ADT 2000 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THIRTY

In addition, in Fiscal 2000 and Fiscal 1999 we paid out $544.2

million and $354.4 million, respectively, in cash that was charged

against reserves established in connection with acquisitions

accounted for under the purchase accounting method. This amount

is included in “Acquisition of businesses, net of cash acquired” in

the Consolidated Statement of Cash Flows.

Business combinations are accounted for either on a pooling of

interests basis or under the purchase accounting method. In Fiscal

1999, the Company made two business combinations, USSC and

AMP, that were required to be accounted for on a pooling of inter-

ests basis. Under pooling of interests accounting, the merged com-

panies are treated as if they had always been part of Tyco, and their

financial statements are included in our Consolidated Financial

Statements for all periods presented.

At the time of each pooling of interests transaction, Tyco estab-

lishes a reserve for transaction costs and the costs that we expect to

incur in integrating the merged company within the relevant Tyco

business segment. By integrating merged companies with our exist-

ing businesses, we expect to realize operating synergies and long-

term cost savings. Integration costs, which relate primarily to

termination of employees and the closure of facilities made

redundant, are detailed in Note 16 to the Consolidated Financial

Statements. Reserves for merger, restructuring and other non-

recurring items are taken as a charge against current earnings at the

time the reserves are established. Amounts expended for merger,

restructuring and other non-recurring costs are charged against the

reserves as they are paid out. If the amount of the reserves proves

to be greater than the costs actually incurred, any excess is credited

against merger, restructuring and other non-recurring charges in the

Consolidated Statement of Operations in the period in which that

determination is made.

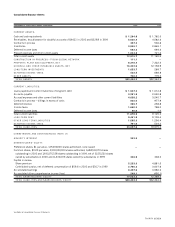

In Fiscal 2000, we established merger, restructuring and other

non-recurring reserves of $325.2 million, of which $7.3 million is

included in cost of sales, primarily related to a reserve for certain

claims relating to a merged company in the Healthcare business,

the restructuring activities in AMP’s Brazilian operations and wire-

less communications business, a non-recurring charge incurred in

connection with the TyCom IPO, charges associated with USSC’s

suture business and the exiting of USSC’s interventional cardiology

business. At the beginning of the fiscal year, there existed merger,

restructuring and other non-recurring reserves of $399.3 million

related to pooling of interests transactions consummated in prior

years and other restructuring charges taken by the merged compa-

nies prior to their combination with Tyco. During Fiscal 2000, we

paid out $155.2 million in cash and incurred $54.5 million in non-

cash charges that were charged against these reserves. Also in Fis-

cal 2000, we determined that $148.9 million of merger,

restructuring and other non-recurring reserves established in prior

years were not needed. These amounts were taken as merger,

restructuring and other non-recurring credits during Fiscal 2000

and offset against the reserves. At September 30, 2000, there

remained $365.9 million of merger, restructuring and other non-

recurring reserves on our Consolidated Balance Sheet, of which

$334.8 million is included in current liabilities and $31.1 million is

included in long-term liabilities.

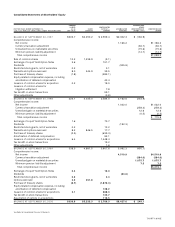

All business combinations completed in Fiscal 2000 were

required to be accounted for under the purchase accounting

method. At the time each purchase acquisition is made, we estab-

lish a reserve for transaction costs and the costs of integrating the

purchased company within the relevant Tyco business segment. The

amounts of such reserves established in Fiscal 2000 are detailed in

Note 3 to the Consolidated Financial Statements. These amounts

are not charged against current earnings but are treated as

additional purchase price consideration and have the effect of

increasing the amount of goodwill recorded in connection with the

respective acquisition. We view these costs as the equivalent of

additional purchase price consideration when we consider making

an acquisition. If the amount of the reserves proves to be in excess

of costs actually incurred, any excess is used to reduce the goodwill

account that was established at the time the acquisition was made.

In Fiscal 2000, we made acquisitions that were accounted for

under the purchase accounting method at an aggregate cost of

$5,162.0 million. Of this amount, $4,246.5 million was paid in cash

(net of cash acquired), $671.4 million was paid in the form of Tyco

common shares, and we assumed $244.1 million in debt. In con-

nection with these acquisitions, we established purchase account-

ing reserves of $426.2 million for transaction and integration costs.

At the beginning of Fiscal 2000, purchase accounting reserves were

$570.3 million as a result of purchase accounting transactions

made in prior years. During Fiscal 2000, we paid out $544.2 million

in cash and incurred $52.1 million in non-cash charges against the

reserves established during and prior to Fiscal 2000. Also in Fiscal

2000, we determined that $117.8 million of purchase accounting

reserves related to acquisitions made prior to Fiscal 2000 were not

needed and reversed that amount against goodwill. At September

30, 2000, there remained $372.6 million in purchase accounting

reserves on our Consolidated Balance Sheet, of which $349.2 mil-

lion is included in current liabilities and $23.4 million is included

in long-term liabilities.

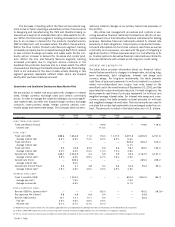

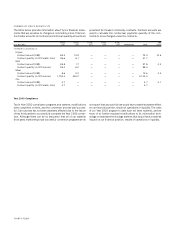

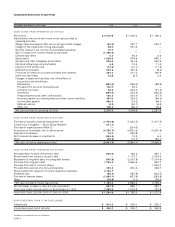

The following details the Fiscal 2000 capital expenditures and

depreciation by segment:

CAPITAL

(I N MILLI ONS) EXPENDITURES DEPRECIATION

Electronics $ 2 9 3 . 8 $ 4 4 4 .9

Telecommunications 3 1 6 .0 (1 ) 5 7 .4

Healthcare and Specialty Products 2 5 1 .1 1 9 2 .8

Fire and Security Services 7 6 4 .3 3 0 9 .4

Flow Control Products and Services 1 4 2 .1 8 2 .9

Corporate 4 7 .6 7 .6

$ 1 ,8 1 4 .9 $ 1 ,0 9 5 .0

(1) Includes $111.1 million in spending for construction of the TyCom Global Network.

We continue to fund capital expenditures to improve the cost

structure of our businesses, to invest in new processes and technol-

ogy, and to maintain high quality production standards. The level of

capital expenditures for the Fire and Security Services segment sig-

nificantly exceeded, and is expected to continue to significantly

exceed, depreciation due to the large volume growth of new residen-

tial subscriber systems capitalized. The level of capital expenditures

in the Telecommunications segment is expected to significantly

increase due to construction of the TyCom Global Network. The level

of capital expenditures in the other segments is expected to increase

moderately in Fiscal 2001. The source of funds for capital expendi-

tures is expected to be cash from operating activities.

The provision for income taxes in the Consolidated Statement

of Operations for Fiscal 2000 was $1,926.0 million, but the amount

of income taxes paid (net of refunds) during the year was $454.7

million. The difference is due primarily to the timing of tax payments

related to the gain on issuance of shares by TyCom. The current

income tax liability at September 30, 2000 was $1,650.3 million,

as compared to $798.0 million at September 30, 1999. After

adjustment for deferred income taxes of acquired companies and

other items, the net increase in deferred income taxes was $507.8