ADT 2000 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORTY TWO

Gains and losses arising on the disposal of property, plant and

equipment are included in the Consolidated Statements of Opera-

tions and were not material.

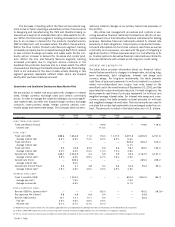

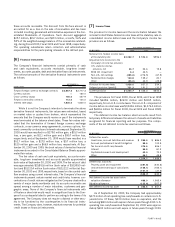

GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill, which is being amortized on a straight-line basis over peri-

ods ranging from 10 to 40 years, was $13,723.0 million and

$10,639.3 million, net, at September 30, 2000 and 1999, respec-

tively. Accumulated amortization amounted to $959.3 million at

September 30, 2000 and $615.6 million at September 30, 1999.

Other intangible assets were $2,609.6 million and $1,519.6 mil-

lion, net, at September 30, 2000 and 1999, respectively. These

amounts include patents, trademarks, customer contracts and other

items, which are being amortized on a straight-line basis over lives

ranging from 2 to 40 years. At September 30, 2000 and 1999, accu-

mulated amortization amounted to $525.2 million and $319.5 mil-

lion, respectively.

INVESTMENTS

The Company accounts for its long-term investments that represent

less than twenty percent ownership using Statement of Financial

Accounting Standards No. 115, “Accounting for Certain Investments

in Debt and Equity Securities.” This standard requires that certain

debt and equity securities be adjusted to market value at the end of

each accounting period. Unrealized market gains and losses are

charged to earnings if the securities are traded for short-term profit.

Otherwise, such unrealized gains and losses are charged or credited

to shareholders’ equity. Management determines the proper classi-

fication of investments in obligations with fixed maturities and mar-

ketable equity securities at the time of purchase and reevaluates

such designations as of each balance sheet date. Realized gains and

losses on sales of investments, as determined on a specific identifi-

cation basis, are included in the Consolidated Statements of Oper-

ations and were not material.

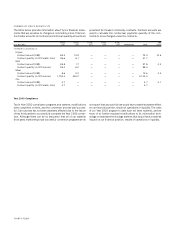

As of September 30, 2000, the Company had Available-for-Sale

equity investments with a fair market value of $1,320.3 million and

a cost basis of $218.7 million. The gross unrealized gains of $1,118.0

million and gross unrealized losses of $16.4 million have been

recorded net of deferred taxes of $18.1 million and have been

included as a separate component of shareholders’ equity.

Other investments for which the Company does not have the

ability to exercise significant influence and for which there is not a

readily determinable market value are accounted for under the cost

method of accounting. The Company periodically evaluates the car-

rying value of its investments accounted for under the cost method

of accounting and, as of September 30, 2000 and 1999, such

investments were recorded at the lower of cost or estimated net real-

izable value.

For investments in which the Company owns or controls

twenty percent or more of the voting shares, or over which it exerts

significant influence over operating and financial policies, the

equity method of accounting is used. The Company’s share of net

income or losses of equity investments is included in the Consoli-

dated Statements of Operations and was not material in any period

presented.

Investments are included in Other Assets in the Consolidated

Balance Sheets.

LONG-LIVED ASSETS

The Company periodically evaluates the net realizable value of long-

lived assets, including goodwill and other intangible assets and

property, plant and equipment, relying on a number of factors

including operating results, business plans, economic projections

and anticipated future cash flows. An impairment in the carrying

value of an asset is assessed when the undiscounted, expected

future operating cash flows derived from the asset are less than its

carrying value.

REVENUE RECOGNITION

Revenue from the sale of services or products is recognized as ser-

vices are rendered or shipments are made. Subscriber billings for

services not yet rendered are deferred and taken into income as

earned, and the deferred element is included in current liabilities.

Revenue from the installation of electronic security systems is rec-

ognized when installations are completed.

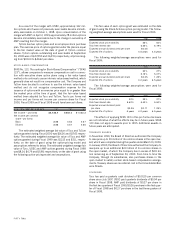

Contract sales for the installation of fire protection systems,

underwater cable systems and other construction related projects

are recorded on the percentage-of-completion method. Profits rec-

ognized on contracts in process are based upon estimated contract

revenue and related cost to completion. Revisions in cost estimates

as contracts progress have the effect of increasing or decreasing

profits in the current period. Provisions for anticipated losses are

made in the period in which they first become determinable.

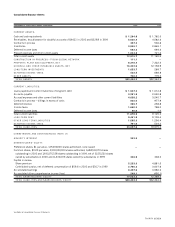

Accounts receivable include amounts billed under retainage

provisions primarily for fire protection and electronic contracts. The

retention balances were $56.6 million and $33.3 million at Sep-

tember 30, 2000 and 1999, respectively, and become due upon con-

tract completion and acceptance. The balance as of September 30,

2000 is expected to be substantially collected during the fiscal year

ending September 30, 2001.

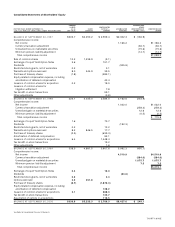

SHARE PREMIUM AND CONTRIBUTED SURPLUS

In accordance with the Bermuda Companies Act of 1981, when the

Company issues shares for cash at a premium to their par value, the

resulting premium is credited to a share premium account, a non-

distributable reserve. When the Company issues shares in exchange

for shares of another company, the excess of the fair value of the

shares acquired over the par value of the shares issued by the Com-

pany is credited, where applicable, to contributed surplus, which is,

subject to certain conditions, a distributable reserve.

INCOME TAXES

Deferred tax liabilities and assets are recognized for the expected

future tax consequences of events that have been included in the

consolidated financial statements or tax returns. Deferred tax lia-

bilities and assets are determined based on the differences between

the consolidated financial statements and the tax basis of assets and

liabilities, using tax rates in effect for the years in which the differ-

ences are expected to reverse. A valuation allowance is provided to

offset any net deferred tax assets if, based upon the available evi-

dence, it is more likely than not that some or all of the deferred tax

assets will not be realized.

RESEARCH AND DEVELOPMENT

Research and development expenditures are expensed when

incurred and are included in cost of sales in the Consolidated State-

ments of Operations.

ADVERTISING

Advertising costs are expensed when incurred.