TCF Bank 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

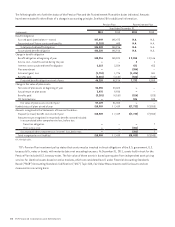

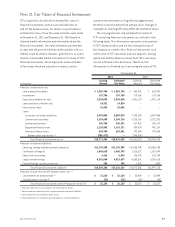

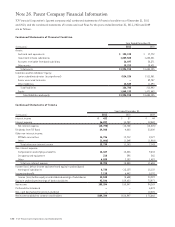

Note 21. Fair Values of Financial Instruments

TCF is required to disclose the estimated fair value of

financial instruments, both assets and liabilities on

and off the balance sheet, for which it is practicable to

estimate fair value. These fair value estimates were made

at December 31, 2011 and December 31, 2010 based on

relevant market information and information about the

financial instruments. Fair value estimates are intended

to represent the price at which an asset could be sold or a

liability could be settled. However, given there is no active

market or observable market transactions for many of TCF’s

financial instruments, the Company has made estimates

of fair values which are subjective in nature, involve

uncertainties and matters of significant judgment and

therefore cannot be determined with precision. Changes in

assumptions could significantly affect the estimated values.

The carrying amounts and estimated fair values of

TCF’s remaining financial instruments are set forth in the

following table. This information represents only a portion

of TCF’s balance sheet, and not the estimated value of

the Company as a whole. Non-financial instruments such

as the value of TCF’s branches and core deposits, leasing

operations and the future revenues from TCF’s customers

are not reflected in this disclosure. Therefore, this

information is of limited use in assessing the value of TCF.

At December 31,

2011 2010

(In thousands)

Carrying

Amount

Estimated

Fair Value

Carrying

Amount

Estimated

Fair Value

Financial instrument assets:

Cash and due from banks $ 1,389,704 $ 1,389,704 $ 663,901 $ 663,901

Investments 157,780 157,780 179,768 179,768

Securities available for sale 2,324,038 2,324,038 1,931,174 1,931,174

Loans and leases held for sale 14,321 14,524 – –

Interest only strips 22,436 22,436 – –

Loans:

Consumer real estate and other 6,933,804 6,583,570 7,195,269 6,907,960

Commercial real estate 3,198,698 3,154,724 3,328,216 3,222,201

Commercial business 250,794 242,331 317,987 303,172

Equipment finance loans 1,110,803 1,118,271 939,474 942,167

Inventory finance loans 624,700 623,651 792,354 792,940

Allowance for loan losses (1) (255,672) – (265,819) –

Total financial instrument assets $15,771,406 $15,631,029 $15,082,324 $14,943,283

Financial instrument liabilities:

Checking, savings and money market deposits $11,136,389 $11,136,389 $10,556,788 $10,556,788

Certificates of deposit 1,065,615 1,068,793 1,028,327 1,031,090

Short-term borrowings 6,416 6,416 126,790 126,790

Long-term borrowings 4,381,664 4,913,637 4,858,821 5,280,615

Forward foreign currency contracts 284 284 1,842 1,842

Total financial instrument liabilities $16,590,368 $17,125,519 $16,572,568 $16,997,125

Financial instruments with off-balance sheet risk: (2)

Commitments to extend credit (3) $ 31,210 $ 31,210 $ 33,909 $ 33,909

Standby letters of credit (4) (71) (71) (92) (92)

Total financial instruments with off-balance-sheet risk $ 31,139 $ 31,139 $ 33,817 $ 33,817

(1) Expected credit losses are included in the estimated fair values.

(2) Positive amounts represent assets, negative amounts represent liabilities.

(3) Carrying amounts are included in other assets.

(4) Carrying amounts are included in accrued expenses and other liabilities.

952011 Form 10-K