TCF Bank 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 18. Financial Instruments with

Off-Balance Sheet Risk

TCF is a party to financial instruments with off-balance sheet

risk, primarily to meet the financing needs of its customers.

These financial instruments, which are issued or held for

purposes other than trading, involve elements of credit and

interest-rate risk in excess of the amount recognized in the

Consolidated Statements of Financial Condition.

TCF’s exposure to credit loss, in the event of non-

performance by the counterparty to the financial

instrument, for commitments to extend credit and standby

letters of credit is represented by the contractual amount

of the commitments. TCF uses the same credit policies in

making these commitments as it does for making direct

loans. TCF evaluates each customer’s creditworthiness on

a case-by-case basis. The amount of collateral obtained is

based on a credit evaluation of the customer.

Financial instruments with off-balance sheet risk are

summarized as follows.

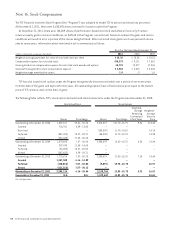

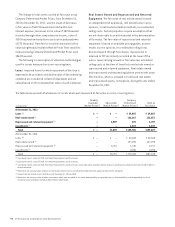

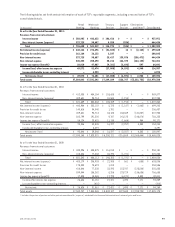

At December 31,

(In thousands) 2011 2010

Commitments to extend credit:

Consumer real estate and other $1,349,779 $1,444,619

Commercial 279,076 277,427

Leasing and equipment finance 177,534 148,597

Total commitments to extend credit 1,806,389 1,870,643

Standby letters of credit and

guarantees on industrial revenue bonds 26,964 31,062

Total $1,833,353 $1,901,705

Commitments to Extend Credit Commitments to extend

credit are agreements to lend provided there is no violation

of any condition in the contract. These commitments

generally have fixed expiration dates or termination clauses

and may require payment of a fee. Since certain of the

commitments are expected to expire without being drawn

upon, the total commitment amounts do not necessarily

represent future cash requirements. Collateral to secure

these commitments predominantly consists of residential

and commercial real estate.

Standby Letters of Credit and Guarantees on

Industrial Revenue Bonds Standby letters of credit and

guarantees on industrial revenue bonds are conditional

commitments issued by TCF guaranteeing the performance

of a customer to a third-party. These conditional

commitments expire in various years through 2016.

Collateral held primarily consists of commercial real estate

mortgages. Since the conditions under which TCF is required

to fund these commitments may not materialize, the

cash requirements are expected to be less than the total

outstanding commitments.

892011 Form 10-K