ADT 2000 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

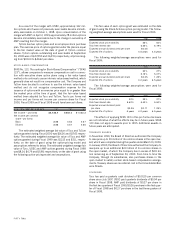

FORTY SIX

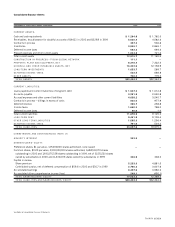

SEVERANCE FACILITI ES OTHER

NUMBER OF NU M BER OF

($ IN M I LLIONS) EMPLOYEES RESERVE FACILITIES RESERVE RESERVE

Original reserve established 5,620 $ 234.3 183 $174.8 $116.3

Fiscal 1999 activity (3,230) (55.9) (95) (48.2) (46.0)

Fiscal 2000 activity (1,969) (158.6) (81) (86.3) (63.5)

Changes in estimates 964 28.7 65 47.5 13.8

Reversal to goodwill in Fiscal 2000 (250) (5.7) (45) (17.7) (2.4)

Ending balance at September 30, 2000 1,135 $ 42.8 27 $ 70.1 $ 18.2

FISCAL 1999

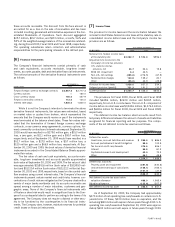

In addition to the pooling of interests transactions discussed in Note

2, during Fiscal 1999, the Company purchased businesses for an

aggregate cost of $6,923.3 million, consisting of $4,546.8 million

in cash, net of cash acquired, the issuance of 32.4 million common

shares valued at $1,449.6 million and the assumption of $926.9 mil-

lion in debt. In addition, $354.4 million of cash was paid during the

year for purchase accounting liabilities related to 1999 and prior

years’ acquisitions. The cash portions of the acquisition costs were

funded utilizing cash on hand, the issuance of long-term debt and

borrowings under the Company’s commercial paper program. Each

of these acquisitions was accounted for as a purchase, and the

results of operations of the acquired companies have been included

in the consolidated results of the Company from their respective

acquisition dates.

In connection with these acquisitions, the Company recorded

purchase accounting liabilities of $525.4 million for transaction

costs and the costs of integrating the acquired companies within the

various Tyco business segments. Details regarding these purchase

accounting liabilities are set forth below. During Fiscal 1999, the

Company spent a total of $4,901.2 million in cash related to the

acquisition of businesses, consisting of $4,546.8 million of

purchase price (net of cash acquired) plus $354.4 million of cash

paid out during the year for purchase accounting liabilities related

to 1999 and prior years’ acquisitions.

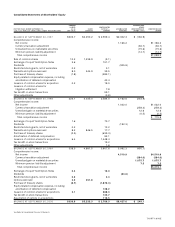

The following table summarizes the purchase accounting

liabilities recorded in connection with the Fiscal 1999 purchase

acquisitions:

plan for the exiting of activities and the involuntary termination of

employees in connection with the 1999 acquisition and integration

of Raychem, and as a result recorded $90.0 million of purchase

accounting liabilities.

During Fiscal 2000, the Company sold certain of its businesses

for net proceeds of approximately $74.4 million in cash that consist

primarily of certain businesses within the Healthcare and Specialty

Products segment.

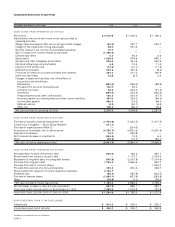

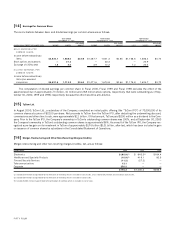

The following unaudited pro forma data summarize the results

of operations for the periods indicated as if the Fiscal 2000 acqui-

sitions and divestitures had been completed as of the beginning of

the periods presented. The pro forma data give effect to actual oper-

ating results prior to the acquisitions and divestitures. Adjustments

to interest expense, goodwill amortization and income taxes related

to the Fiscal 2000 acquisitions are reflected in the pro forma data.

No effect has been given to cost reductions or operating synergies

in this presentation. These pro forma amounts do not purport to be

indicative of the results that would have actually been obtained if

the acquisitions and divestitures had occurred as of the beginning

of the periods presented or that may be obtained in the future.

YEAR ENDED SEPTEMBER 3 0 ,

(I N MILLI ONS, EXCEPT PER SHARE DATA) 2 0 0 0 1 9 9 9

Net sales $30,383.6 $25,633.3

Income before extraordinary items 4,478.2 976.8

Net income 4,478.0 931.1

Net income per common share:

Basic 2 .6 5 0.57

Diluted 2 .6 1 0.56

The $174.8 million of exit costs are associated with the closure

and consolidation of facilities involving 183 facilities located pri-

marily in the Asia-Pacific region and the United States. These facil-

ities include manufacturing plants, sales offices, corporate

administrative facilities and research and development facilities.

Included within these costs are accruals for non-cancelable leases

associated with certain of these facilities. Approximately 176 facil-

ities had been closed or consolidated at September 30, 2000. The

remaining facilities include primarily large manufacturing plants,

which are expected to be shut down in Fiscal 2001. Expenses in con-

nection with the closure of these remaining facilities, as well as the

expiration of non-cancelable leases (less any expected sublease

income for facilities already closed), comprise the approximately

$70.1 million for facility related costs remaining in the Consolidated

Balance Sheet as of September 30, 2000.

Purchase accounting liabilities recorded during Fiscal 1999

consist of $234.3 million for severance and related costs, $174.8

million for costs associated with the shut down and consolidation of

certain acquired facilities and $116.3 million for transaction and

other direct costs. The $234.3 million of severance and related costs

covers employee termination benefits for approximately 5,620

employees located throughout the world, consisting primarily of

manufacturing and distribution employees to be terminated as a

result of the shut down and consolidation of production facilities

and, to a lesser extent, administrative, technical and sales and mar-

keting personnel. At September 30, 2000, 5,199 employees had

been terminated and $42.8 million in severance and related costs

remained in the Consolidated Balance Sheet. The Company expects

that the remaining employee terminations will be completed in

Fiscal 2001.