TCF Bank 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

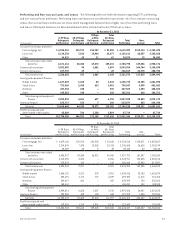

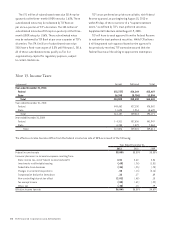

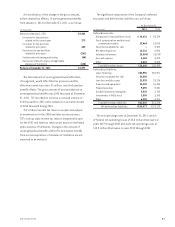

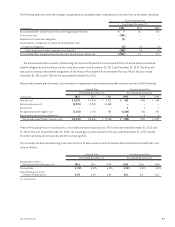

A reconciliation of the change in the gross amount,

before related tax effects, of unrecognized tax benefits

from January 1, 2011 to December 31, 2011 is as follows.

(In thousands)

Balance at January 1, 2011 $2,464

Increases for tax positions

related to the current year 273

Increases for tax positions

related to prior years 605

Decreases for tax positions

related to prior years (261)

Settlements with taxing authorities (84)

Decreases related to lapses of applicable

statutes of limitation (620)

Balance at December 31, 2011 $2,377

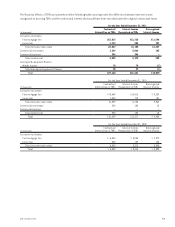

The total amount of unrecognized tax benefits that,

if recognized, would affect the tax provision and the

effective income tax rate is $1 million, net of related tax

benefit effects. The gross amount of accrued interest on

unrecognized tax benefits was $240 thousand at December

31, 2011. TCF recorded an increase in accrued interest of

$22 thousand for 2011 and a reduction in accrued interest

of $154 thousand during 2010.

TCF’s federal income tax returns are open and subject

to examination for the 2008 and later tax return years.

TCF’s various state income tax returns are generally open

for the 2007 and later tax return years based on individual

state statutes of limitation. Changes in the amount of

unrecognized tax benefits within the next twelve months

from normal expirations of statutes of limitation are not

expected to be material.

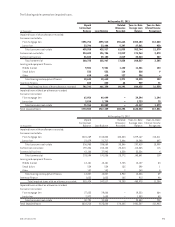

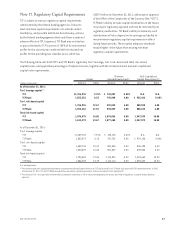

The significant components of the Company’s deferred

tax assets and deferred tax liabilities are as follows.

At December 31,

(In thousands) 2011 2010

Deferred tax assets:

Allowance for loan and lease losses $ 92,031 $ 93,159

Stock compensation and deferred

compensation plans 23,464 18,910

Securities available for sale – 9,442

Net operating losses 16,316 8,988

Valuation allowance (5,094) (4,159)

Accrued expense 3,469 3,200

Other 6,462 8,655

Total deferred tax assets 136,648 138,195

Deferred tax liabilities:

Lease financing 304,996 252,951

Securities available for sale 32,568 –

Loan fees and discounts 21,938 23,124

Premises and equipment 20,505 16,434

Prepaid expenses 9,092 9,431

Goodwill and other intangibles 5,532 2,780

Investments in FHLB stock 2,509 3,183

Other 6,385 4,471

Total deferred tax liabilities 403,525 312,374

Net deferred tax liabilities $266,877 $174,179

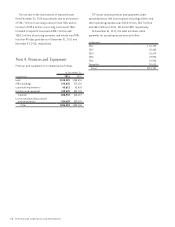

The net operating losses at December 31, 2011 consist

of federal net operating losses of $3.4 million that expire in

years 2027 through 2031 and state net operating losses of

$12.9 million that expire in years 2012 through 2031.

812011 Form 10-K