ADT 2000 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TWENTY NINE

American and European valve operations and at Earth Tech. Also,

royalty and licensing fee income from certain intellectual property

associated with the divested businesses offset a portion of the oper-

ating income lost from the divestitures. Increased operating margins

in Fiscal 2000 resulted primarily from royalty and licensing fee

income and margin improvement in the North American and Euro-

pean valve operations and at Earth Tech.

The 32.5% increase in operating income in Fiscal 1999 over

Fiscal 1998 was primarily due to increased sales in the European

flow control operations and North American valve products and at

Earth Tech. The increase in operating margins was principally due

to cost containment programs that improved margins in our North

American pipe products business and the worldwide valve opera-

tions. The gain on the sale of Mueller and portions of Grinnell in this

segment did not significantly impact operating profits and margins

in Fiscal 1999.

FOREIGN CURRENCY

The effect of changes in foreign exchange rates during Fiscal 2000,

Fiscal 1999 and Fiscal 1998 was not material to our sales and oper-

ating income.

CORPORATE EXPENSES

Corporate expenses, excluding non-recurring charges of $275.0 mil-

lion as a reserve for certain claims relating to a merged company in

the Healthcare business and other non-recurring charges of $1.2

million, were $187.4 million in Fiscal 2000 compared to $122.9 mil-

lion in Fiscal 1999 and $68.3 million in Fiscal 1998. These

increases were due principally to higher compensation expense

under our equity-based incentive compensation plans and an

increase in corporate staffing and related costs to support and mon-

itor our expanding businesses and operations.

AMORTIZATION OF GOODWILL

Amortization of goodwill, a non-cash charge, increased $128.3 mil-

lion to $344.4 million in Fiscal 2000 compared with Fiscal 1999.

Fiscal 1999 amortization of goodwill increased to $216.1 million

from $131.8 million in Fiscal 1998. The increase in amortization of

goodwill is due to the $5,162.0 million in consideration paid for

acquisitions and acquisition related costs in Fiscal 2000, which

resulted in goodwill and other intangibles of $5,206.8 million, and

the $6,923.3 million in consideration paid for acquisitions and

acquisition related costs in Fiscal 1999, which resulted in goodwill

and other intangibles of $5,807.9 million.

INTEREST EXPENSE, NET

Interest expense, net, increased $284.0 million to $769.6 million

in Fiscal 2000, as compared to Fiscal 1999, and increased $240.3

million to $485.6 million in Fiscal 1999, as compared to Fiscal

1998. These increases were primarily due to higher average debt

balances, resulting from borrowings to finance acquisitions and our

stock repurchase program and, to a lesser extent, higher average

interest rates in Fiscal 2000. The increase in borrowings was miti-

gated in part by the use of free cash flow to pay for certain acquisi-

tions. The weighted-average rate of interest on all long-term debt

during Fiscal 2000, Fiscal 1999 and Fiscal 1998 was 6.5%, 6.2%

and 6.4%, respectively.

EXTRAORDINARY ITEMS

Extraordinary items in Fiscal 2000, Fiscal 1999 and Fiscal 1998

included after-tax losses amounting to $0.2 million, $45.7 million

and $2.4 million, respectively, relating primarily to our tender offers

for debt and the write-off of net unamortized deferred financing

costs related to the LYONs. Further details are provided in Notes 4

and 13 to the Consolidated Financial Statements.

INCOME TAX EXPENSE

The effective income tax rate, excluding the impact of merger,

restructuring and other non-recurring credits (charges), charges for

the impairment of long-lived assets and gain on the sale of TyCom

shares, was 24.8% during Fiscal 2000 as compared to 27.0% in Fis-

cal 1999 and 30.6% in Fiscal 1998. The decreases in the effective

income tax rates were primarily due to higher earnings in tax juris-

dictions with lower income tax rates. We believe that we will gen-

erate sufficient future income to realize the tax benefits related to

our deferred tax assets. A valuation allowance has been maintained

due to continued uncertainties of realization of certain tax benefits,

primarily tax loss carryforwards (See Note 7).

Liquidity and Capital Resources

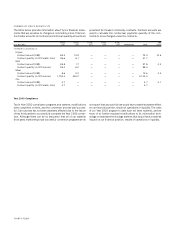

The following table shows the sources of our cash flow from operat-

ing activities and the use of a portion of that cash in our operations

in Fiscal 2000 and Fiscal 1999. We refer to the net amount of cash

generated from operating activities less capital expenditures and

dividends as “free cash flow.”

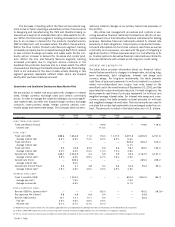

(I N MILLI ONS) Fiscal 20 00 Fiscal 19 99

Operating income, before certain charges(1) $ 6 , 0 9 4 .1 $ 3,949.6

Depreciation and amortization(2) 1 ,3 0 0 . 0 1,095.1

Net increase in deferred income taxes 5 0 7 .8 351.6

Less:

Net increase in working capital(3) (6 4 .9 ) (122.6)

Interest expense, net (7 6 9 .6 ) (485.6)

Income tax expense (1 ,9 2 6 .0 ) (637.5)

Restructuring expenditures(4) (1 5 5 .2 ) (633.6)

Other, net 2 8 8 .8 32.8

Cash flow from operating activities 5 ,2 7 5 .0 3,549.8

Less:

Capital expenditures (1 ,8 1 4 .9 ) (1,632.5)

Dividends paid (8 6 .2 ) (187.9)

Free cash flow $ 3 ,3 7 3 .9 $ 1,729.4

(1) This amount is the sum of the operating income of the five business segments as set forth above,

less certain corporate expenses, and is before merger, restructuring and other non-recurring cred-

its and charges, charges for the impairment of long-lived assets and goodwill amortization.

(2) This amount is the sum of depreciation of tangible property ($1,095.0 million and $979.6 mil-

lion in Fiscal 2000 and Fiscal 1999, respectively) and amortization of intangible property other

than goodwill ($205.0 million and $115.5 million in Fiscal 2000 and Fiscal 1999, respectively).

(3) This amount is net of $100.0 million and $50.0 million received on the sale of accounts receiv-

able in Fiscal 2000 and Fiscal 1999, respectively.

(4) This amount is the sum of all cash paid out for (a) merger, restructuring and other non-

recurring charges in connection with business combinations accounted for on a pooling of interests

basis and (b) other restructuring and non-recurring charges taken by the pooled companies prior to

their combination with Tyco.