TCF Bank 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

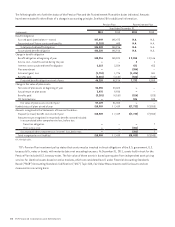

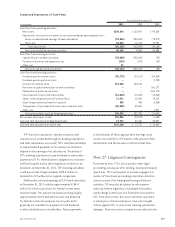

The change in total assets carried at fair value using

Company Determined Market Prices, from December 31,

2010 to December 31, 2011, was the result of decreases

in fair values of $672 thousand recorded within non-

interest expense, decreases in fair value of $82 thousand

recorded through other comprehensive income, sales of

$100 thousand and reductions due to principal paydowns

of $70 thousand. Transfers to securities measured at fair

value using Readily Available Market Prices from securities

measured using Company Determined Market Prices were

$264 thousand.

The following is a description of valuation methodologies

used for assets measured on a non-recurring basis.

Loans Impaired loans for which repayment of the loan is

expected to be provided solely by the value of the underlying

collateral are considered collateral dependent and are

valued based on the estimated fair value of such collateral.

Real Estate Owned and Repossessed and Returned

Equipment The fair value of real estate owned is based

on independent full appraisals, real estate broker’s price

opinions, or automated valuation methods, less estimated

selling costs. Certain properties require assumptions that

are not observable in an active market in the determination

of fair value. The fair value of repossessed and returned

equipment is based on available pricing guides, auction

results or price opinions, less estimated selling costs.

Assets acquired through foreclosure, repossession or

returned to TCF are initially recorded at the lower of the

loan or lease carrying amount or fair value less estimated

selling costs at the time of transfer to real estate owned or

repossessed and returned equipment. Real estate owned

and repossessed and returned equipment were written down

$26.4 million, which is included in foreclosed real estate

and repossessed assets, net expense, during the year ended

December 31, 2011.

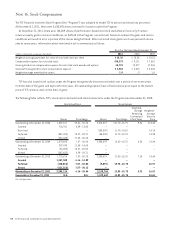

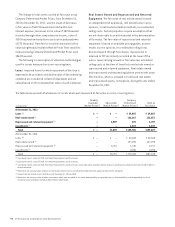

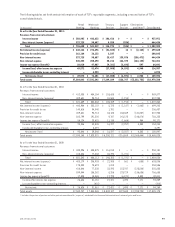

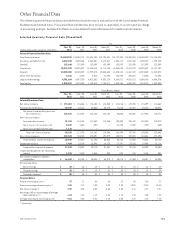

The table below presents the balances of assets which were measured at fair value on a non-recurring basis.

(In thousands)

Readily

Available

Market Prices(1)

Observable

Market Prices(2)

Company

Determined

Market Prices(3)

Total at

Fair Value

At December 31, 2011:

Loans (4) $ – $ – $ 29,003 $ 29,003

Real estate owned (5) – – 122,263 122,263

Repossessed and returned equipment (5) – 3,889 270 4,159

Investments (6) – – 4,244 4,244

Total $ – $3,889 $155,780 $159,669

At December 31, 2010:

Loans (4) $ – $ – $ 42,683 $ 42,683

Real estate owned (5) – – 127,295 127,295

Repossessed and returned equipment (5) – 5,731 1,180 6,911

Investments (6) – – 4,296 4,296

Total $ – $5,731 $ 175,454 $181,185

(1) Considered Level 1 under ASC 820, Fair Value Measurements and Disclosures.

(2) Considered Level 2 under ASC 820, Fair Value Measurements and Disclosures.

(3) Considered Level 3 under ASC 820, Fair Value Measurements and Disclosures and are based on valuation models that use significant assumptions that are not observable in

an active market.

(4) Represents the carrying value of loans for which impairment reserves are determined based on the appraisal value of the collateral.

(5) Amounts do not include assets held at cost at December 31, 2011 or 2010.

(6) Represents the carrying value of other investments which were recorded at fair value determined by using quoted prices, when available, and incorporating results of

internal pricing techniques and observable market information.

94 TCF Financial Corporation and Subsidiaries