TCF Bank 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

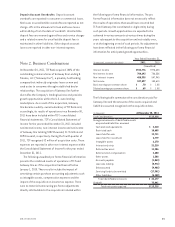

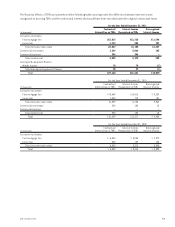

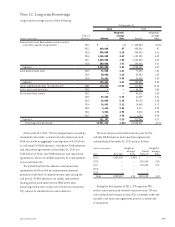

Subsequent to the acquisition of Gateway One in

2011, TCF sold $37.4 million of consumer auto loans with

servicing retained and received cash of $37.4 million,

resulting in gains of $1.1 million. Related to these sales,

TCF retained an interest-only strip of $2.2 million and

assumed contractual recourse liabilities of $321 thousand.

At December 31, 2011, interest only strips and contractual

recourse liabilities totaled $22.4 million and $6 million,

respectively. No servicing assets or liabilities were

recorded within TCF’s Consolidated Statements of Financial

Condition, as the contractual servicing fees are adequate

to compensate TCF for its servicing responsibilities. The

unpaid principal balance of auto loans serviced for third

parties was $425.1 million at December 31, 2011.

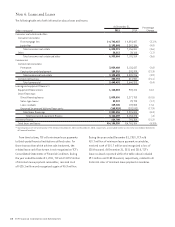

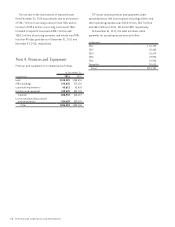

Future minimum lease payments receivable for direct

financing, sales-type leases and operating leases as of

December 31, 2011 are as follows.

(In thousands) Total

2012 $ 838,237

2013 574,518

2014 354,925

2015 187,331

2016 77,801

Thereafter 23,499

Total $2,056,311

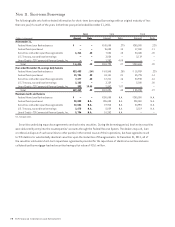

The aggregate amount of loans to non-management

directors of TCF and their related interests was $21.3

million and $7.4 million at December 31, 2011 and 2010,

respectively. During 2011, $19.5 million in new loans were

made and $5.5 million of loans were repaid. All loans to

outside directors and their related interests were made

in the ordinary course of business on normal credit terms,

including interest rates and collateral, as those prevailing

at the time for comparable transactions with unrelated

persons. The aggregate amount of loans to executive

officers of TCF was $97 thousand at December 31, 2011

and 2010. In the opinion of management, the above

mentioned loans to outside directors and their related

interests and executive officers do not represent more

than a normal risk of collection.

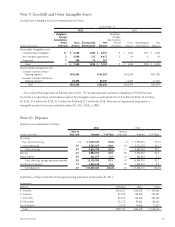

Acquired Loans and Leases During the year ended

2011, TCF paid $67.1 million to acquire leasing and equipment

finance loans and leases having remaining contractual

principal cash flows including residuals on leases of $69.9

million and paid $5.9 million to acquire inventory finance

loans having a portfolio balance of $6 million. See Note 2

for information regarding loans acquired with Gateway One.

During the year ended 2010, TCF paid $186.8 million and

$168.6 million to acquire leasing and equipment finance and

inventory finance loans and leases, respectively, with portfolio

balances of $186.8 million and $168.4 million, respectively.

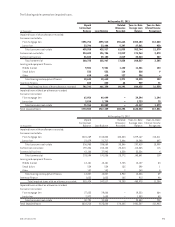

Within TCF’s $371.9 million acquired loan and lease

portfolios at December 31, 2011, there are certain loans

which had experienced credit quality deterioration at the

time of acquisition. These loans had outstanding principal

balances of $10.8 million and $13.7 million at December 31,

2011 and December 31, 2010, respectively.

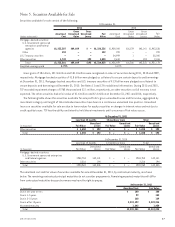

The excess of expected cash flows to be collected over

the initial fair value of the acquired portfolios is referred to

as the accretable yield and is accreted into interest income

over the estimated life of the acquired portfolios using the

effective yield method. The accretable yield is affected by

changes in interest rate indices for variable-rate acquired

portfolios, changes in prepayment assumptions and

changes in the expected principal and interest payments

over the estimated life of the loan or lease. These loans

and leases are classified as accruing and interest income

continues to be recognized unless expected credit losses

exceed the non-accretable discount. These acquired

loans and leases do not have an allowance for loan and

lease losses recorded against them as the non-accretable

discount is adequate to absorb expected remaining credit

losses. In the future, if TCF is unable to collect the expected

cash flows or reduces its expectations for cash flows below

the current level, an allowance for credit losses will be

established on these acquired portfolios.

The non-accretable discount on loans acquired with

deteriorated credit quality was $946 thousand and $769

thousand at December 31, 2011 and December 31, 2010,

respectively. The accretable discount to be recognized in

income for these loans was $754 thousand at December 31,

2011 and $207 thousand at December 31, 2010. Accretion

of $157 thousand and $169 thousand was recorded for the

years ended December 31, 2011 and 2010, respectively.

692011 Form 10-K