ADT 2000 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIFTY ONE

Committee of the Board of Directors of the Company, which consists

exclusively of independent directors of the Company. Options are

granted to purchase common shares at prices which are equal to or

greater than the market price of the common shares on the date the

option is granted. Conditions of vesting are determined at the time

of grant. Options which have been granted under the Incentive Plan

to date have generally vested and become exercisable over periods

of up to five years from the date of grant and have a maximum term

of ten years. The Company has reserved 140.0 million common

shares for issuance under the Incentive Plan. Awards which the

Company becomes obligated to make through the assumption of, or

in substitution for, outstanding awards previously granted by an

acquired company are assumed and administered under the Incen-

tive Plan but do not count against this limit. At September 30, 2000,

there were approximately 37.0 million shares available for future

grant under the Incentive Plan. During October 1998, a broad-based

option plan for non-officer employees, the Tyco Long-Term Incentive

Plan II (“LTIP II”), was approved by the Board of Directors. The Com-

pany has reserved 50.0 million common shares for issuance under

the LTIP II. The terms and conditions of this plan are similar to the

Incentive Plan. At September 30, 2000, there were approximately

17.2 million shares available for future grant under the LTIP II.

In connection with the acquisitions of Raychem in Fiscal 1999

and CIPE S.A. and Holmes Protection in Fiscal 1998, options out-

standing under the respective stock option plans of these companies

were assumed under the Incentive Plan. In connection with the

mergers occurring in Fiscal 1999 (See Note 2), all of the options

outstanding under the USSC and AMP stock option plans were

assumed under the Incentive Plan. These options are administered

under the Incentive Plan but retain all of the rights, terms and condi-

tions of the respective plans under which they were originally granted.

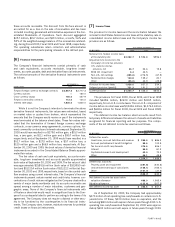

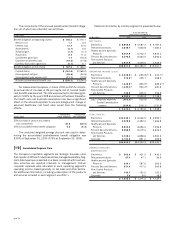

Share option activity for all Tyco plans since September 30,

1997 has been as follows:

WEIGHTED-

AVERAGE

EXERCISE

OUTSTANDI NG PRICE

At September 30, 1997 107,261,072 $17 .03

Assumed from acquisition 87,232 10.23

Granted 32,011,414 23.51

Exercised (37,626,616) 9.20

Canceled (7,281,946) 27.48

At September 30, 1998 94,451,156 24.83

Assumed from acquisition 8,883,160 37.44

Granted 30,313,362 38.44

Exercised (43,180,390) 22.79

Canceled (4,476,021) 47.83

At September 30, 1999 85,991,267 27.91

Granted 30,355,027 44.30

Exercised (17,240,959) 20.72

Canceled (4,090,184) 37.25

At September 30, 2000 95,015,151 $32.01

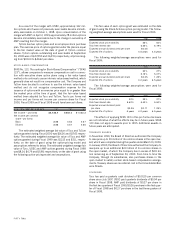

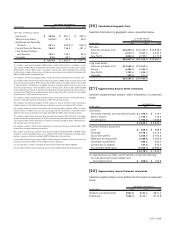

The following table summarizes information about outstanding and exercisable Tyco options at September 30, 2000:

OPTIONS OUTSTANDING OPTIONS EXERCISABLE

WEIGHTED-

WEIGHTED- AVERAGE WEIGHTED-

AVERAGE REMAIN I N G AVERAGE

RANGE OF NUMBER EXERCISE CONTRACTUAL NUMBER EXERCISE

EXERCISE PRICES OUTSTANDI NG PRI CE LIFE

—

YEARS EXERCISABLE PRICE

$ 0.00 to $ 4.98 541,696 $ 4.11 2.8 541,696 $ 4.11

4.99 to 7.44 4,792,734 6.58 4.5 4,792,734 6.58

7.45 to 9.98 1,503,739 8.85 5.2 1,157,128 8.86

9.99 to 11.76 780,224 10.84 5.8 421,916 10.84

11.77 to 14.88 2,807,377 14.03 5.9 2,053,457 13.98

14.89 to 19.97 8,025,566 18.88 6.7 6,619,681 18.80

19.98 to 24.93 9,164,125 21.63 6.4 8,182,205 21.72

24.94 to 29.87 9,339,844 28.19 7.5 4,315,879 28.27

29.88 to 31.80 5,057,521 31.41 6.3 5,031,454 31.41

31.81 to 34.42 2,226,357 32.79 7.7 1,416,219 32.83

34.43 to 44.62 30,989,158 38.61 8.8 2,484,907 38.96

44.63 to 50.00 8,580,994 49.43 8.4 6,888,088 49.65

50.01 to 52.01 2,916,906 51.01 8.7 2,906,302 51.01

52.02 to 75.00 8,288,910 59.14 8.7 6,208,686 58.52

Total 95,015,151 53,020,352