TCF Bank 2011 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

near-term due to the sluggish economy.

Despite our efforts, we will need to see

significant improvement in the economy

to see more substantial improvement in

credit quality.

• Demonstrate strong enterprise risk

management. In today’s regulatory

environment, a strong enterprise risk

management program is essential.

At TCF, we have enhanced our program

under our new management structure.

It will be important to appropriately

manage our risks and maintain clear and

open communication with our regulators.

• Use capital wisely. TCF is solidly

capitalized. We will continue to be good

stewards of our stockholders’ capital

and think in terms of the best long-term

interest of the company. It will be

important that we prudently monitor

our capital position to ensure we are in

a position to take advantage of various

balance sheet opportunities. Prudent

capital management, which includes

making wise investment decisions, is a

top priority as well as staying cognizant

of maintaining a strong liquidity

position for unanticipated situations.

• Monitor corporate development

opportunities. Under the new function-

ally organized management structure,

corporate development will be key.

With this evolution of TCF comes the

need for an executive presence to

oversee corporate development issues

on both the asset and liability sides of

the balance sheet, as well as evaluate

potential new business lines. In 2012,

we must actively monitor and be ready

to act on these opportunities that will

increase stockholder value.

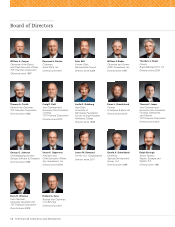

• Continue our longstanding commit-

ment to strong corporate governance.

Our customers and stockholders entrust

us with their money and confidential

information and therefore, our manage-

ment practices demand the highest of

standards. Reputation for honesty and

integrity continues to rank at the top of

our priorities.

Risks to Our

Business Strategy

• Congressional and regulatory actions

continue to produce a cloud of uncer-

tainty over the banking industry. While

the Durbin Amendment has been

implemented, uncertainty continues as

Congress has introduced a bill to repeal

it while the retailers have filed a lawsuit

stating the Federal Reserve did not

reduce debit card interchange enough.

• The economic climate remains a

major risk for all banks, including TCF.

Unemployment and depressed home

and commercial real estate values

reduce consumer spending and loan

demand, which impacts the ability of

banks to generate fee income and earn

interest on new loans.

• The competitive landscape in the

banking industry is changing. With

banks exploring various ways to

recover lost revenue, trends may

emerge with the types of fees charged

going forward. Fee strategies may be

impacted by the changes we make as

well as the ensuing public perception.

We already saw this in 2011 when

public outcry caused Bank of America

to back off of their plan to charge a

debit card usage fee.

10 TCF Financial Corporation and Subsidiaries

• With the current economy and TCF’s

changing product structure, customer

behavior is still an unknown and could

impact future fee revenue. We spent time

researching, testing and piloting our

various product changes but it generally

takes an extended period of time to fully

understand how customer behavior will

respond in the long run. This will be the

case with any additional changes we

make. We will monitor how our customers

respond and react accordingly.

• Managing interest-rate risk and the

continued low levels of interest rates

with an eye toward the possibility of

rapidly increasing inflation continues

to be a challenge.

• Potential reductions in our borrowing

capacity because of restrictions put on

the Federal Home Loan Banks or the

Federal Reserve Discount Window could

reduce our liquidity and inhibit growth

or force higher deposit costs. Growing

core deposits reduces this risk.

• Growth expectations of our new

specialty finance businesses may not

be achieved. While we have the track

record and experience to successfully

operate national specialty finance

businesses, the ability to retain existing

business relationships and attract new

customers is challenging in the current

competitive environment. We will also

have to work to mitigate the integration

and operational risks associated with

these new businesses.