ADT 2000 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIFTY THREE

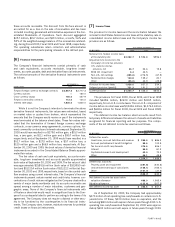

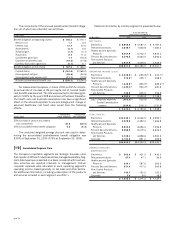

[1 1 ] Comprehensive Income

The purpose of reporting comprehensive income (loss) is to report

a measure of all changes in equity, other than transactions with

shareholders. Total comprehensive income (loss) is included in the

Consolidated Statements of Shareholders’ Equity. The components

of accumulated other comprehensive income (loss) are as follows:

ACCUMULATED

CURRENCY UN REALIZED MINIMUM OTHER

TRANSLATI ON GAIN (LOSS) PENSION COMPREHENSI VE

(I N MILLI ONS) ITEMS ON SECURITI ES LI ABI LI TY I NCOME (LOSS)

Balance at September 30, 1997 $(137.1) $ 10.8 $(10.6) $(136.9)

Current period change, gross (45.0) (21.5) (24.6) (91.1)

Income tax benefit 8.3 5.9 9.9 24.1

Balance at September 30, 1998 (173.8) (4.8) (25.3) (203.9)

Current period change, gross (277.8) 18.6 5.2 (254.0)

Income tax benefit (expense) 19.5 (6.0) (5.7) 7.8

Balance at September 30, 1999 (432.1) 7.8 (25.8) (450.1)

Current period change, gross (384.0) 1,094.8 11.5 722.3

Income tax expense

—

(19.1) (4.0) (23.1)

Balance at September 30, 2000 $(816.1) $1,083.5 $(18.3) $ 249.1

improvement plan and the combination of facilities as a result of its

merger with the Company, approximately $143.6 million of which

was taken as part of the AMP profit improvement plan prior to its

acquisition by Tyco. It also includes an impairment in the value of

goodwill and other intangibles of $81.4 million. The Company

evaluated the profitability and anticipated customer demand for its

various products and found that certain product lines were under-

performing compared to expectations. As a result of this analysis,

which was performed in connection with AMP’s profit improvement

plan, the book value of goodwill and other intangibles was deemed

impaired and written down to fair value.

The Healthcare and Specialty Products segment recorded a

charge of $76.0 million in Fiscal 1999 primarily relating to the write-

down of property, plant and equipment, principally administrative

facilities, associated with the consolidation of facilities in USSC’s

operations in the United States and Europe as a result of its merger

with the Company.

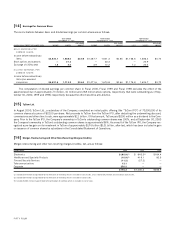

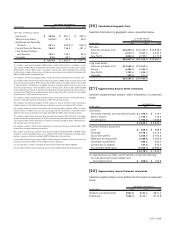

[1 3 ] Extraordinary Items

The extraordinary item in Fiscal 2000 of $0.2 million, net of tax

benefit of $0.1 million, relates to the write-off of unamortized

deferred financing costs related to the LYONs (See Note 4).

The extraordinary item in Fiscal 1999 of $45.7 million, net of tax

benefit of $18.0 million, relates primarily to the write-off of net

unamortized deferred financing costs related to the Company’s debt

tender offers (See Note 4). The extraordinary item in Fiscal 1998 of

$2.4 million, net of tax benefit of $1.2 million, was the write-off

of unamortized deferred financing costs related to the LYONs

(See Note 4).

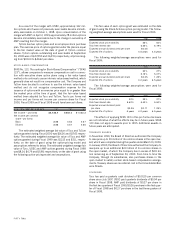

[1 2 ] Charge for the I mpairment of Long-Lived Assets

The Company reviews the recoverability of the carrying value of long-

lived assets, primarily property, plant and equipment and related

goodwill and other intangible assets, for impairment whenever

events or changes in circumstances indicate that the carrying

amount of an asset may not be fully recoverable. Impairment losses

are recognized when expected future undiscounted cash flows are

less than the assets’ carrying value. When indicators of impairment

are present, the carrying values of the assets are evaluated in rela-

tion to the operating performance and future undiscounted cash

flows of the underlying business. The net book value of the underly-

ing assets is adjusted to fair value if the sum of expected future

undiscounted cash flows is less than book value. Fair values are

based on quoted market prices and assumptions concerning the

amount and timing of estimated future cash flows and assumed dis-

count rates, reflecting varying degrees of perceived risk.

2000 CHARGES

The Healthcare and Specialty Products segment recorded a charge

of $99.0 million primarily related to an impairment in goodwill and

other intangible assets associated with the Company exiting the

interventional cardiology business of USSC.

1999 CHARGES

The Electronics segment recorded a charge of $431.5 million in Fis-

cal 1999, which includes $350.1 million related to the write-down

of property, plant and equipment, primarily manufacturing and

administrative facilities, associated with facility closures through-

out AMP’s worldwide operations in connection with its profit