ADT 2000 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TWENTY SIX

Operating income improved in all segments in each of Fiscal

2000 and Fiscal 1999. The operating improvements are the result

of both increased revenues in all segments and enhanced margins

in all but one segment in Fiscal 2000. Increased revenues result

from organic growth and from acquisitions that are accounted for

under the purchase method of accounting. We enhance our margins

through improved productivity and cost reductions in the ordinary

course of business, unrelated to acquisition or divestiture activities.

We regard charges that we incur to reduce costs in the ordinary

course of business as recurring charges, which are reflected in cost

of sales and in selling, general and administrative expenses in the

Consolidated Statements of Operations.

When we make an acquisition, the acquired company is imme-

diately integrated with our existing operations. Consequently, we do

not separately track the financial results of acquired companies. The

year-to-year sales comparisons that are presented below include

estimates of year-to-year sales growth that exclude the effects of

acquisitions that are accounted for under the purchase method of

accounting. These estimates assume that the acquisitions were

made at the beginning of the relevant fiscal periods.

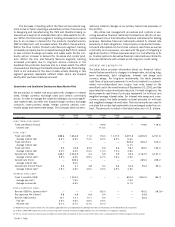

SALES AND OPERATING INCOME

ELECTRONICS

Tyco’s Electronics segment’s products and services include:

• designing, engineering and manufacturing of electronic con-

nector systems, fiber optic components, wireless devices, heat

shrink products, power components, wire and cable, relays,

sensors, touch screens, identification and labeling products,

switches and battery assemblies; and

• designing and manufacturing of multi-layer printed circuit

boards, backplane assemblies, electronic modules and similar

components.

The AMP merger occurred in April 1999, but as required under

the pooling of interests method of accounting, AMP’s results have

been included for all periods presented. The following table sets

forth sales and operating income (loss) and margins for the Elec-

tronics segment:

($ IN M I LLIONS) FISCAL 20 00 FISCAL 19 99 FISCAL 19 98

Sales $ 9 ,9 0 9 .8 $6,087.4 $5,787.3

Operating income, before

certain credits (charges) $ 2 ,4 4 7 .7 $ 848 .9 $ 567.6

Operating margins, before

certain credits (charges) 2 4 .7 % 13.9% 9.8%

Operating income (loss), after

certain credits (charges) $ 2 ,5 3 8 .6 $ (225.9) $ 403.1

Operating margins, after

certain credits (charges) 2 5 .6 % (3.7%) 7.0%

The 62.8% increase in sales in Fiscal 2000 over Fiscal 1999

in the Electronics segment resulted primarily from acquisitions and,

to a lesser extent, increased organic growth. These acquisitions

included: the acquisition in August 1999 of Raychem Corporation;

the acquisition in November 1999 of Siemens Electromechanical

Components GmbH & Co. KG; the acquisition in December 1999 of

Praegitzer Industries, Inc.; the acquisition in March 2000 of Critch-

ley Group PLC; and the acquisition in July 2000 of the Electronic

OEM Business of Thomas & Betts. Excluding the impact of these

acquisitions, sales increased an estimated 15.1%.

The 5.2% increase in sales in Fiscal 1999 over Fiscal 1998 was

predominantly due to the acquisition of Raychem in August 1999

and Sigma Circuits, Inc. in July 1998. Excluding the impact of these

acquisitions, sales remained relatively stable.

The substantial increase in operating income and margins,

before certain credits (charges), in Fiscal 2000 compared with Fis-

cal 1999 was primarily due to the acquisitions of Raychem and

Siemens and improved margins at both AMP and Tyco Printed Cir-

cuit Group. The improved operating margins, before certain charges,

in Fiscal 2000 compared with Fiscal 1999 resulted from increased

volume, improved pricing and continuing cost reduction programs

following the AMP merger.

In addition to the items discussed above, the substantial

increase in operating income and margins, after certain credits

(charges), was due to a merger, restructuring and other non-recur-

ring net credit of $90.9 million in Fiscal 2000 compared with a

restructuring and other non-recurring charge of $1,074.8 million in

Fiscal 1999.

The 49.6% increase in operating income, before certain

credits (charges), in Fiscal 1999 compared with Fiscal 1998 was

due to improved margins at AMP, the acquisition of Raychem, and

higher sales volume at the Tyco Printed Circuit Group. The improved

operating margins, before certain credits (charges), in Fiscal 1999

compared with Fiscal 1998 were primarily due to the implementa-

tion of AMP’s profit improvement plan, which was initiated in the

fourth quarter of Fiscal 1998, cost reduction programs associated

with the AMP merger, a pension curtailment/settlement gain and the

acquisition of Raychem. These improvements were partially offset

by $253.4 million of certain costs in Fiscal 1999 at AMP prior to the

merger with Tyco, including costs to defend the AlliedSignal Inc.

tender offer, the write-off of inventory and other balance sheet write-

offs and adjustments.

In addition, the decrease in operating income and margins,

after certain credits (charges), was due to merger, restructuring and

impairment charges of $1,074.8 million in Fiscal 1999 compared

with net restructuring and impairment charges of $164.4 million in

Fiscal 1998.

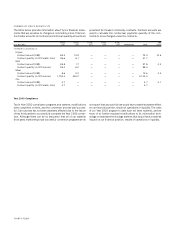

TELECOMMUNICATIONS

Tyco’s 86% owned subsidiary, TyCom Ltd. (“TyCom”), is a leading

independent provider of transoceanic fiber optic networks and

services. TyCom’s products and services include:

• design, engineering, manufacture and installation of undersea

cable communications systems;

• service and maintenance of major undersea cable networks;

and

• design, manufacture and installation of a global undersea

fiber optic network, known as the TyCom Global NetworkTM

(“TGN”). TyCom plans to operate, maintain and sell bandwidth

capacity on the TGN.

The following table sets forth sales and operating income and

margins for the Telecommunications segment:

($ IN M I LLIONS) FISCAL 20 00 FISCAL 19 99 FISCAL 19 98

Sales $ 2 ,5 3 9 .7 $1,623.8 $1,280.0

Operating income, before

certain charges $ 5 2 9 . 7 $ 325.1 $ 268.3

Operating margins, before

certain charges 2 0 .9 % 20.0% 21.0%

Operating income, after

certain charges $ 5 1 6 . 6 $ 325.1 $ 268.3

Operating margins, after

certain charges 2 0 .3 % 20.0% 21.0%