TCF Bank 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

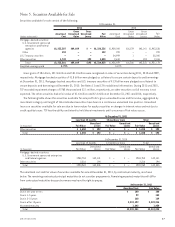

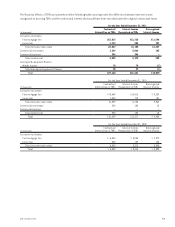

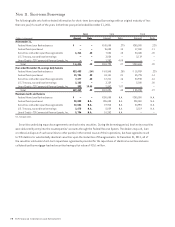

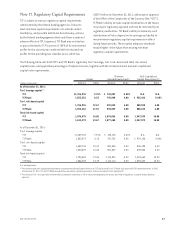

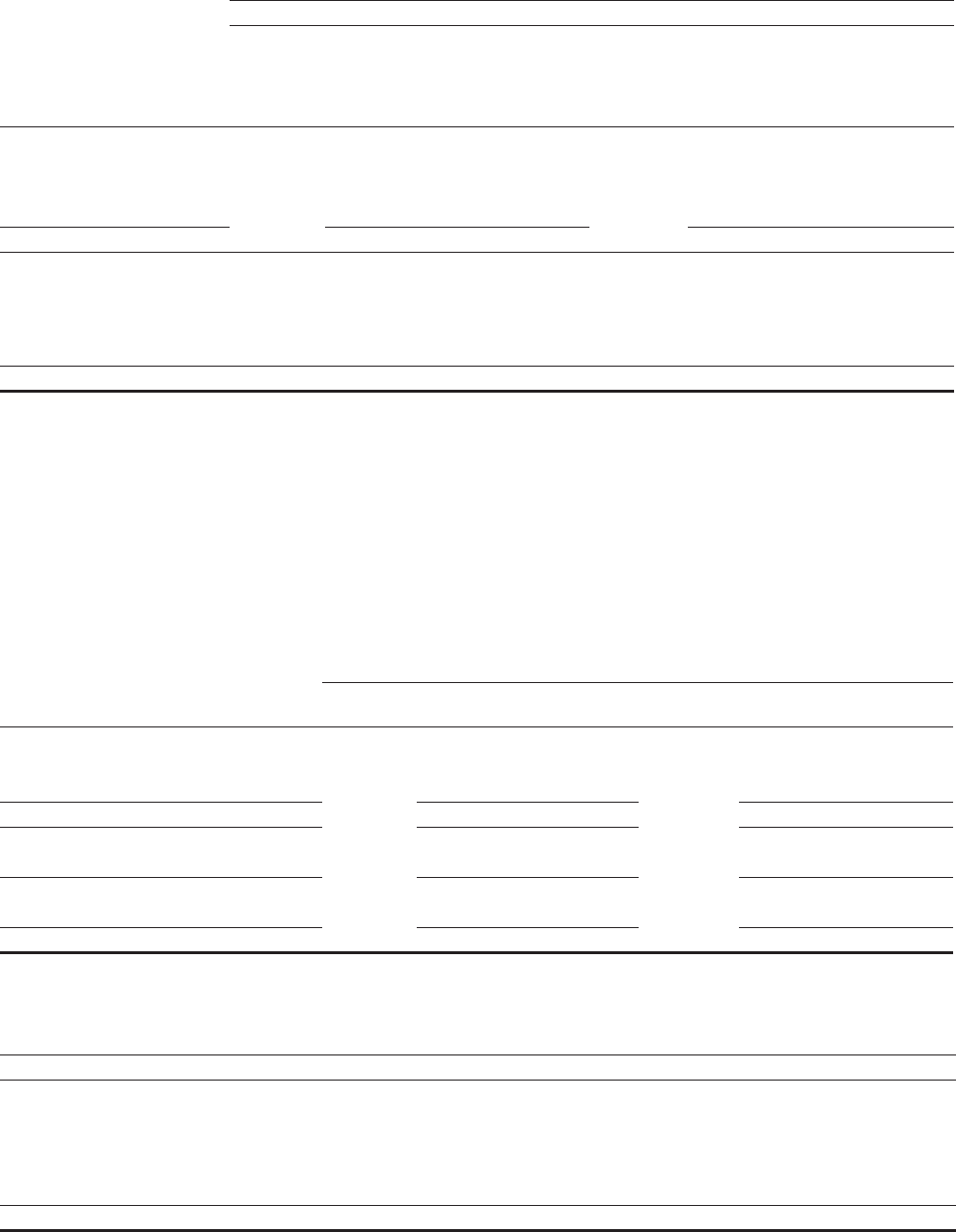

Note 9. Goodwill and Other Intangible Assets

Goodwill and intangible assets are summarized as follows.

At December 31,

2011 2010

(Dollars in thousands)

Weighted-

average

Amortization

Period

(In Years)

Gross

Amount

Accumulated

Amortization

Net

Amount

Weighted-

average

Amortization

Period

(In Years)

Gross

Amount

Accumulated

Amortization

Net

Amount

Amortizable intangible assets:

Customer base intangibles 11 $ 2,730 $360 $ 2,370 9 $ 1,400 $197 $ 1,203

Non-compete agreements 5 4,590 113 4,477 3 50 21 29

Tradename 2 300 13 287 – – – –

Total 7 $ 7,620 $486 $ 7,134 9 $ 1,450 $218 $ 1,232

Unamortizable intangible assets:

Goodwill related to Retail

Banking segment $141,245 $141,245 $141,245 $141,245

Goodwill related to Wholesale

Banking segment 84,395 84,395 11,354 11,354

Total $225,640 $225,640 $152,599 $152,599

As a result of the acquisition of Gateway One in 2011, TCF recorded goodwill and other intangibles of $73 million and

$6.2 million, respectively. Amortization expense for intangible assets is estimated to be $1.3 million for 2012, $1.5 million

for 2013, $1.3 million for 2014, $1.2 million for 2015 and $1.1 million for 2016. There was no impairment of goodwill or

intangible assets for the years ended December 31, 2011, 2010, or 2009.

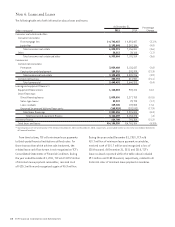

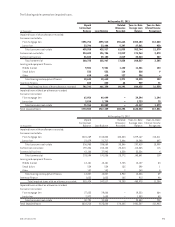

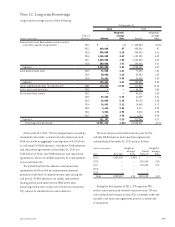

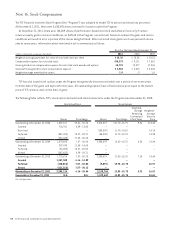

Note 10. Deposits

Deposits are summarized as follows.

2011 2010

(Dollars in thousands)

Rate at

Year-end Amount % of Total

Rate at

Year-end Amount % of Total

Checking:

Non-interest bearing – % $ 2,442,522 20.0% – % $ 2,429,061 21.0%

Interest bearing .16 2,187,227 18.0 .26 2,101,003 18.1

Total checking .07 4,629,749 38.0 .12 4,530,064 39.1

Savings .37 5,855,263 48.0 .55 5,390,802 46.5

Money market .36 651,377 5.3 .54 635,922 5.5

Total checking, savings and money market .25 11,136,389 91.3 .37 10,556,788 91.1

Certificates of deposit .75 1,065,615 8.7 .84 1,028,327 8.9

Total deposits .29 $12,202,004 100.0% .41 $11,585,115 100.0%

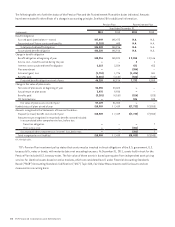

Certificates of deposit had the following remaining maturities at December 31, 2011.

(In thousands)

Maturity $100,000+ Other Total

0-3 months $213,611 $146,035 $ 359,646

4-6 months 67,993 155,394 223,387

7-12 months 89,169 246,880 336,049

13-24 months 35,175 93,481 128,656

Over 24 months 3,225 14,652 17,877

Total $409,173 $656,442 $1,065,615

772011 Form 10-K