TCF Bank 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of December 31, 2011 and 2010, the carrying amount

of these five investments was $22.1 million and $29.4

million, respectively. The maximum exposure to loss on

these five investments was $22.1 million at December 31,

2011; however, the general partner of these partnerships

provides various guarantees to TCF including guaranteed

minimum returns. These guarantees are backed by a BBB

credit-rated company and limit any risk of loss. In addition

to the guarantees, the investments are supported by the

performance of the underlying real estate properties which

also mitigates the risk of loss.

Interest Only Strips TCF periodically sells auto loans

to third party financial institutions, at fixed rates, on

a limited-recourse basis. For those transactions which

achieve sales treatment, the underlying loan is not

recognized on TCF’s Consolidated Statements of Financial

Condition. TCF sells these loans at par value and retains a

participation in the expected future cash flows of borrower

loan payments which represents the deferral of a portion

of the purchase price known as an interest only strip. The

interest only strip is recorded at fair value at the time of

sale in other assets within the Consolidated Statements

of Financial Condition. The fair value of the interest only

strip represents the present value of future cash flows to

be generated by the loans, in excess of the interest paid to

investors, and costs of servicing the loans and completing

the sale. After initial recording of the interest only strip,

the accretable yield is measured as the difference between

the fair value and the cash flows expected to be collected.

The accretable yield is amortized into interest income over

the life of the interest only strip using the effective yield

method. The expected cash flows are evaluated quarterly to

determine if they have changed from previous projections.

If the present value of the original cash flows expected to

be collected is less than the present value of the current

estimate of cash flows to be collected, the change is

adjusted prospectively over the remaining life of the

interest only strip. If the present value of the original cash

flows expected to be collected is greater than the present

value of the current estimate, an other than temporary

impairment is recorded.

Intangible Assets Goodwill is tested for impairment

annually. Other intangibles are amortized over their

estimated useful life. The Company reviews the recoverability

of these assets at least annually or earlier whenever an event

occurs indicating that they may be impaired.

Stock-Based Compensation The fair value of restricted

stock and stock options is determined on the date of

grant and amortized to compensation expense, with a

corresponding increase in additional paid-in capital, over

the longer of the service period or performance period,

but in no event beyond an employee’s retirement date.

For performance-based restricted stock, TCF estimates

the degree to which performance conditions will be met

to determine the number of shares that will vest and the

related compensation expense. Compensation expense

is adjusted in the period such estimates change. Non-

forfeitable dividends, if any, paid on shares of restricted

stock are recorded to retained earnings for shares that are

expected to vest and to compensation expense for shares

that are not expected to vest.

Income tax benefits related to stock compensation

in excess of grant date fair value less any proceeds on

exercise are recognized as an increase to additional paid-in

capital upon vesting or exercise and delivery of the stock.

Any income tax benefits that are less than grant date

fair value less any proceeds on exercise would be

recognized as a reduction of additional paid in capital

to the extent of previously recognized income tax benefits

and then as income tax expense for the remaining

amount. See Note 16, Stock Compensation for additional

information concerning stock-based compensation.

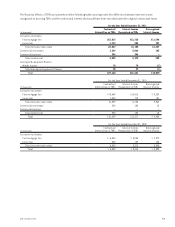

Employee Benefits Plans During the fourth quarter of 2011,

TCF retrospectively changed its method of accounting for

pension and other postretirement benefits. TCF’s prior

policy was to report net actuarial gains and losses as a

component of stockholders’ equity in the Consolidated

Statements of Financial Condition on an annual basis.

TCF’s policy for actuarial gains and losses is now to

immediately recognize them in its operating results in the

year in which the gains and losses occur. Additionally,

for purposes of calculating the expected return on plan

assets, TCF will no longer use an averaging technique for

the market-related value of plan assets, but will instead

use the actual fair value of plan assets. While both the

prior and new policies are permitted under U.S. GAAP,

TCF believes that the new policies are preferable as the

economic results of the Pension and Postretirement Plans

will be recognized in earnings in the year they occur.

Financial data for all periods presented has been adjusted

to reflect the effect of these accounting changes. See

Note 28 for additional information.

64 TCF Financial Corporation and Subsidiaries