TCF Bank 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1110090807

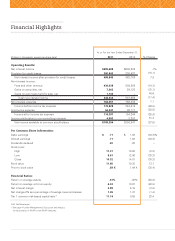

$957

Millions of Dollars

$969

$1,020

$1,334

$1,579

Tangible Realized Common Equity

Tangible Realized Common Equity Ratio

Tangible Realized

Common Equity

Millions of Dollars

Certicates of Deposit

$9.6

$10.2

$11.6

$11.6

$12.2

Core Deposits

1110090807

Total Deposits

Billions of Dollars

04 TCF Financial Corporation and Subsidiaries

• On March 15, 2011, TCF raised gross

proceeds of $230 million through a

public common stock offering of

15,081,968 shares. As we have done

in the past, we chose to take advantage

of market conditions and raised the

capital when we could. This additional

capital allowed us to pay off our senior

unsecured notes and continue the

growth of our very successful specialty

finance businesses. TCF’s capital

management strategy is prudent and

provides flexibility to take advantage

of balance sheet opportunities.

• With TCF’s annual dividend rate of

$.20 per share in 2011, TCF has paid a

common stock dividend 95 consecutive

quarters. When capital accumulation

from earnings exceeds capital required

for asset growth and risk parameters

permit, TCF will raise its dividend.

We actively review these factors on a

quarterly basis as returning capital to

our stockholders remains an important

part of how we deliver value.

• TCF is nancially strong and remains

a safe and sound bank. We are solidly

capitalized and have ample liquidity

to conduct business. TCF’s tangible

realized common equity, which we feel

is the most important capital metric,

was $1.6 billion, or 8.42 percent of

tangible assets at December 31, 2011.

We continue to exceed all well-capital-

ized requirements as defined by the

regulatory agencies. At December 31,

2011, TCF had $647.3 million of total

risk-based capital in excess of the

stated well-capitalized requirement.

We also anticipate exceeding the

minimum standards under the Basel III

capital guidelines.

• At December 31, 2011, TCF’s stock

price closed at $10.32 per share, down

from $14.81 per share on December 31,

2010. Several key factors weighed

heavily on stock prices across the

industry in 2011, including regulatory

uncertainty such as the Durbin

Amendment and macroeconomic

concerns including depressed home

values, elevated unemployment and

the European debt crisis. Until the

economy shows more consistent

signs of improvement, pressure

on the stock price may continue.

Retail Banking

TCF’s Retail Banking division consists

of branch banking and retail lending.

In branch banking, our focus has been

on growing low-cost deposits to fund

both our regional and national lending

programs. Similar to 2010, we have

recently spent a significant amount of

time developing products that can help

increase the level of convenience for

our customers in the ever-changing

competitive environment. Deposit

balances totaled $12.2 billion at

year-end, up 5.3 percent from 2010.

We are committed to providing our

customers with the most convenient

products possible, including the launch

of free TCF Mobile Banking in early

2011. Our recent product changes have

increased the simplicity and conve-

nience to our customers with the

intention of also increasing profitability

for the bank, however, changes to our

deposit account products are still

evolving. We are currently evaluating

additional ideas and expect to make

further enhancements in 2012.