TCF Bank 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

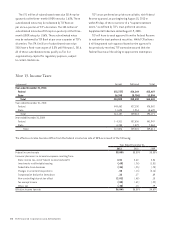

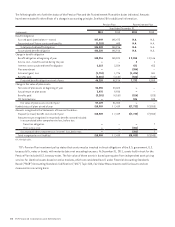

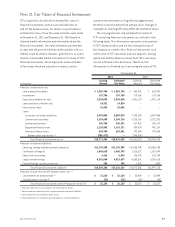

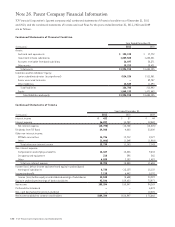

Note 19. Foreign Exchange Contracts

Forward foreign exchange contracts to sell a foreign currency

are used to manage the foreign exchange risk associated

with certain assets, liabilities and forecasted transactions.

Forward foreign exchange contracts represent agreements

to exchange a foreign currency for U.S. dollars at an agreed-

upon price on an agreed-upon settlement date.

All forward foreign exchange contracts are recognized

within other assets or other liabilities at fair value on

the Consolidated Statements of Financial Condition.

These contracts typically settle within 30 days with the

exception of contracts associated with cash flow hedges

which have maturities as long as seven months. The

following table summarizes the forward foreign exchange

contracts, recorded at fair value, that are reflected within

other assets and other liabilities on TCF’s Consolidated

Statements of Financial Condition. See Note 20, Fair

Value Measurement for additional information.

December 31, 2011

Receivables Payables

(In thousands)

Notional

Amount

Designated

as Hedges

Not

Designated

as Hedges Total

Designated

as Hedges

Not

Designated

as Hedges Total

Forward foreign exchange contracts $176,979 $ – $ 396 $ 396 $ 3 $ 662 $ 665

Netting adjustments (1) – (396) (396) (3) (378) (381)

Net receivable / payable $ – $ – $ – $ – $ 284 $ 284

December 31, 2010

Receivables Payables

(In thousands)

Notional

Amount

Designated

as Hedges

Not

Designated

as Hedges Total

Designated

as Hedges

Not

Designated

as Hedges Total

Forward foreign exchange contracts $185,540 $ 12 $ 3 $ 15 $198 $1,659 $1,857

Netting adjustments (1) (12) (3) (15) (12) (3) (15)

Net receivable / payable $ – $ – $ – $186 $1,656 $1,842

(1) Foreign exchange contract receivables and payables, and the related cash collateral received and paid are netted when a legally enforceable master netting agreement

exists between TCF and a counterparty. Includes $150 thousand of cash collateral received and $135 thousand of cash collateral posted at December 31, 2011.

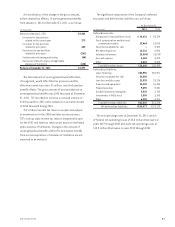

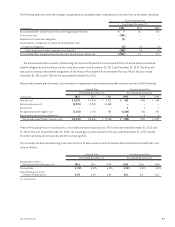

The value of forward foreign exchange contracts will vary

over their contractual term as the related currency exchange

rates fluctuate. The accounting for changes in the fair value

of a forward foreign exchange contract depends on whether

or not the contract has been designated and qualifies as

a hedge. To qualify as a hedge, a contract must be highly

effective at reducing the risk associated with the exposure

being hedged. In addition, for a contract to be designated

as a hedge, the risk management objective and strategy

must be documented. Hedge documentation must also

identify the hedging instrument, the asset or liability and

type of risk to be hedged and how the effectiveness of the

contract is assessed prospectively and retrospectively. To

assess effectiveness, TCF uses statistical methods such as

regression analysis. The extent to which a contract has been,

and is expected to continue to be effective at offsetting

changes in cash flows or the net investment must be

assessed and documented quarterly. If it is determined that

a contract is not highly effective at hedging the designated

exposure, hedge accounting is discontinued.

Upon origination of a forward foreign exchange

contract, the contract is designated either as a hedge of

a forecasted transaction or the variability of cash flows

to be paid related to a recognized asset or liability (“cash

flow hedge”); or a hedge of the volatility of an investment

in foreign operations driven by changes in foreign currency

exchange rates (“net investment hedge”). To the extent

that a hedge is effective, changes in fair value are recorded

within accumulated other comprehensive income (loss),

with any ineffectiveness recorded in non-interest expense.

90 TCF Financial Corporation and Subsidiaries