TCF Bank 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

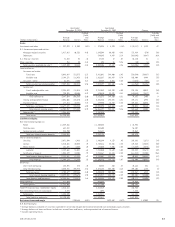

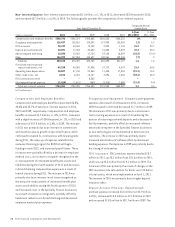

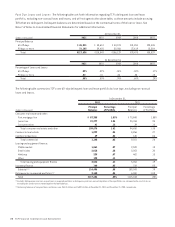

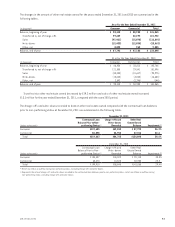

Leasing and Equipment Finance The following tables summarize TCF’s leasing and equipment finance portfolio by

marketing segment and by equipment type, excluding operating leases.

At December 31,

(Dollars in thousands) 2011 2010

Market Segment Balance

Percent

of Total Balance

Percent

of Total

Middle market (1) $1,641,898 52.3% $1,632,829 51.8%

Small ticket (2) 865,169 27.5 833,053 26.4

Winthrop 448,822 14.3 530,063 16.8

Other 186,370 5.9 158,533 5.0

Total $3,142,259 100.0% $3,154,478 100.0%

(1)Middle market consists primarily of loan and lease financing of construction and manufacturing equipment and specialty vehicles.

(2) Small ticket includes loan and lease financings to small- and mid-size companies through programs with vendors, manufacturers,distributors, buying groups,

and franchise organizations.

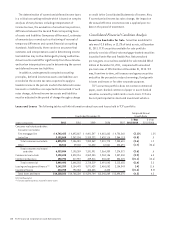

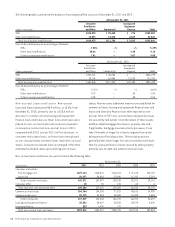

At December 31,

(Dollars in thousands) 2011 2010

Equipment Type Balance

Percent

of Total Balance

Percent

of Total

Specialty vehicles $ 693,435 22.1% $ 624,149 19.8%

Manufacturing 476,963 15.2 567,622 18.0

Medical 424,591 13.5 432,973 13.7

Construction 336,563 10.7 349,841 11.1

Golf cart and turf 296,871 9.4 211,796 6.7

Technology and data processing 286,596 9.1 321,279 10.2

Furniture and fixtures 169,004 5.4 162,131 5.1

Exercise equipment 95,981 3.1 99,342 3.1

Printing 74,309 2.4 84,187 2.7

Other 287,946 9.1 301,158 9.6

Total $3,142,259 100.0% $3,154,478 100.0%

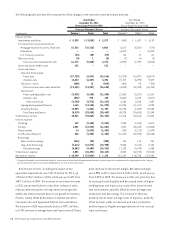

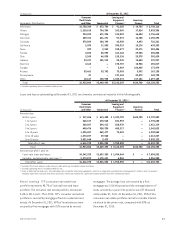

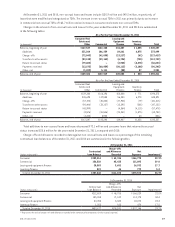

The leasing and equipment finance portfolio was

$3.1 billion at December 31, 2011, relatively flat with

December 31, 2010, and consisted of $2 billion of leases

and $1.1 billion of loans. Total loan and lease originations

within TCF’s leasing and equipment finance portfolios

were $1.5 billion for 2011, an increase of 17.8% from

$1.3 billion in 2010. Total loan and lease purchases within

TCF’s leasing and equipment finance portfolios were

$67.1 million within the small ticket segment during 2011,

compared with $186.8 million within the middle market

segment during 2010. The backlog of approved transactions

was $455.3 million at December 31, 2011, compared with

$402.6 million at December 31, 2010. The average size of

transactions originated during 2011 was $93.9 thousand,

compared with $81.6 thousand during 2010. TCF’s leasing

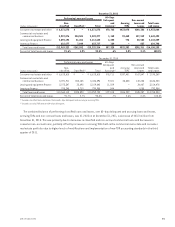

and equipment finance activity is subject to risk of cyclical

downturns and other adverse economic developments. In

an adverse economic environment, there may be a decline

in the demand for some types of equipment, resulting in

a decline in the amount of new equipment being placed

into service as well as a decline in equipment values for

equipment previously placed in service. Declines in the value

of leased equipment increase the potential for impairment

losses and credit losses due to diminished collateral value,

and may result in lower sales-type revenue at the end of the

contractual lease term. See Note 1 of Notes to Consolidated

Financial Statements — Summary of Significant Accounting

Policies — Policies Related to Critical Accounting Estimates

for information on lease accounting.

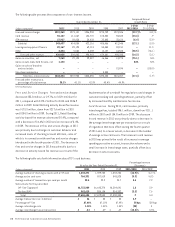

At December 31, 2011 and 2010, $121.7 million and

$212.4 million, respectively, of TCF’s lease portfolio was

discounted on a non-recourse basis with third-party

financial institutions and, consequently, TCF retains no

credit risk on such amounts. The leasing and equipment

finance portfolio tables above include lease residuals.

Lease residuals represent the estimated fair value of the

leased equipment at the expiration of the initial term of

the transaction and are reviewed on an ongoing basis. Any

downward revisions in estimated fair value are recorded in

the periods in which they become known. At December 31,

2011, lease residuals totaled $129.1 million, or 11.2% of

original equipment value, compared with $109.6 million, or

10.1% of original equipment value, at December 31, 2010.

332011 Form 10-K