ADT 2000 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

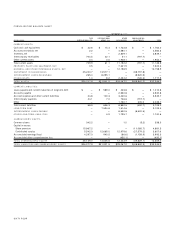

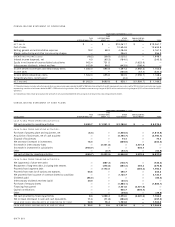

SIXTY ONE

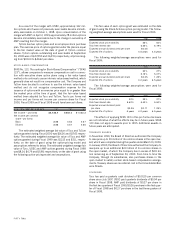

YEAR ENDED SEPTEMBER 3 0 ,

(I N MILLI ONS) 2 0 0 0 1 9 9 9 1 9 9 8

CAPITAL EXPENDITURES:

Electronics $ 2 9 3 .8 $ 391.1 $ 492.0

Telecommunications 316.0(11) 97.4 28.2

Healthcare and Specialty

Products 251.1 235.9(12) 202.9

Fire and Security Services 764.3 746.3 491.4

Flow Control Products

and Services 142.1 135.1 92.6

Corporate 4 7 .6 26.7 10.4

$ 1 , 8 1 4 .9 $ 1,632.5 $ 1,317.5

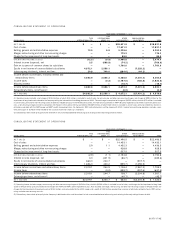

(1) Includes a restructuring charge of $16.9 million, of which $0.9 million is included in cost of

sales, related to AMP’s Brazilian operations and wireless communications business and a credit of

$107.8 million, of which $6.3 million is included in cost of sales, primarily representing a revision

of estimates of merger, restructuring, and other non-recurring accruals related to the merger with

AMP and AMP’s profit improvement plan.

(2) Includes a non-recurring charge of $13.1 million incurred in connection with the TyCom IPO.

(3) Includes charges for the impairment of long-lived assets of $99.0 million and restructuring and

other non-recurring charges of $7.9 million, of which $6.4 million is included in cost of sales, related

to exiting USSC’s interventional cardiology business. Includes restructuring and other non-

recurring charges of $11.1 million related to USSC’s suture business. Also includes a credit of $29.9

million representing a revision in estimates of merger, restructuring, and other non-recurring accru-

als consisting of $19.7 million related primarily to the merger with USSC and $10.2 million related

to the Company’s 1997 restructuring accruals.

(4) Includes a merger, restructuring and other non-recurring credit of $11.2 million representing a

revision in estimates related to the Company’s 1997 restructuring accruals.

(5) Includes a non-recurring charge of $275.0 million as a reserve for certain claims relating to a

merged company in the Healthcare business and other non-recurring charges of $1.2 million.

(6) Includes merger, restructuring and other non-recurring charges of $643.3 million, of which

$106.4 million is included in cost of sales, and charges for the impairment of long-lived assets of

$431.5 million primarily related to the merger with AMP and AMP’s profit improvement plan.

(7) Includes merger, restructuring and other non-recurring charges of $423.8 million and charges

for the impairment of long-lived assets of $76.0 million, primarily related to the merger with USSC,

and a credit of $4.7 million representing a revision of estimates related to Tyco’s 1997 restructur-

ing and other non-recurring accruals.

(8) Includes a credit of $27.2 million representing a revision of estimates related to Tyco’s 1997

restructuring and other non-recurring accruals.

(9) Includes restructuring and other non-recurring charges recorded by AMP of $185.8 million

related to its profit improvement plan and a credit of $21.4 million to restructuring charges repre-

senting a revision of estimates related to AMP’s 1996 restructuring activities.

(10) Includes non-recurring charges of $80.5 million primarily related to business exit costs and

restructuring charges of $12.0 million related to USSC’s operations.

(11) Includes $111.1 million in spending for construction of the TyCom Global Network.

(12) Excludes $234.0 million related to the purchase of property previously leased by USSC.

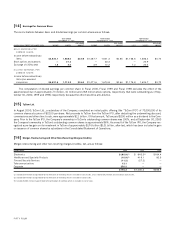

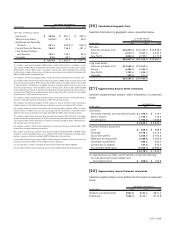

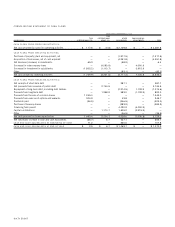

[2 0 ] Consolidated Geographic Data

Selected information by geographic area is presented below.

AS AT AND FOR THE

YEAR ENDED SEPTEMBER 3 0 ,

(I N MILLI ONS) 2 00 0 1 9 9 9 19 9 8

Net sales:

Americas (primarily U.S.) $ 1 8 ,4 5 7 .5 $14,409.0 $12,518.4

Europe 6 ,6 1 0 .1 5,362.4 4,431.4

Asia-Pacific 3 ,8 6 4 .3 2,725.1 2,111.9

$ 2 8 ,9 3 1 .9 $22,496.5 $19,061.7

Long-Lived Assets:

Americas (primarily U.S.) $ 1 7 ,6 5 5 .4 $13,849.4

Europe 5 ,4 5 3 .3 4,084.6

Asia-Pacific 1 ,7 5 1 .5 1,838.3

Corporate 4 3 5 .0 311.3

$ 2 5 ,2 9 5 .2 $20,083.6

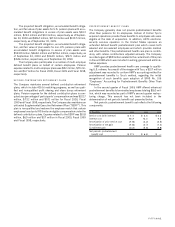

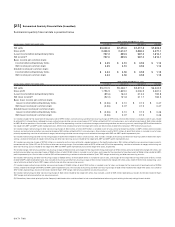

[2 1 ] Supplementary Balance Sheet Information

Selected supplementary balance sheet information is presented

below.

SEPTEMBER 3 0 ,

(I N MILLI ONS) 2 0 0 0 1 9 9 9

Inventories:

Purchased materials and manufactured parts $ 1 ,0 7 6 .5 $ 719.1

Work in process 1 ,1 0 5 .1 774.2

Finished goods 1 ,6 6 3 . 5 1,355.8

$ 3 ,8 4 5 .1 $ 2,849.1

Property, Plant and Equipment:

Land $ 5 3 8 .8 $ 386.8

Buildings 2 ,4 1 6 .1 2,414.0

Subscriber systems 3 ,2 0 0 .7 2,703.3

Machinery and equipment 7 ,0 8 9 .5 7,005.3

Leasehold improvements 2 9 5 .8 224.4

Construction in progress 7 2 7 .6 573.0

Accumulated depreciation (6 ,0 5 0 .1 ) (5,984.4)

$ 8 ,2 1 8 .4 $ 7,322.4

Accrued expenses and other current liabilities include the following:

Accrued payroll and payroll related costs

(including bonuses) $ 8 0 8 .9 $ 723.5

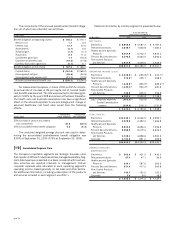

[2 2 ] Supplementary Income Statement Information

Selected supplementary income statement information is presented

below.

YEAR ENDED SEPTEMBER 3 0 ,

(I N MILLI ONS) 2 00 0 1 9 9 9 19 9 8

Research and development $ 5 2 7 .5 $450.5 $511.4

Advertising $ 1 4 9 .3 $133.1 $110.8