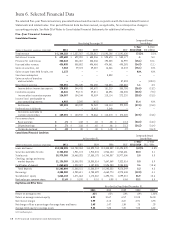

TCF Bank 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

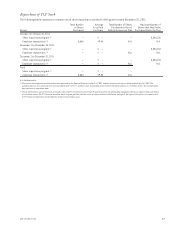

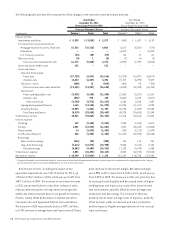

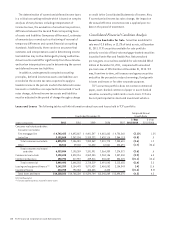

Year Ended

December 31, 2010

Year Ended

December 31, 2009 Change

(Dollars in thousands)

Average

Balance Interest

Average

Yields

and

Rates

Average

Balance Interest

Average

Yields

and

Rates

Average

Balance Interest

Average

Yields and

Rates

(bps)

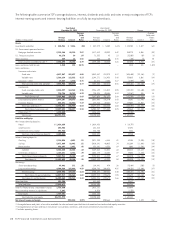

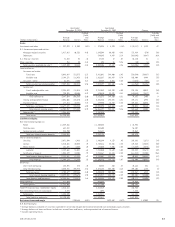

Assets:

Investments and other $ 337,279 $ 5,509 1.63% $ 375,396 $ 4,370 1.16% $ (38,117) $ 1,139 47

U.S. Government sponsored entities:

Mortgage-backed securities 1,817,413 80,332 4.42 1,645,544 80,902 4.92 171,869 (570) (50)

Debentures – – – 389,245 8,487 2.18 (389,245) (8,487) N.M.

U.S. Treasury securities 71,233 93 .13 17,123 12 .07 54,110 81 6

Other securities 454 20 4.41 494 26 5.26 (40) (6) (85)

Total securities available for sale (1) 1,889,100 80,445 4.26 2,052,406 89,427 4.36 (163,306) (8,982) (10)

Loans and leases:

Consumer real estate:

Fixed-rate 5,082,487 313,573 6.17 5,421,081 348,400 6.43 (338,594) (34,827) (26)

Variable-rate 2,148,171 116,436 5.42 1,862,267 106,987 5.74 285,904 9,449 (32)

Consumer — other 26,576 2,303 8.67 35,849 3,061 8.54 (9,273) (758) 13

Total consumer real estate and other 7,257,234 432,312 5.96 7,319,197 458,448 6.26 (61,963) (26,136) (30)

Commercial:

Fixed- and adjustable-rate 2,956,699 176,018 5.95 2,741,563 165,999 6.05 215,136 10,019 (10)

Variable-rate 730,325 30,604 4.19 870,810 33,221 3.81 (140,485) (2,617) 38

Total commercial 3,687,024 206,622 5.60 3,612,373 199,220 5.51 74,651 7,402 9

Leasing and equipment finance 3,056,006 196,570 6.43 2,826,835 192,575 6.81 229,171 3,995 (38)

Inventory finance 677,214 49,881 7.37 179,990 14,797 8.22 497,224 35,084 (85)

Total loans and leases (2) 14,677,478 885,385 6.03 13,938,395 865,040 6.21 739,083 20,345 (18)

Total interest-earning assets 16,903,857 971,339 5.75 16,366,197 958,837 5.86 537,660 12,502 (11)

Other assets (3) 1,286,683 1,157,314 129,369

Total assets $18,190,540 $17,523,511 $ 667,029

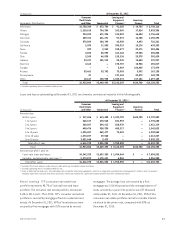

Liabilities and Equity:

Non-interest bearing deposits:

Retail $ 1,429,436 $ 1,402,442 $ 26,994

Small business 641,412 584,605 56,807

Commercial and custodial 284,750 265,681 19,069

Total non-interest bearing deposits 2,355,598 2,252,728 102,870

Interest-bearing deposits:

Checking 2,071,990 6,466 .31 1,802,694 8,137 .45 269,296 (1,671) (14)

Savings 5,410,681 40,023 .74 4,732,316 58,556 1.24 678,365 (18,533) (50)

Money market 656,691 4,532 .69 683,030 7,006 1.03 (26,339) (2,474) (34)

Subtotal 8,139,362 51,021 .63 7,218,040 73,699 1.02 921,322 (22,678) (39)

Certificates of deposit 1,054,179 10,208 .97 1,915,467 48,413 2.53 (861,288) (38,205) (156)

Total interest-bearing deposits 9,193,541 61,229 .67 9,133,507 122,112 1.34 60,034 (60,883) (67)

Total deposits 11,549,139 61,229 .53 11,386,235 122,112 1.07 162,904 (60,883) (54)

Borrowings:

Short-term borrowings 124,891 474 .38 85,228 233 .27 39,663 241 11

Long-term borrowings 4,580,786 208,972 4.56 4,373,182 202,830 4.64 207,604 6,142 (8)

Total borrowings 4,705,677 209,446 4.45 4,458,410 203,063 4.55 247,267 6,383 (10)

Total interest-bearing liabilities 13,899,218 270,675 1.95 13,591,917 325,175 2.39 307,301 (54,500) (44)

Total deposits and borrowings 16,254,816 270,675 1.66 15,844,645 325,175 2.05 410,171 (54,500) (39)

Other liabilities 511,589 416,555 95,034

Total liabilities 16,766,405 16,261,200 505,205

Total TCF Financial Corp. stockholders' equity 1,415,161 1,261,219 153,942

Non-controlling interest in subsidiaries 8,974 1,092 7,882

Total equity 1,424,135 1,262,311 161,824

Total liabilities and equity $18,190,540 $17,523,511 $ 667,029

Net interest income and margin $700,664 4.15% $633,662 3.87% $ 67,002 28

N.M. Not Meaningful.

(1) Average balances and yields of securities available for sale are based upon the historical amortized cost and exclude equity securities.

(2) Average balances of loans and leases include non-accrual loans and leases, and are presented net of unearned income.

(3) Includes operating leases.

232011 Form 10-K