ADT 2000 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

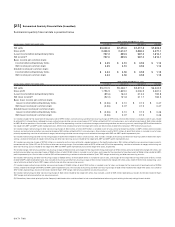

As a result of the merger with USSC, approximately 14.2 mil-

lion options which were not previously exercisable became immedi-

ately exercisable on October 1, 1998. Upon consummation of the

merger with AMP on April 2, 1999, approximately 7.8 million options

became immediately exercisable due to the change in ownership of

AMP resulting from the merger.

TyCom has two option plans and an employee stock purchase

plan. The exercise price of options granted under the plans is equal

to the fair market value at the date of grant of TyCom common

shares. TyCom options outstanding and exercisable at September

30, 2000 were 21,607,050 and 26,250, respectively, at prices rang-

ing from $32.00 to $44.62 per share.

STOCK-BASED COMPENSATION

SFAS No. 123, “Accounting for Stock-Based Compensation” (“SFAS

123”), allows companies to measure compensation cost in connec-

tion with executive share option plans using a fair value based

method or to continue to use an intrinsic value based method, which

generally does not result in a compensation cost. The Company and

TyCom have decided to continue to use the intrinsic value based

method and do not recognize compensation expense for the

issuance of options with an exercise price equal to or greater than

the market price at the time of grant. Had the fair value based

method been adopted by Tyco and TyCom, Tyco’s pro forma net

income and pro forma net income per common share for Fiscal

2000, Fiscal 1999 and Fiscal 1998 would have been as follows:

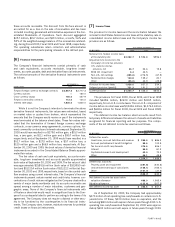

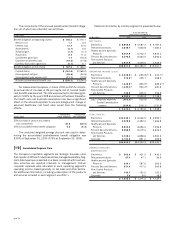

(I N MILLI ONS, EXCEPT PER SHARE DATA) 200 0 1 9 9 9 19 9 8

Net income

—

pro forma $ 4 ,1 3 6 .7 $858.3 $1,063.3

Net income per common

share

—

pro forma

Basic 2 .4 5 0.52 0.67

Diluted 2 .4 2 0.51 0.66

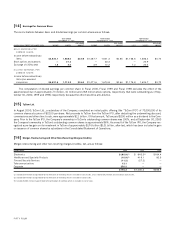

The estimated weighted-average fair value of Tyco and TyCom

options granted during Fiscal 2000 was $16.26 and $17.47, respec-

tively. The estimated weighted-average fair value of Tyco and AMP

options granted during Fiscal 1999 was $12.13 and $7.11, respec-

tively, on the date of grant using the option-pricing model and

assumptions referred to below. The estimated weighted-average fair

value of Tyco, USSC and AMP options granted during Fiscal 1998

was $8.24, $6.79 and $5.98, respectively, on the date of grant using

the following option-pricing model and assumptions.

The fair value of each option grant was estimated on the date

of grant using the Black-Scholes option-pricing model. The follow-

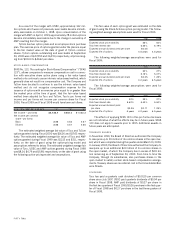

ing weighted-average assumptions were used for Fiscal 2000:

TYCO TYCOM

Expected stock price volatility 36% 60%

Risk free interest rate 6.35% 6.19%

Expected annual dividend yield per share $0.05

—

Expected life of options 4.5 years 4.5 years

The following weighted-average assumptions were used for

Fiscal 1999:

TYCO AMP

Expected stock price volatility 30% 27%

Risk free interest rate 5.15% 5.07%

Expected annual dividend yield per share $0.05 1.25%

Expected life of options 4.2 years 6.5 years

The following weighted-average assumptions were used for

Fiscal 1998:

TYCO USSC AMP

Expected stock price volatility 22% 39% 27%

Risk free interest rate 5.62% 5.40% 5.50%

Expected annual dividend yield

per share $0.05 $0.11 1.25%

Expected life of options 5 years 4.2 years 6.5 years

The effects of applying SFAS 123 in this pro forma disclosure

are not indicative of what the effects may be in future years. SFAS

123 does not apply to awards prior to 1995. Additional awards in

future years are anticipated.

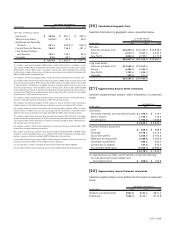

TREASURY SHARES

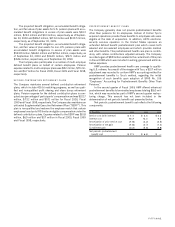

In November 1999, the Board of Directors authorized the Company

to reacquire up to 20 million of its common shares in the open mar-

ket, which was completed during the quarter ended March 31, 2000.

In January 2000, the Board of Directors authorized the Company to

reacquire up to an additional $2.0 billion of its common shares in

the open market, of which the Company has in excess of $0.9 bil-

lion remaining as of September 30, 2000. From time to time the

Company, through its subsidiaries, also purchases shares in the

open market to satisfy certain stock-based compensation arrange-

ments. Treasury shares are recorded at cost in the Consolidated Bal-

ance Sheets.

DIVIDENDS

Tyco has paid a quarterly cash dividend of $0.0125 per common

share since July 1997. USSC paid quarterly dividends of $0.04 per

share in Fiscal 1998. AMP paid dividends of $0.27 per share in

the first two quarters of Fiscal 1999, $0.26 per share in the first quar-

ter of Fiscal 1998 and $0.27 per share in the last three quarters of

Fiscal 1998.

FIFTY TWO