ADT 2000 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIFTY NINE

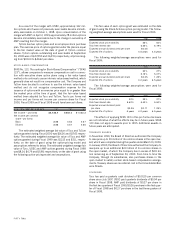

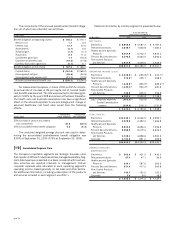

The projected benefit obligation, accumulated benefit obliga-

tion, and fair value of plan assets for U.S. pension plans with accu-

mulated benefit obligations in excess of plan assets were $30.3

million, $29.3 million and $9.3 million, respectively, as of Septem-

ber 30, 2000 and $186.7 million, $173.4 million and $130.7 million,

respectively, as of September 30, 1999.

The projected benefit obligation, accumulated benefit obliga-

tion, and fair value of plan assets for non-U.S. pension plans with

accumulated benefit obligations in excess of plan assets were

$543.8 million, $464.0 million and $256.1 million, respectively, as

of September 30, 2000 and $563.5 million, $517.1 million and

$314.6 million, respectively, as of September 30, 1999.

The Company also participates in a number of multi-employer

defined benefit plans on behalf of certain employees. Pension

expense related to multi-employer plans was $8.2 million, $7.5 mil-

lion and $1.7 million for Fiscal 2000, Fiscal 1999 and Fiscal 1998,

respectively.

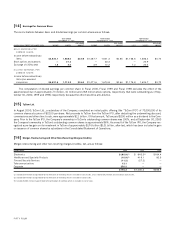

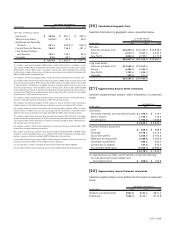

DEFINED CONTRIBUTION RETIREMENT PLANS

The Company maintains several defined contribution retirement

plans, which include 401(k) matching programs, as well as quali-

fied and nonqualified profit sharing and share bonus retirement

plans. Pension expense for the defined contribution plans is com-

puted as a percentage of participants’ compensation and was $132.7

million, $73.2 million and $57.1 million for Fiscal 2000, Fiscal

1999 and Fiscal 1998, respectively. The Company also maintains an

unfunded Supplemental Executive Retirement Plan (“SERP”). This

plan is nonqualified and restores the employer match that certain

employees lose due to IRS limits on eligible compensation under the

defined contribution plans. Expense related to the SERP was $10.8

million, $6.9 million and $3.7 million in Fiscal 2000, Fiscal 1999

and Fiscal 1998, respectively.

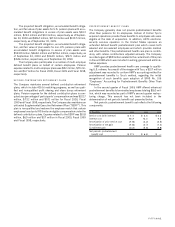

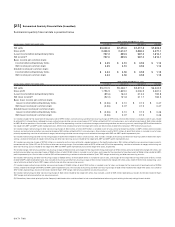

POSTRETIREMENT BENEFIT PLANS

The Company generally does not provide postretirement benefits

other than pensions for its employees. Certain of Former Tyco’s

acquired operations provide these benefits to employees who were

eligible at the date of acquisition. In addition, ADT’s electronic

security services operation in the United States sponsors an

unfunded defined benefit postretirement plan which covers both

salaried and non-salaried employees and which provides medical

and other benefits. This postretirement health care plan is contrib-

utory, with retiree contributions adjusted annually. The Company

recorded a gain of $8.8 million related to the curtailment of this plan

in Fiscal 1998 which was included in selling, general and adminis-

trative expenses.

AMP provides postretirement health care coverage to qualify-

ing U.S. retirees. As a result of the merger with Tyco, a $13.7 million

adjustment was recorded to conform AMP’s accounting method for

postretirement benefits to Tyco’s method, regarding the initial

recognition of such benefits upon adoption of SFAS No. 106

“Employers’ Accounting for Postretirement Benefits Other Than

Pensions.”

In the second quarter of Fiscal 1999, AMP offered enhanced

postretirement benefits to terminated employees totaling $16.0 mil-

lion, which was recorded as part of AMP’s second quarter restruc-

turing charge. This amount has not been included in the

determination of net periodic benefit cost presented below.

Net periodic postretirement benefit cost reflects the following

components:

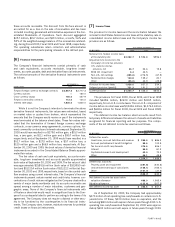

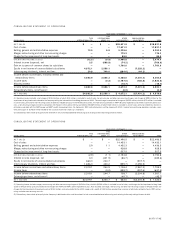

(I N MILLI ONS) 2 00 0 1 9 9 9 19 9 8

Service cost (with interest) $ 1 .1 $ 3.5 $ 3.2

Interest cost 1 2 .7 12.0 9.5

Amortization of prior service cost (1 .9 ) (2.2) (2.5)

Amortization of net gain (1 . 6 ) (0.7) (1.4)

Curtailment gain (3 . 2 ) (5.8) (8.8)

Net periodic postretirement

benefit cost $ 7 .1 $ 6.8 $

—