TCF Bank 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

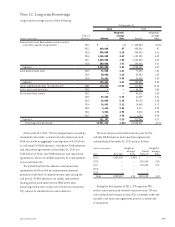

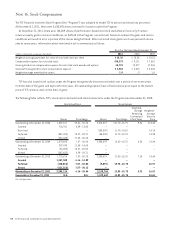

The $71 million of subordinated notes due 2014 reprice

quarterly at the three-month LIBOR rate plus 1.63%. These

subordinated notes may be redeemed by TCF Bank at

par once a quarter at TCF’s discretion. The $50 million of

subordinated notes due 2015 reprice quarterly at the three-

month LIBOR rate plus 1.56%. These subordinated notes

may be redeemed by TCF Bank at par once a quarter at TCF’s

discretion. The $74.6 million of subordinated notes due

2016 have a fixed-rate coupon of 5.5% until February 1, 2016.

All of these subordinated notes qualify as Tier 2 or

supplementary capital for regulatory purposes, subject

to certain limitations.

TCF’s trust preferred securities are callable, with Federal

Reserve approval, at par beginning August 15, 2013 or

within 90 days of the occurrence of a “capital treatment

event,” as defined by TCF’s trust preferred securities

Supplemental Indenture dated August 19, 2008.

TCF will have to seek approval from the Federal Reserve

to redeem the trust preferred securities. While TCF believes

it will be granted such approval based on the approval it

has previously received, TCF cannot be assured that the

Federal Reserve will be willing to approve the redemption.

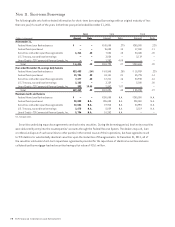

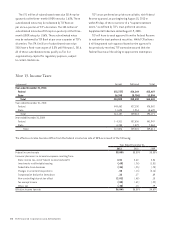

Note 13. Income Taxes

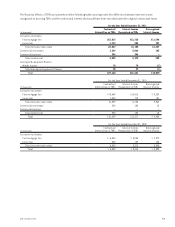

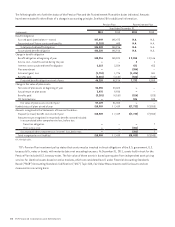

(In thousands) Current Deferred Total

Year ended December 31, 2011:

Federal $(2,737) $56,144 $53,407

State 16,740 (5,706) 11,034

Total $14,003 $50,438 $64,441

Year ended December 31, 2010:

Federal $49,462 $27,100 $76,562

State 11,695 1,914 13,609

Total $61,157 $29,014 $90,171

Year ended December 31, 2009:

Federal $ 4,311 $37,636 $41,947

State 6,285 1,579 7,864

Total $10,596 $39,215 $49,811

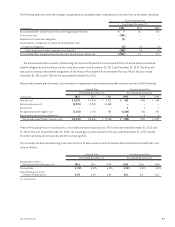

The effective income tax rate differs from the federal income tax rate of 35% as a result of the following.

Year Ended December 31,

2011 2010 2009

Federal income tax rate 35.00% 35.00% 35.00%

Increase (decrease) in income tax expense resulting from:

State income tax, net of federal income tax benefit 4.01 3.62 3.56

Investments in affordable housing (.69) (.76) (1.31)

Deductible stock dividends (.34) (.25) (.78)

Changes in uncertain tax positions .05 (.14) (3.16)

Compensation deduction limitations .22 .17 .69

Non-controlling interest tax effect (1.01) (.48) .10

Tax exempt income (.82) (.41) (.22)

Other, net (.38) .14 .79

Effective income tax rate 36.04% 36.89% 34.67%

80 TCF Financial Corporation and Subsidiaries