TCF Bank 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

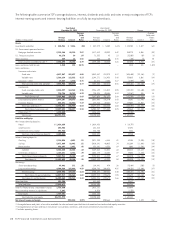

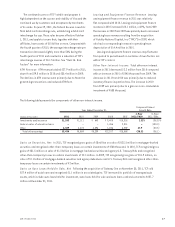

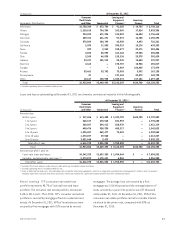

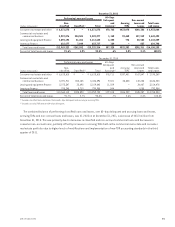

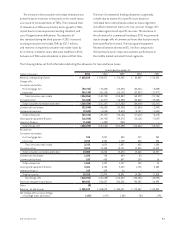

(In thousands) At December 31, 2011

Geographic Distribution:

Consumer

Real Estate

and Other Commercial

Leasing and

Equipment

Finance(1)

Inventory

Finance Total

Minnesota $2,750,344 $ 873,759 $ 91,258 $ 14,755 $ 3,730,116

Illinois 2,118,618 794,389 102,565 17,814 3,033,386

Michigan 924,252 671,296 124,583 16,484 1,736,615

Wisconsin 459,741 621,271 57,573 16,708 1,155,293

Colorado 574,569 104,749 42,950 4,093 726,361

California 2,395 17,505 395,319 18,176 433,395

Texas 209 2,549 248,477 32,171 283,406

Florida 3,694 55,592 167,160 29,358 255,804

Ohio 2,268 46,838 128,136 25,378 202,620

Indiana 23,417 101,912 58,945 15,653 199,927

New York 2,162 – 175,707 18,948 196,817

Canada – – 3,069 168,405 171,474

Arizona 53,461 33,702 73,983 5,992 167,138

Pennsylvania 57 – 137,162 23,579 160,798

Other 18,617 125,930 1,335,372 217,186 1,697,105

Total $6,933,804 $3,449,492 $3,142,259 $624,700 $14,150,255

(1) Excludes operating leases included in other assets.

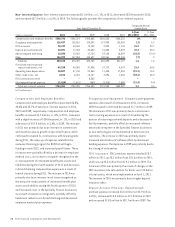

Loans and leases outstanding at December 31, 2011 are shown by contractual maturity in the following table.

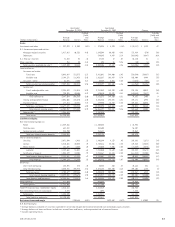

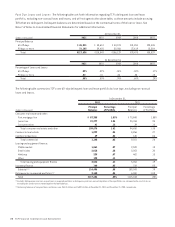

At December 31, 2011(3)

(In thousands)

Consumer

Real Estate

and Other Commercial

Leasing and

Equipment

Finance(2)

Inventory

Finance Total

Amounts due:

Within 1 year $ 317,606 $ 613,488 $ 1,183,709 $624,700 $ 2,739,503

1 to 2 years 268,127 670,565 831,993 – 1,770,685

2 to 3 years 248,567 594,613 568,939 – 1,412,119

3 to 5 years 498,476 958,330 485,217 – 1,942,023

5 to 10 years 1,296,687 569,477 72,401 – 1,938,565

10 to 15 years 1,272,697 39,540 – – 1,312,237

Over 15 years 3,031,644 3,479 – – 3,035,123

Total after 1 year 6,616,198 2,836,004 1,958,550 – 11,410,752

Total $6,933,804 $3,449,492 $ 3,142,259 $624,700 $14,150,255

Amounts due after 1 year on:

Fixed-rate loans and leases $4,242,325 $1,657,383 $ 1,954,544 $ – $ 7,854,252

Variable- and adjustable-rate loans (1) 2,373,873 1,178,621 4,006 – 3,556,500

Total after 1 year $6,616,198 $2,836,004 $ 1,958,550 $ – $11,410,752

(1) Excludes fixed-term amounts under lines of credit which are included in closed-end loans.

(2) Excludes operating leases included in other assets.

(3) Gross of deferred fees and costs. This table does not include the effect of prepayments, which is an important consideration in management’s interest-rate risk analysis.

Company experience indicates that loans and leases remain outstanding for significantly shorter periods than their contractual terms.

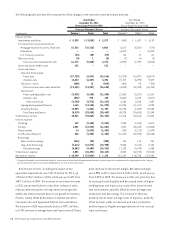

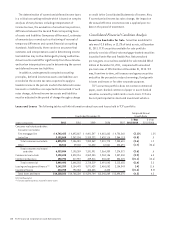

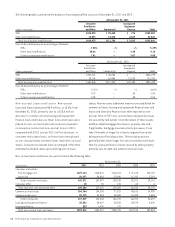

Retail Lending TCF’s consumer real estate loan

portfolio represents 48.7% of its total loan and lease

portfolio. The consumer real estate portfolio decreased

3.6% in 2011 and 1.7% in 2010. TCF’s consumer real estate

portfolio is secured by mortgages filed on residential real

estate. At December 31, 2011, 69% of loan balances were

secured by first mortgages with 31% secured by second

mortgages. The average loan size secured by a first

mortgage was $116 thousand and the average balance of

loans secured by a junior lien position was $37 thousand

at December 31, 2011. At December 31, 2011, 35% of the

consumer real estate portfolio carried a variable interest

rate tied to the prime rate, compared with 33% at

December 31, 2010.

312011 Form 10-K