TCF Bank 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

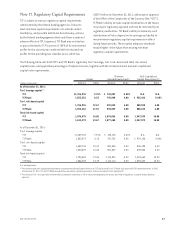

Note 15. Regulatory Capital Requirements

TCF is subject to various regulatory capital requirements

administered by the federal banking agencies. Failure to

meet minimum capital requirements can initiate certain

mandatory, and possible additional discretionary, actions

by the federal banking agencies that could have a material

adverse effect on TCF. In general, TCF Bank may not declare

or pay a dividend to TCF in excess of 100% of its net retained

profits for the current year combined with its retained net

profits for the preceding two calendar years, which was

$329.4 million at December 31, 2011, without prior approval

of the Office of the Comptroller of the Currency (the “OCC”).

TCF Bank’s ability to make capital distributions in the future

may require regulatory approval and may be restricted by its

regulatory authorities. TCF Bank’s ability to make any such

distributions will also depend on its earnings and ability to

meet minimum regulatory capital requirements in effect

during future periods. These capital adequacy standards

may be higher in the future than existing minimum

regulatory capital requirements.

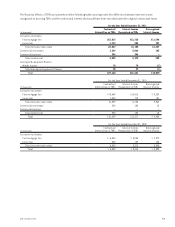

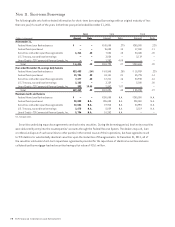

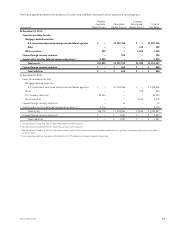

The following table sets forth TCF’s and TCF Bank’s regulatory tier 1 leverage, tier 1 risk-based and total risk-based

capital levels, and applicable percentages of adjusted assets, together with the stated minimum and well-capitalized

capital ratio requirements.

Actual

Minimum

Capital Requirement(1)

Well-Capitalized

Capital Requirement(1)

(Dollars in thousands) Amount Ratio Amount Ratio Amount Ratio

As of December 31, 2011:

Tier 1 leverage capital (2)

TCF $1,706,926 9.15% $ 745,887 4.00% N.A. N.A.

TCF Bank 1,553,381 8.33 745,940 4.00 $ 932,426 5.00%

Tier 1 risk-based capital

TCF 1,706,926 12.67 539,013 4.00 808,520 6.00

TCF Bank 1,553,381 11.53 538,829 4.00 808,243 6.00

Total risk-based capital

TCF 1,994,875 14.80 1,078,026 8.00 1,347,533 10.00

TCF Bank 1,841,273 13.67 1,077,658 8.00 1,347,072 10.00

As of December 31, 2010:

Tier 1 leverage capital

TCF $1,459,703 7.91% $ 738,105 4.00% N.A. N.A.

TCF Bank 1,503,379 8.15 737,702 4.00 $ 922,128 5.00%

Tier 1 risk-based capital

TCF 1,459,703 10.47 557,465 4.00 836,198 6.00

TCF Bank 1,503,379 10.80 557,057 4.00 835,585 6.00

Total risk-based capital

TCF 1,792,683 12.86 1,114,930 8.00 1,393,663 10.00

TCF Bank 1,836,233 13.19 1,114,114 8.00 1,392,642 10.00

N.A. Not Applicable.

(1) The minimum and well-capitalized requirements are determined by the Federal Reserve for TCF and by the OCC for TCF Bank pursuant to the FDIC Improvement Act of 1991.

At December 31, 2011, TCF and TCF Bank exceeded their regulatory capital requirements and are considered “well-capitalized.”

(2) The minimum Tier 1 leverage ratio for bank holding companies and banks is 3.0 or 4.0 percent depending on factors specified in regulations issued by federal banking

agencies.

832011 Form 10-K