ADT 2000 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIFTY SIX

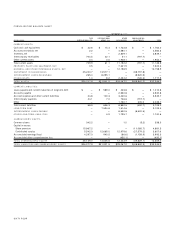

The cost of announced workforce reductions of $433.7 million

includes the elimination of 16,139 positions primarily in the United

States and Europe, consisting primarily of manufacturing and dis-

tribution, administrative, research and development and sales and

marketing personnel. The cost of facility closures of $68.6 million

consists primarily of the shut-down and consolidation of 87 facili-

ties primarily in the United States and Europe, consisting primarily

of manufacturing plants, distribution centers, administrative build-

ings, research and development facilities and sales offices. It also

includes $18.3 million related to the write-down of inventory, which

is included in cost of sales. At September 30, 2000, 10,072 employ-

ees had been terminated and 62 facilities had been shut down.

The other charges of $141.0 million consist of transaction costs

of $67.9 million for legal, printing, accounting, financial advisory

services and other direct expenses related to the AMP merger; $88.1

million related to the write-down of inventory, discussed below;

lease termination costs following the merger of $9.6 million; a credit

of $50.0 million related to a litigation settlement with AlliedSignal

Inc.; and other costs of $25.4 million relating to the consolidation

of certain product lines and other non-recurring charges related to

the AMP merger.

As part of the integration of AMP’s electronics business and

AMP’s profit improvement plan, the Company evaluated the prof-

itability and anticipated customer demand for its various products.

As a result of this evaluation, management decided to exit certain

product lines and/or businesses which were under-performing rela-

tive to expectations. The inventory held by the Company related to

these exited activities was deemed impaired and written down to

estimated fair value. The total write-down of $88.1 million was

recorded as a charge to cost of sales. These discontinued product

lines represented approximately $150 million of historical net sales

for AMP on an annualized basis.

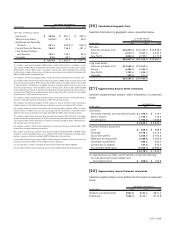

The Healthcare and Specialty Products segment recorded net

merger, restructuring and other non-recurring charges of $419.1 mil-

lion, consisting of a $423.8 million charge primarily related to the

merger with USSC and a $4.7 million credit representing a revision

of estimates related to Tyco’s 1997 restructuring and other non-

recurring accruals discussed below. The following table provides

information about these charges, in addition to revision in estimates

of Fiscal 1999 charges:

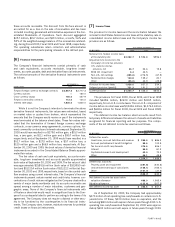

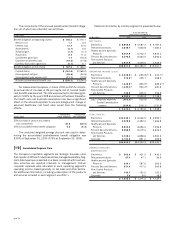

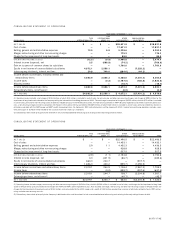

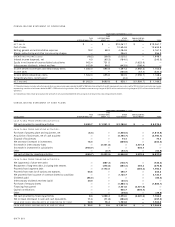

SEVERANCE FACILITI ES OTHER

NUMBER OF NU M BER OF

($ IN M I LLIONS) EMPLOYEES RESERVE FACILITIES RESERVE RESERVE TOTAL

Fiscal 1999 charges 1,467 $124.8 45 $ 51.8 $ 247.2 $ 423.8

Fiscal 1999 activity (1,282) (99.3) (20) (18.3) (217.6) (335.2)

Fiscal 2000 revision in estimates

—

(4.2) (1) (4.5) (11.0) (19.7)

Fiscal 2000 utilization (91) (14.8) (17) (10.7) (18.6) (44.1)

Ending balance at September 30, 2000 94 $ 6.5 7 $ 18.3 $

—

$ 24.8

the actions under Tyco’s 1997 restructuring and other non-recurring

plans are completed or near completion and have resulted in total

estimated costs being less than originally anticipated.

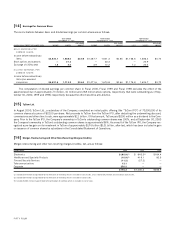

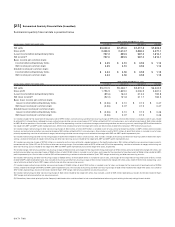

1998 CHARGES AND CREDIT

During the fourth quarter of Fiscal 1998, AMP recorded charges of

$185.8 million associated with its profit improvement plan, which

includes the reduction of support staff throughout all its business

units and the consolidation of manufacturing plants and other facil-

ities, in addition to certain sales growth initiatives. These charges

include the cost of staff reductions of $172.1 million involving the

voluntary retirement and involuntary termination of approximately

2,700 staff support personnel and 700 direct manufacturing

employees, and the cost of consolidation of certain facilities of $13.7

million relating to six plant and facility closures and consolidations.

At September 30, 1999, these restructuring activities were sub-

stantially completed. See Note 18 for discussion of the voluntary

early retirement program.

During the first quarter of Fiscal 1998, AMP recorded a credit

of $21.4 million to merger, restructuring and other non-recurring

charges representing a revision of estimates related to its 1996

restructuring activities, which were completed in Fiscal 1998.

During the fourth quarter of Fiscal 1998, USSC recorded cer-

tain charges of $80.5 million. These charges include $70.9 million

of costs to exit certain businesses representing the write down of

assets from earlier purchases of technology that had minimal com-

mercial application and the adjustment to net realizable value of

certain assets. In addition, merger costs of $9.6 million were

recorded that represent legal and insurance costs related to the

merger consummated in the first quarter of Fiscal 1999. During the

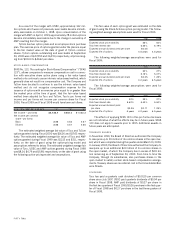

The cost of announced workforce reductions of $124.8 million

includes the elimination of 1,467 positions primarily in the United

States and Europe, consisting primarily of manufacturing and dis-

tribution, sales and marketing, administrative and research and

development personnel. The cost of facility closures of $51.8 mil-

lion includes the shut-down and consolidation of 45 facilities pri-

marily in Europe and the United States, consisting primarily of

manufacturing plants, distribution centers, sales offices, adminis-

trative buildings and research and development facilities. At Sep-

tember 30, 2000, 1,373 employees had been terminated and 37

facilities had been shut down.

The other charges of $247.2 million consist of transaction costs

of $53.3 million for legal, printing, accounting, financial advisory

services and other direct expenses related to the USSC merger, lease

termination costs following the merger of $156.8 million and other

costs of $37.1 million relating to the consolidation of certain prod-

uct lines and other non-recurring charges primarily related to the

USSC merger. The lease termination costs of $156.8 million relate

to the USSC North Haven facility that was purchased by Tyco sub-

sequent to the merger (See Note 2).

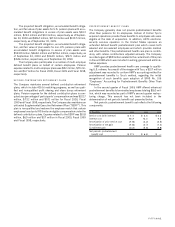

The remaining balance at September 30, 2000 of $24.8 million

is included in other current liabilities in the Consolidated Balance

Sheet. The Company currently anticipates that the restructuring and

other non-recurring activities to which all of these charges relate will

be completed within Fiscal 2001.

In Fiscal 1999, the Company recorded a credit of $31.9 million,

including $27.2 million in the Fire and Security Services segment

and $4.7 million in the Healthcare and Specialty Products segment

referred to above, representing a revision of estimates related to

Tyco’s 1997 restructuring and other non-recurring accruals. Most of