ADT 2000 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORTY SEVEN

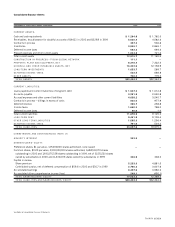

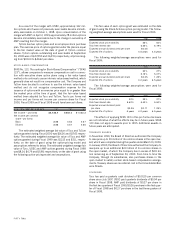

[4 ] Indebtedness

Long-term debt is as follows:

SEPTEMBER 3 0 ,

(I N MILLI ONS) 2 0 0 0 1 9 9 9

Commercial paper program(1) $ 2 ,4 2 0 .6 $ 1,392.0

Bank credit agreement(1)

——

Euro commercial paper program(2) 1 7 2 .9

—

International overdrafts and demand loans(3) 8 3 .0 184.9

8.125% public notes due 1999

—

10.5

Floating rate private placement notes

due 2000(4)

—

499.4

0.57% Yen denominated private placement

notes due 2000(4)

—

89.7

8.25% senior notes due 2000

—

9.5

Floating rate private placement notes

due 2001(4) 4 9 9 . 7 499.1

6.5% public notes due 2001 2 9 9 .7 299.3

6.125% public notes due 2001(5) 7 4 9 .2 748.1

Floating rate Euro denominated private

placement note due 2002(6) 6 6 .3

—

6.875% public notes due 2002(4) 9 9 4 .9 992.2

5.875% public notes due 2004(7) 3 9 8 .2 397.7

6.375% public notes due 2004 1 0 4 .7 104.6

6.375% public notes due 2005(5) 7 4 4 .8 743.7

6.125% Euro denominated public

notes due 2007(8) 5 2 5 .4

—

6.125% public notes due 2008(7) 3 9 5 .5 394.9

7.2% notes due 2008(9) 3 9 8 .9 398.8

7.25% senior notes due 2008(10) 8 .2 8.2

6.125% public notes due 2009(11) 3 9 4 .7 394.1

Zero coupon Liquid Yield Option Notes

due 2010(12) 3 5 .0 49.1

International bank loans, repayable

through 2013(13) 2 1 8 .0 208.2

6.25% public Dealer Remarketable Securities

(“Drs.”) due 2013(5) 7 5 7 .3 760.1

9.5% public debentures due 2022 4 9 .0 49.0

8.0% public debentures due 2023 5 0 . 0 50.0

7.0% public notes due 2028(5) 4 9 2 .6 492.4

6.875% public notes due 2029(11) 7 8 1 .2 780.5

Financing lease obligation(14) 5 5 .3 69.5

Other 3 0 3 .9 496.7

Total debt 1 0 ,9 9 9 .0 10,122.2

Less current portion 1 ,5 3 7 .2 1,012.8

Long-term debt $ 9 , 4 6 1 .8 $ 9,109.4

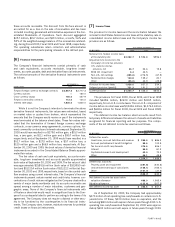

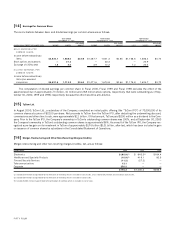

(1) In January 1999, Tyco International Group S.A. (“TIG”), a wholly-owned subsidiary of the Com-

pany, initiated a commercial paper program with an aggregate face value of up to $1.75 billion. In

February 2000, TIG increased its borrowing capacity under the commercial paper program to $4.5

billion. The notes are fully and unconditionally guaranteed by the Company. Proceeds from the sale

of the notes are used for working capital and other corporate purposes. TIG is required to maintain

an available unused balance under its bank credit agreement sufficient to support amounts out-

standing under the commercial paper program. In February 2000, TIG renegotiated its revolving

credit agreement with a group of commercial banks, giving it the right to borrow up to $4.5 billion

until February 9, 2001, with the option to extend to February 9, 2002. TIG has the option to increase

the $4.5 billion credit facility up to $5.0 billion. TIG also has a $0.5 billion multiyear revolving credit

facility which expires on February 12, 2003. Interest payable on borrowings under the two facili-

ties is variable based upon TIG’s option to select a Euro rate plus margins ranging from 0.41% to

0.43%, or a base rate, as defined. If the outstanding principal amount of loans equals or exceeds

25% of the commitments, the Euro margins are increased by 0.125%. The obligations of TIG under

the credit agreements are fully and unconditionally guaranteed by the Company. TIG is using the

credit agreements to fully support its commercial paper program and therefore expects these facil-

ities to remain largely undrawn. The Company is required to meet certain covenants under the credit

agreements, none of which is considered restrictive to the operations of the Company.

During Fiscal 1999, the Company reduced its estimate of pur-

chase accounting liabilities relating primarily to Fiscal 1998 acqui-

sitions by $90.0 million and, accordingly, goodwill and related

deferred tax assets were reduced by an equivalent amount. These

changes primarily resulted from costs being less than originally

anticipated for acquisitions consummated prior to Fiscal 1999.

During Fiscal 1999, the Company sold certain of its businesses

for net proceeds of approximately $926.8 million in cash. These

consist primarily of certain businesses within the Flow Control Prod-

ucts and Services segment, including The Mueller Company and

portions of Grinnell Supply Sales and Manufacturing, and certain

businesses within the Healthcare and Specialty Products segment.

The aggregate net gain recognized on the sale of these businesses

was not material. In connection with the Flow Control divestiture,

the Company granted a non-exclusive license to the buyer for use of

certain intellectual property and is entitled to receive future royal-

ties equal to a percentage of net sales of the businesses sold. The

Company also granted an option to the buyer to purchase certain

intellectual property in the future at the then fair market value.

FISCAL 1998

During Fiscal 1998, the Company acquired companies for an aggre-

gate cost of $4,559.4 million, consisting of $4,154.8 million in cash,

the assumption of approximately $260 million in debt and the

issuance of 765,544 common shares valued at $19.2 million and

1,254 subsidiary preference shares valued at $125.4 million. The

cash portions of the acquisition costs were funded utilizing cash on

hand, borrowings under bank credit agreements, proceeds of approx-

imately $1,245.0 million from the sale of common shares, and bor-

rowings under the Company’s uncommitted lines of credit. Each of

these acquisitions was accounted for as a purchase, and the results

of operations of the acquired companies were included in the con-

solidated results of the Company from their respective acquisition

dates. As a result of the acquisitions, the Company recorded approx-

imately $3,947.0 million in goodwill and other intangibles. As of

September 30, 2000, $14.3 million in employee severance, princi-

pally payments to employees previously severed, and $28.7 million

of facility related costs, principally for the expiration of non-cance-

lable leases on vacant premises, remained in the Consolidated

Balance Sheet.

In July 1998, the Company acquired the U.S. operations of

Crosby Valve, Inc. in exchange for 1,254 cumulative dividend pref-

erence shares of a newly created subsidiary, valued at $125.4 mil-

lion. The subsidiary has authorized 2,000 cumulative dividend

preference shares. The holders of these preference shares have the

option to require the Company to repurchase the preference shares

at par value plus unpaid dividends at any time after July 2001. The

outstanding preference shares were issued at $100,000 par value

each and have been classified in other long-term liabilities on the

Consolidated Balance Sheets. Cash dividends accumulate on a pre-

ferred basis, whether or not earned or declared, at the rate of $3,750

per share per annum. Upon liquidation, the holders of shares are

entitled to receive an amount equal to $100,000 per share, plus any

unpaid dividends. These preference shares may be redeemed by the

subsidiary at any time on or after December 31, 2008 at a price per

share of $100,000, plus unpaid dividends. In October 2000, the

Company redeemed these preference shares for $128.7 million.