TCF Bank 2011 Annual Report Download - page 38

Download and view the complete annual report

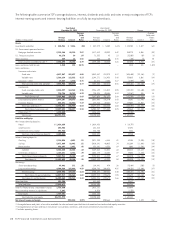

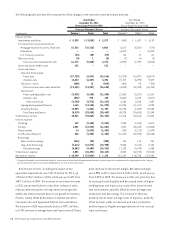

Please find page 38 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net interest income, the difference between interest

income earned on loans and leases, securities available

for sale, investments and other interest-earning assets

and interest paid on deposits and borrowings, represented

61.2% of TCF’s total revenue in 2011. Net interest income

can change significantly from period to period based on

general levels of interest rates, customer prepayment

patterns, the mix of interest-earning assets and the mix

of interest-bearing and non-interest bearing deposits

and borrowings. TCF manages the risk of changes in

interest rates on its net interest income through an Asset/

Liability Committee and through related interest-rate

risk monitoring and management policies. See “Item 1A.

Risk Factors” and “Item 7A. Quantitative and Qualitative

Disclosures about Market Risk” for further discussion.

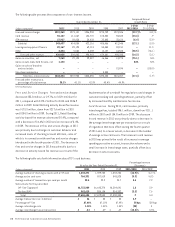

Non-interest income is a significant source of revenue

for TCF and an important factor in TCF’s results of

operations. Increasing fee and service charge revenue

has been challenging as a result of economic conditions,

changing customer behavior and the impact of the

implementation of new regulation. Providing a wide range

of retail banking services is an integral component of TCF’s

business philosophy and a major strategy for generating

additional non-interest income. Key drivers of non-interest

income are the number of deposit accounts and related

transaction activity.

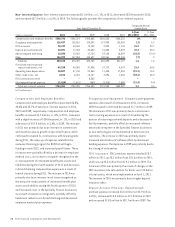

In response to new regulations, TCF introduced a new

anchor checking account product that replaced the TCF

Totally Free Checking product. The new product carries

a monthly maintenance fee on accounts not meeting

certain specific requirements. In addition, the success of

the Michigan pilot of TCF’s daily overdraft product did not

transfer well to other markets. As a result, TCF introduced

additional overdraft product options in 2012.

The Company’s Visa® debit card program has grown

significantly since its inception in 1996. TCF is the 15th

largest issuer of Visa consumer debit cards in the United

States, based on payments volume for the three months

ended September 30, 2011, as published by Visa. TCF earns

interchange revenue from customer card transactions paid

primarily by merchants, not TCF’s customers. Card products

represent 27.1% of banking fee revenue for the year ended

December 31, 2011. Visa has significant litigation against

it regarding interchange pricing and there is a risk this

revenue could be impacted by any settlement or adverse

rulings in such litigation.

TCF’s card revenues have been impacted by the Durbin

Amendment to the Dodd-Frank Wall Street and Consumer

Protection Act of 2010 (the “Dodd-Frank Act”), which

directed the Board of Governors of the Federal Reserve

System (“Federal Reserve”) to establish rules related to

debit-card interchange fees. The final rule, which became

effective on October 1, 2011, sets a base interchange fee

limit of 21 cents, plus a per transaction component of 5

basis points, and a one cent charge if issuers comply with

certain fraud protection provisions. This rule resulted in a

$14.7 million, or slightly more than 50%, reduction in TCF’s

card interchange revenue during the fourth quarter of 2011.

See “Item 1A. Risk Factors” and “Item 7. Management’s

Discussion and Analysis of Financial Condition and Results

of Operations — Consolidated Income Statement Analysis”

for more information.

On November 30, 2011, TCF’s wholly-owned subsidiary,

TCF Bank, completed the acquisition of Gateway One.

Headquartered in Anaheim, California, Gateway One utilizes

its more than 3,400 active dealer relationships to originate

loans and services to consumers in 30 states on new and

used autos. As part of the acquisition, TCF is retaining

Gateway One’s seasoned executive management team. The

addition of Gateway One further diversifies TCF’s lending

business and provides ample growth opportunities within

the U.S. auto lending marketplace, the second largest

consumer finance market in the U.S.

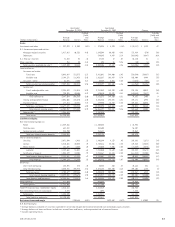

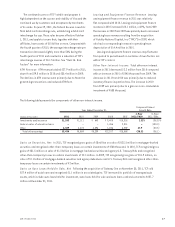

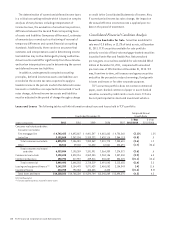

The following portions of Management’s Discussion and

Analysis of Financial Condition and Results of Operations

focus in more detail on the results of operations for 2011,

2010 and 2009 and on information about TCF’s balance

sheet, loan and lease portfolio, liquidity, funding resources,

capital and other matters.

Results of Operations

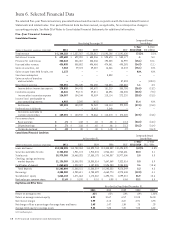

Performance Summary TCF reported diluted earnings

per common share of $.71 for 2011, compared with $1.08

for 2010 and $.60 for 2009. Net income was $109.4 million

for 2011, compared with $150.9 million for 2010 and

$94.3 million for 2009. Net income available to common

stockholders for 2009 includes a non-cash deemed

preferred stock dividend of $12 million, or 9 cents per

common share.

Return on average assets was .61% in 2011, compared with

.85% in 2010 and .54% in 2009. Return on average common

equity was 6.32% in 2011, compared with 10.67% in 2010

and 6.57% in 2009. The effective income tax rate for 2011

was 36%, compared with 36.9% in 2010 and 34.7% in 2009.

20 TCF Financial Corporation and Subsidiaries