ADT 2000 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2000 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORTY FIVE

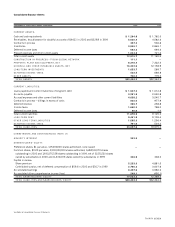

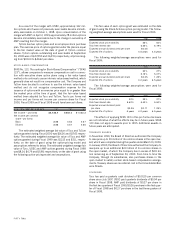

The following table shows the fair values of assets and liabili-

ties and purchase accounting liabilities recorded for purchase

acquisitions completed in Fiscal 2000, adjusted to reflect changes

in fair values of assets and liabilities and purchase accounting lia-

bilities recorded for acquisitions completed prior to Fiscal 2000:

(I N MILLI ONS) 2 0 0 0

Receivables $ 714.4

Inventories 453.9

Prepaid expenses and other current assets 257.0

Property, plant and equipment 674.6

Goodwill and other intangible assets 5,206.8

Other assets 95.2

7,401.9

Accounts payable 485.8

Accrued expenses and other current liabilities 1,286.6

Other long-term liabilities 351.0

Options assumed 116.5

2,239.9

$5,162.0

Cash consideration paid (net of cash acquired) $4,246.5

Share consideration paid 671.4

Debt assumed 244.1

$5,162.0

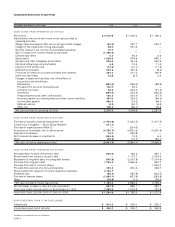

Thus, in Fiscal 2000, the Company spent a total of $4,790.7

million in cash related to the acquisition of businesses, consisting

of $4,246.5 million of cash in purchase price for these businesses

(net of cash acquired) plus $544.2 million of cash paid out during

the year for purchase accounting liabilities related to current and

prior years’ acquisitions.

Fiscal 2000 purchase acquisitions include, among others, the

acquisition of General Surgical Innovations, Inc. (“GSI”), AFC Cable

Systems, Inc. (“AFC Cable”) and Siemens Electromechanical

Components GmbH & Co. KG (“Siemens EC”) in November 1999,

Praegitzer Industries, Inc. (“Praegitzer”) in December 1999, Critchley

Group PLC (“Critchley”) in March 2000 and the Electronic OEM

Business of Thomas & Betts in July 2000. GSI, a manufacturer and

distributor of balloon dissectors and related devices for minimally

invasive surgery, was purchased through the issuance of approxi-

mately 2.8 million Tyco common shares valued at $108.6 million and

has been integrated within the Healthcare and Specialty Products

segment. AFC Cable, a manufacturer of prewired armor cable, was

purchased through the issuance of approximately 12.8 million Tyco

common shares valued at $562.8 million and has been integrated

within the Flow Control Products and Services segment. Siemens

EC, a world market leader for relays and one of the world’s leading

providers of components to the communications, automotive, con-

sumer and general industry sectors, was purchased for $1,165.8 mil-

lion in cash and has been integrated within the Electronics segment.

Praegitzer, a provider of printed circuit board and interconnect solu-

tions to OEMs and contract manufacturers in the communications,

computer, industrial and consumer electronics industries, was pur-

chased for $72.2 million in cash and has been integrated within the

Electronics segment. Critchley, a world leader in cable identification

products, was purchased for $185.0 million in cash and has been

integrated within the Electronics segment. The Electronic OEM

Business of Thomas & Betts, a manufacturer of electronic connec-

tors for the telecommunications, computer and automotive indus-

tries, was purchased for $750.0 million in cash and is being

integrated within the Electronics segment.

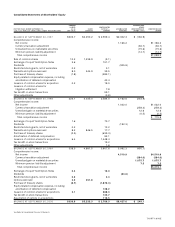

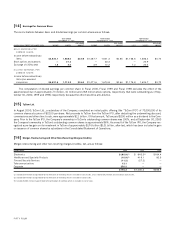

The following table summarizes the purchase accounting

liabilities recorded in connection with the Fiscal 2000 purchase

acquisitions:

SEVERANCE FACILITI ES OTHER

NUMBER OF NU M BER OF

($ IN M I LLIONS) EMPLOYEES RESERVE FACILITIES RESERVE RESERVE

Original reserve established 7,215 $ 243.0 102 $ 87.6 $ 95.6

Fiscal 2000 activity (4,023) (146.2) (53) (34.3) (47.3)

Ending balance at September 30, 2000 3,192 $ 96.8 49 $ 53.3 $ 48.3

facilities in the United States, 32 facilities in Europe, 24 facilities

in the Asia-Pacific region and 3 facilities in Canada, primarily con-

sisting of manufacturing plants, sales offices, corporate adminis-

trative facilities and research and development facilities. At

September 30, 2000, 4,023 employees had been terminated and 53

facilities had been closed or consolidated.

In connection with the purchase acquisitions consummated

during Fiscal 2000, liabilities for approximately $96.8 million for

severance and related costs, $53.3 million for the shutdown and

consolidation of acquired facilities and $48.3 million in transaction

and other direct costs remained on the balance sheet at September

30, 2000. The Company expects that the termination of employees

and consolidation of facilities related to all such acquisitions will be

substantially complete within one year of plan finalization, except

for certain long-term contractual obligations.

During Fiscal 2000, the Company reduced its estimate of pur-

chase accounting liabilities related to acquisitions in prior years by

$117.8 million and, accordingly, goodwill and related deferred tax

assets were reduced by an equivalent amount. These changes pri-

marily resulted from costs being less than originally anticipated on

certain acquisitions. In addition, the Company finalized its business

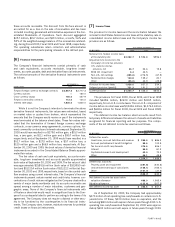

Purchase accounting liabilities recorded during Fiscal 2000

consist of $243.0 million for severance and related costs; $87.6 mil-

lion for costs associated with the shut down and consolidation of

certain acquired facilities, including unfavorable leases, lease ter-

minations and other related fees and other costs and $95.6 million

for transaction and other direct costs, including pension and other

employee related costs and other costs. These purchase accounting

liabilities relate primarily to the acquisitions of GSI, AFC Cable,

Siemens EC, Praegitzer, Critchley and the Electronics OEM Busi-

ness of Thomas & Betts.

In connection with the Fiscal 2000 purchase acquisitions, the

Company began to formulate plans at the date of each acquisition

for workforce reductions and the closure and consolidation of an

aggregate of 102 facilities. The Company has communicated with

the employees of the acquired companies to announce the benefit

arrangements. The costs of employee termination benefits relate to

the elimination of 2,895 positions in the United States, 2,434 posi-

tions in Europe, 1,135 positions in Canada and Latin America and

751 positions in the Asia-Pacific region, primarily consisting of man-

ufacturing and distribution, administrative, technical, and sales and

marketing personnel. Facilities designated for closure include 43