ADT 2000 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORTY FOUR

STOCK SPLITS

Per share amounts and share data have been retroactively restated

to give effect to the two-for-one stock splits distributed on October

22, 1997 and October 21, 1999, both effected in the form of a stock

dividend (See Note 10).

[2 ] Pooling of Interests Transactions

On April 2, 1999 and October 1, 1998, Tyco merged with AMP and

USSC, respectively. A total of approximately 329.2 million and 118.4

million Tyco common shares, respectively, were issued to the former

shareholders of these companies.

Both of the merger transactions discussed below were

accounted for under the pooling of interests accounting method,

which presents as a single interest common shareholder interests

which were previously independent. The historical consolidated

financial statements for periods prior to the consummation of the

combination are restated as though the companies had been com-

bined during such periods.

Aggregate fees and expenses related to the mergers and to the

integration of the combined companies have been expensed in the

Consolidated Statements of Operations in the period in which each

transaction was consummated, as required under the pooling of

interests method of accounting (See Notes 12 and 16).

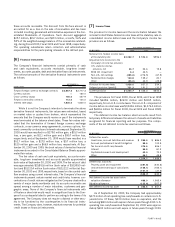

Combined and separate results of Tyco, USSC and AMP for the

periods preceding the mergers were as follows:

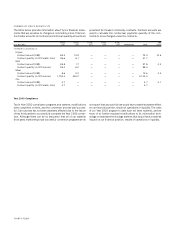

(I N MILLI ONS) TYCO USSC AMP ADJUSTM ENTS COMBINED

Six Months ended March 31, 1999 (unaudited)(1)

Net sales $ 7,776.8 $

—

$2,675.5 $

—

$10,452.3

Operating income (loss) 906.1

—

(405.2)

—

500.9

Extraordinary items, net of taxes (44.9)

———

(44.9)

Net income (loss) 408.8

—

(376.0) (3.0)(3 ) 29.8

Year ended September 30, 1998(2)

Net sales 12,311.3 1,225.9 5,524.5

—

19,061.7

Operating income (loss) 1,923.7 (298.5) 322.9

—

1,948.1

Extraordinary items, net of taxes (2.4)

———

(2.4)

Net income (loss) 1,174.7 (212.0) 208.5 (5.0)(3) 1,166.2

(1) Includes merger, restructuring and other non-recurring charges of $414.6 million and impairment charges of $76.0 million primarily related to the merger with USSC, and restructuring and other non-

recurring charges of $275.3 million, of which $55.2 million is included in cost of sales, and impairment charges of $236.7 million related to AMP’s profit improvement plan. Also includes a credit of

$8.3 million representing a revision of estimates related to Tyco’s 1997 merger, restructuring and other non-recurring accruals.

(2) Includes restructuring and other non-recurring charges of $164.4 million primarily related to AMP’s profit improvement plan and $92.5 million principally related to costs incurred by USSC to exit

certain businesses.

(3) As a result of the combination of Tyco and AMP, an income tax adjustment was recorded to conform tax accounting.

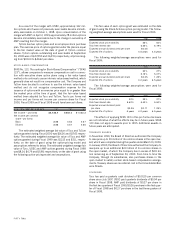

program. Each of these acquisitions was accounted for as a pur-

chase, and the results of operations of the acquired companies have

been included in the consolidated results of the Company from their

respective acquisition dates.

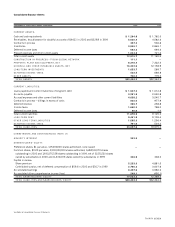

In connection with these acquisitions, the Company recorded

purchase accounting liabilities of $426.2 million for transaction

costs and the costs of integrating the acquired companies within the

various Tyco business segments. Details regarding these purchase

accounting liabilities are set forth below.

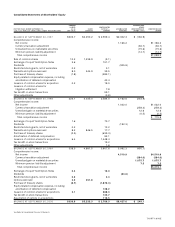

At the time each purchase acquisition is made, the Company

records each asset acquired and each liability assumed at its esti-

mated fair value, which amount is subject to future adjustment

when appraisals or other further information are obtained. The

excess of (a) the total consideration paid for the acquired company

over (b) the fair value of assets acquired less liabilities assumed and

purchase accounting liabilities recorded is recorded as goodwill. As

a result of acquisitions completed in Fiscal 2000, and adjustments

to the fair values of assets and liabilities and purchase accounting

liabilities recorded for acquisitions completed prior to Fiscal 2000,

the Company recorded approximately $5,206.8 million in goodwill

and other intangibles.

In connection with the USSC merger, the Company assumed an

operating lease for USSC’s North Haven facilities. In December

1998, the Company assumed the debt related to the North Haven

property of approximately $211 million. The assumption of the debt

combined with the settlement of certain other obligations in the

amount of $23 million resulted in the Company acquiring owner-

ship of the North Haven property for a total cost of $234 million.

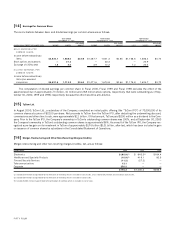

[3 ] Acquisitions and Divestitures

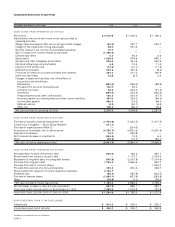

FISCAL 2000

During Fiscal 2000, the Company purchased businesses for an

aggregate cost of $5,162.0 million, consisting of $4,246.5 million in

cash, net of cash acquired, the issuance of approximately 15.6 mil-

lion common shares valued at $671.4 million and the assumption of

$244.1 million in debt. In addition, $544.2 million of cash was paid

during the year for purchase accounting liabilities related to current

and prior years’ acquisitions. The cash portions of the acquisition

costs were funded utilizing cash on hand, the issuance of long-

term debt and borrowings under the Company’s commercial paper