ADT 2000 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THIRTY FOUR

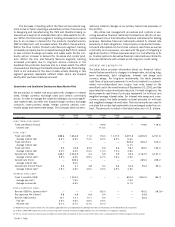

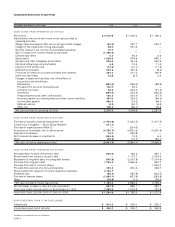

COMMODITY PRICE SENSITIVITY

The table below provides information about Tyco’s financial instru-

ments that are sensitive to changes in commodity prices. Total con-

tract dollar amounts (in millions) and notional quantity amounts are

presented for forward commodity contracts. Contract amounts are

used to calculate the contractual payments quantity of the com-

modity to be exchanged under the contracts.

FISCAL FISCAL FISCAL FISCAL FISCAL FAI R

($ IN M I LLIONS) 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 THEREAFTER TOTAL VALUE

FORWARD CONTRACTS:

Copper

Contract amount (US$) 62.4 10.9

————

73.3 10.6

Contract quantity (in 000 metric tons) 35.6 6.1

————

41.7

Gold

Contract amount (US$) 25.8 1.7

————

27.5 0.4

Contract quantity (in 000 ounces) 93.0 6.0

————

99.0

Silver

Contract amount (US$) 8.6 2.0

————

10.6 0.0

Contract quantity (in 000 ounces) 1,700.0 400.0

————

2,100.0

Zinc

Contract amount (US$) 0.7

—————

0.7 0.1

Contract quantity (in 000 metric tons) 0.7

—————

0.7

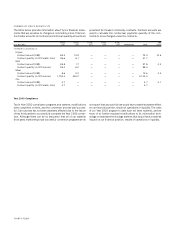

Year 2 0 0 0 Compliance

Tyco’s Year 2000 compliance programs and systems modifications

were completed on time, and the conversion process was success-

ful. Our business has not been adversely affected due to the failure

of key third parties to successfully complete the Year 2000 conver-

sion. Although there can be no assurance that all of our material

third-party relationships had successful conversion programs we do

not expect that any such failure would have a material adverse effect

on our financial position, results of operations or liquidity. The costs

of our Year 2000 program to date have not been material, and we

know of no further required modifications to its information tech-

nology or embedded technology systems that would have a material

impact on our financial position, results of operations or liquidity.