ADT 2000 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORTY

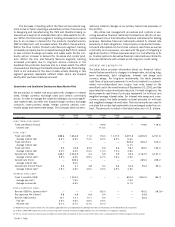

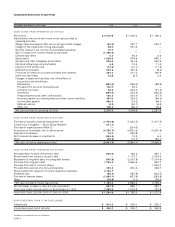

Consolidated Statements of Cash Flows

YEAR ENDED SEPTEMBER 3 0 (I N M I LLIONS) 2 0 0 0 1 9 9 9 1 9 9 8

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income $ 4 ,5 1 9 .9 $ 1,022.0 $ 1,166.2

Adjustments to reconcile net income to net cash provided by

operating activities:

Merger, restructuring and other non-recurring (credits) charges (8 4 .2 ) 327.7 253.7

Charge for the impairment of long-lived assets 9 9 .0 507.5

—

Minority interest in net income of consolidated subsidiary 1 8 .7

——

Gain on issuance of common shares by subsidiary (1 ,7 6 0 .0 )

——

Extraordinary items 0 .2 45.4 2.4

Depreciation 1 ,0 9 5 .0 979.6 895.1

Goodwill and other intangibles amortization 549.4 331.6 242.6

Debt and refinancing cost amortization 6 .8 10.4 11.3

Interest on ITS vendor note (1 4 .0 ) (12.1) (11.5)

Deferred income taxes 507.8 351.6 (8.2)

Provisions for losses on accounts receivable and inventory 354.3 211.5 192.9

Other non-cash items 7 3 .8 (6.7) 2.5

Changes in assets and liabilities, net of the effects of

acquisitions and divestitures:

Receivables (992.4) (796.0) (88.9)

Proceeds from accounts receivable sale 100.0 50.0

—

Contracts in process 2 8 .9 642.2 (91.4)

Inventories (850.0) (124.4) (226.2)

Prepaid expenses and other current assets 100.2 (154.1) (57.7)

Accounts payable, accrued expenses and other current liabilities 497.0 324.0 (96.4)

Income taxes payable 896.4 (10.2) 66.3

Deferred revenue (0 . 2 ) (54.1) (6.5)

Other, net 128.4 (96.1) 35.6

Net cash provided by operating activities 5 ,2 7 5 .0 3,549.8 2,281.8

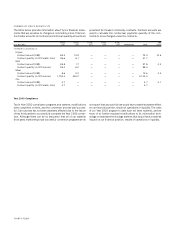

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchase of property, plant and equipment, net (1 ,7 0 3 .8 ) (1,632.5) (1,317.5)

Construction in progress — TyCom Global Network (111.1)

——

Purchase of leased property (Note 2)

—

(234.0)

—

Acquisition of businesses, net of cash acquired (4 ,7 9 0 .7 ) (4,901.2) (4,251.8)

Disposal of businesses 7 4 .4 926.8

—

Net (increase) decrease in investments (353.4) 10.5 6.4

Other (5 2 .9 ) (13.7) (83.1)

Net cash utilized by investing activities (6 ,9 3 7 .5 ) (5,844.1) (5,646.0)

CASH FLOWS FROM FINANCING ACTIVITIES:

Net (payments) receipts of short-term debt (736.0) 162.3 287.1

Net proceeds from issuance of public debt

—

1,173.7 2,744.5

Repayment of long-term debt, including debt tenders (376.8) (2,057.8) (1,074.6)

Proceeds from long-term debt 1 ,7 9 3 .2 3,665.6 802.0

Proceeds from sale of common shares

——

1,245.0

Proceeds from exercise of options and warrants 355.3 872.4 348.7

Net proceeds from issuance of common shares by subsidiary 2 ,1 3 0 .7

——

Dividends paid (8 6 .2 ) (187.9) (303.0)

Purchase of treasury shares (1 ,8 8 5 .1 ) (637.8) (283.9)

Other (2 9 .8 ) (7.1) (36.5)

Net cash provided by financing activities 1 ,1 6 5 .3 2,983.4 3,729.3

Net (decrease) increase in cash and cash equivalents (497.2) 689.1 365.1

CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR 1 ,7 6 2 .0 1,072.9 707.8

CASH AND CASH EQUIVALENTS AT END OF YEAR $ 1 ,2 6 4 .8 $ 1,762.0 $ 1,072.9

SUPPLEMENTARY CASH FLOW DISCLOSURE:

Interest paid $ 8 1 4 .2 $ 509.1 $ 250.7

Income taxes paid (net of refunds) $ 4 5 4 .7 $ 209.7 $ 345.9

See Notes to Consolidated Financial Statements.