credit loss on the receivables and, accordingly, the full amount of

the allowance for doubtful accounts has been retained in the Con-

solidated Balance Sheets. The availability under the program is

$500 million. At September 30, 2000 and 1999, $450 million and

$350 million, respectively, was utilized under the program. The pro-

ceeds from the sales were used to reduce borrowings under TIG’s

commercial paper program and are reported as operating cash flows

in the Consolidated Statements of Cash Flows. The proceeds of sale

are less than the face amount of accounts receivable sold by an

amount that approximates the cost that the limited purpose sub-

sidiary would incur if it were to issue commercial paper backed by